What I Will Remember from 2021

The good and bad of a year that wasn’t without surprises… yet again.

2020 has been a difficult year for many of us. The combination of a pandemic and lockdowns has been dramatic for our lives and, because you’re reading a magazine dedicated to watches, for the watchmaking industry. This year, 2021, has certainly been better on multiple levels, but not yet ideal, as we’re still living in a world full of uncertainties. Looking at the bright side of things, 2021 has been a great year for MONOCHROME. We’ve enlarged our core team with new members, we’ve published more articles than ever before (over 1,100 articles in total) and we successfully launched two collaboration watches – the Montre de Souscription 1 and the Montre de Souscription 2 – that sold out faster than we ever dreamed of. In this regard, I think 2021 has been a great year for us. But, as said, not everything was perfect. As we’re about to turn the page on this year, I wanted to share with you what I will remember from 2021, the ups and downs, the trends, my feelings on the overall watchmaking world.

Business is recovering… but with uncertainties too

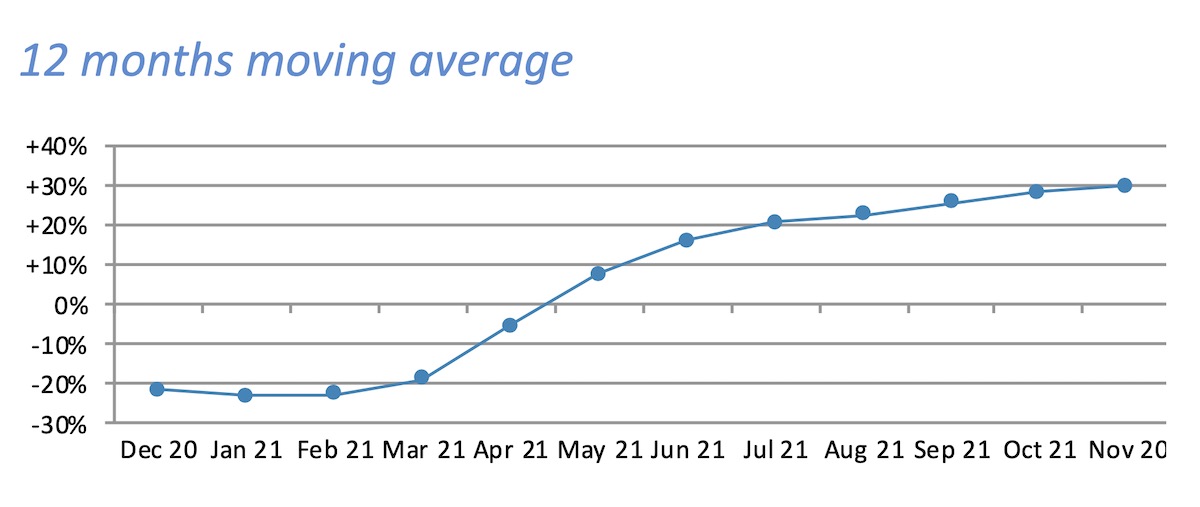

Looking at facts and numbers, we can certainly say that sales of luxury watches for the year 2021 were good. In fact, and according to the Federation of the Swiss Watch Industry (and its report of November 2021), sales are expected to be higher than 2020 – which isn’t a surprise, considering the historic fall in sales we’ve seen over the year, at minus 22%. More interestingly, sales will most likely be higher than pre-pandemic levels, with exports that are about 2% higher for January-November 2021 than the same period in 2019. Even better, the FHS is planning on sales that will be close to the record levels of 2014, as the Federation plans on Swiss watch exports of about CHF 22 billion, close to the CHF 22.4 billion reported in 2014. On this side of things, we can say that the market has recovered.

But there are 2 comments to make. First of all, even if the sales are good this year, it is the result of a correction and isn’t enough to compensate for the losses recorded by most brands over the year 2020. The impact of the pandemic is there, undeniably, and will have a long-term effect on the business, even though, let’s be positive, sales in 2021 have certainly been better than some might have expected.

Second, if sales are good, the pulse of the industry is still relatively slow, and brands/groups are still living in an uncertain future. With Omicron casting its shadow, it could well be that 2022 will start on difficult grounds, as multiple countries have announced already some confinement measures and travel restrictions. This will, without a doubt, have an effect on the business.

