Richemont Group Yearly Results Remain Positive, Yet Strongly Affected by Coronavirus

Luxury powerhouse’s results were good, until the 4th quarter and the pandemic.

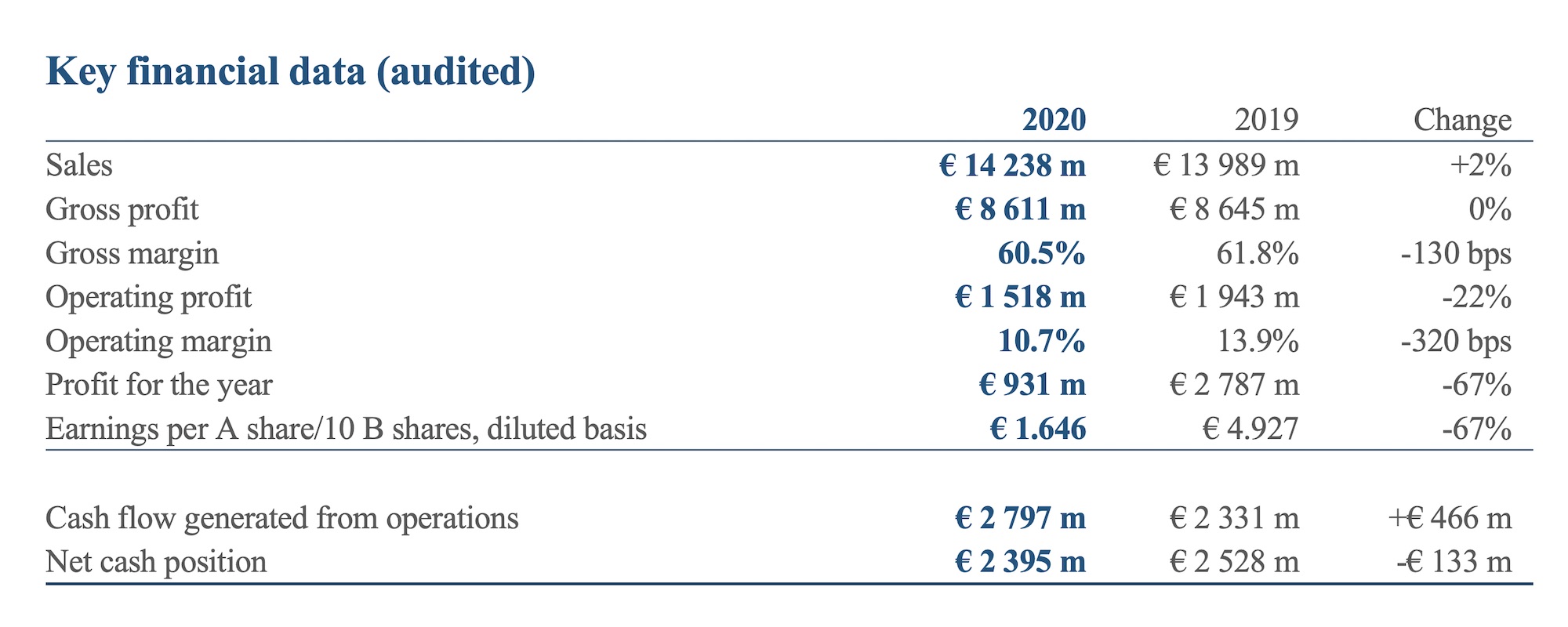

In a statement released this morning, luxury group Richemont – the owner of multiple high-end watch brands, such as IWC, Lange, JLC or Cartier – has announced its results for the year ended 31 March 2020. On a yearly basis, the group recorded revenues of EUR 14, 238 million, up 2% at actual exchange rates and stable at constant exchange rate compared to the prior year. However, this doesn’t reflect the current situation in the market.

Sales over the nine-month period from April to December 2019 had increased by 8% at actual exchange rates and by 5% at constant exchange rates, before the Coronavirus pandemic put downward pressure on the global economy. As expected, over the 4th quarter, operations were strongly affected by the COVID-19 crisis. Sales over this period declined by 18% at actual exchange rates, with sales in Asia Pacific down by 36%, including Hong Kong SAR and China down by 67%. Sales in Europe decreased by 9% while they rose by 9% in the Americas, only hit by the pandemic a few weeks later.

In this respect, the 2019-2020 results do not fully reflect the severe situation on the market yet. The luxury industry, including the Swiss watch industry, is expected to be amongst the hardest-hit sectors. Consumer consumption has collapsed as many countries have been under complete lockdown. Swiss watch exports were down 9.2% in February and 21.9% in March.

The impact of the crisis cannot be precisely evaluated without knowing the timetable for a return to normal business. According to a report from Bank Vontobel, published early April, the Swiss watch exports will decline by no less than 25% this year before bouncing back in 2021. Richemont states that “there is very limited visibility as to what the year ahead holds” but that “there are signs of improvement in terms of our business. Since our 462 boutiques in China have reopened after the virus, we have seen strong demand.”

For the whole 2019-2020, the growth was driven by Online Distributors (EUR 2,427 million, +15% ) and Jewellery Maisons (EUR 7,127 million, +2%). For what is our main concern here, the sales of Specialist Watchmakers were down 4% at EUR 2,859 million, reflecting the challenging environment. Panerai and A. Lange & Söhne are mentioned as brands generating good growth.

The performances in the Americas (+10%), Europe (+4%) and Japan (+1%) more than offset a decline in Asia Pacific (-5%).

Operating profit for the year decreased by 22% to EUR 1,518 million and operating margin to 10.7%. Profit for the year declined by 67% to EUR 931 million. This decrease reflected the non-recurrence of last year’s EUR 1,378 million post-tax non-cash accounting gain on the revaluation of the YOOX NET-A-PORTER shares held prior to the tender offer.

For more information, please visit www.richemont.com.

1 response

I don’t want to buy a luxury watch from an Investment Bank which is really what Richemont is.