Baselworld is, sadly, a thing of the past

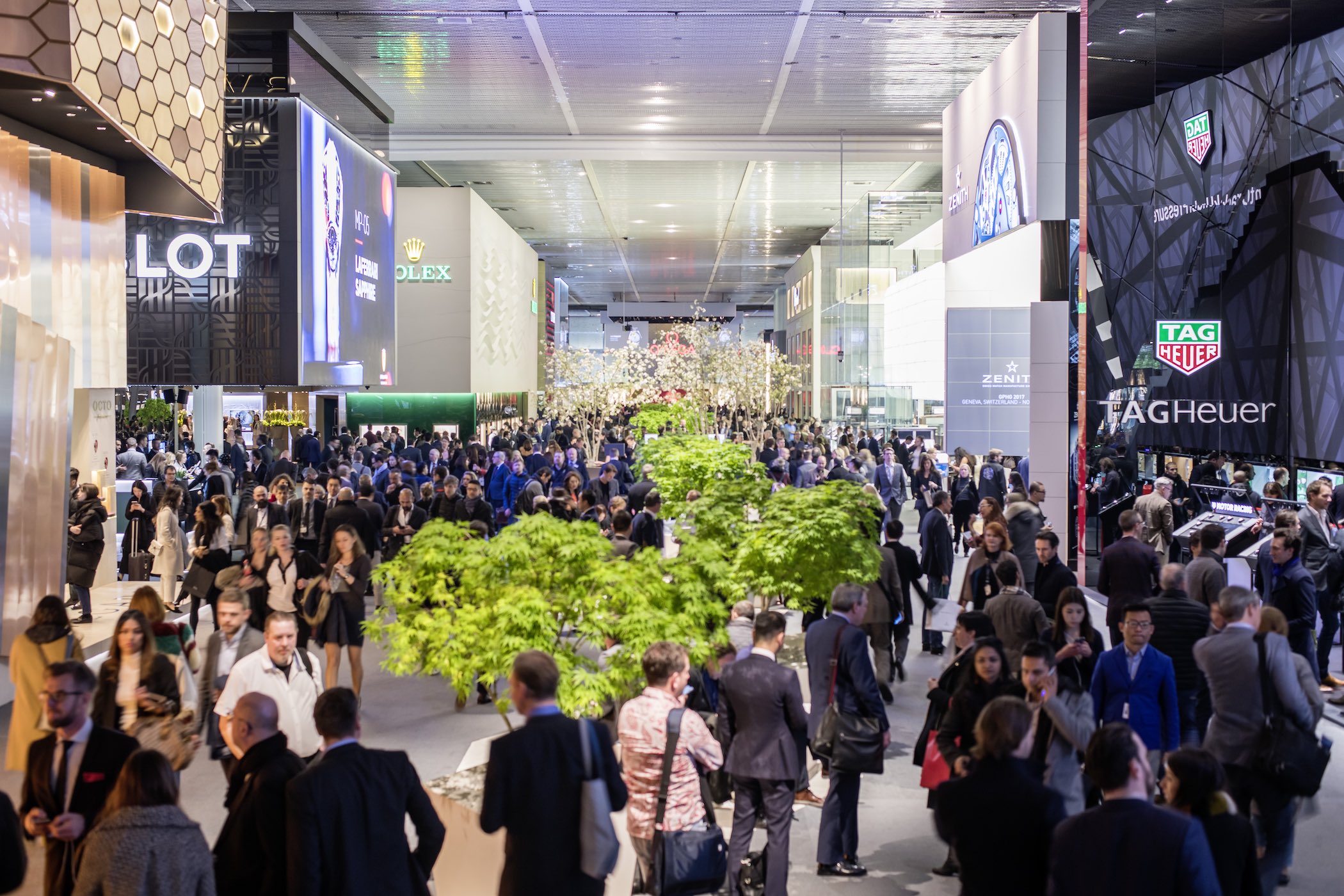

The combination of the pandemic, the cancellation of the 2020 edition, and the departure of almost all the major exhibitors marked the end of the largest watch fair as we’ve come to know it. It is a fact, Baselworld, the extravagant, oversized, frenetic watch fair that we all loved is dead. Period. This role now goes to Watches & Wonders Geneva, which now gathers most of the actors of the watch industry – over 40 brands, with heavyweights such as Rolex, Patek, Tudor, Grand Seiko, LVMH, and all of Richemont’s brands.

Yet, 2021 gave us two signs of hope regarding the future of Baselworld. Sure, we knew that the format will never be the same. First, the show announced its presence during the Geneva Watch Days 2021. The result, a dark event, in a basement, with a dozen brands exposing in, sorry for being rude, terrible conditions and minimal space, without any visibility. It would be an understatement to say that this pop-up event was disappointing. The name Baselworld deserves better than that.

Also, in June this year, the organization of Baselworld announced that the show will take place again, in the historic location, in March/April 2022. What used to be the most important annual meeting place for the luxury brands in the watch world was about to come back, a place of exhibition where “smaller watches and jewellery manufacturers and gemstone traders can present their products and retailers will have efficient and easy access to the diversity of manufacturers” according to the MCH Group. With a combination of physical and digital presence, the concept was not perfect on paper, but at least promising.

However, as announced recently, the 2022 edition of Baselworld has been, once again cancelled. “Organizers have decided to take more time for the launch of the new concept. Baselworld, scheduled for spring 2022, will therefore not take place,” is what you can read on the website. The iconic show has been struggling and will certainly struggle again. Sadly, as I loved this moment of the year and the typical atmosphere of the show, fairly different from the luxurious corridors of the SIHH.

2021 was not a year of audacity and news creations… but of conservatism

This situation is relatively easy to understand. Knowing that the business was only recovering and that uncertainties are still present, most brands have been playing on the safe side this year. I’m not saying that we haven’t seen many new models – in fact, there have been hundreds of new launches in 2021 – but most new watches were evolutions of existing models, new SKUs (new dial colour, new material, addition of a complication to a collection…) Creativity wasn’t the keyword for 2021 and I believe that innovation – whether in terms of design or regarding technical and mechanical content – has to come back in 2022.

Surely, this needs investments and risk-oriented management (which is not necessarily a common thing in large groups…) but it will pay off. Being in a wait-and-see policy won’t bring energy to the market or to the sales. So dear CEOs and product managers, please be creative, please take risks, please innovate, and bring fresh designs to the watch industry. That will only enlarge the scope of your clientele and increase the attention towards this industry.

Auctions and Second-Hand markets are booming

While the trend isn’t new, 2021 showed once again impressive progression for the auction and second-hand markets – which are certainly different, but also are the two sides of a coin, both marketing mostly used or vintage watches.

First, auctions. The watch departments of the two main auctions houses, Phillips and Christie’s, both reported record revenues in 2021. Spread over 3,213 lots during the year, Christie’s achieves USD 205 million sales in 2021, compared to USD 80 million in 2020 and USD 130 million in 2019. This marks a 50%-plus increase compared to the pre-pandemic level, numbers that are reinforcing the idea that growth is and will be found on this portion of the market. In the same vein, Phillips watch department announced that it achieved its most successful year yet again, with an annual auction total of over USD 209 million, a record for the house but the first time this sale total has been reached by any auction house. It represents an increase of revenue of 57% compared to 2020. Notably, the increase is mostly seen with the rise of online bids, understandable knowing the internationalization of the market and regulations on travels.

Regarding second-hand watches, it’s harder to measure the actual size of the market – it is huge and spread over thousands of actors. Yet, the tendency is clearly on growth, with a market that is estimated at about USD 20 billion according to McKinsey as reported by CNBC. The explosion of the market is driven by online sales – thanks to major actors such as Chrono24, Watchfinder, Watchbox, Chronext, or even eBay recently – and also by the shortage of new watches. As such, McKinsey (an American consultancy firm) estimates that pre-owned watch sales will be about half the size of the market for new watches by 2025 (around USD 30 billion), while it represents about a third of the market today.

The rise of modern watches and independent watchmakers at auctions

Up until very recently – think about a couple of years ago – records at auctions were mostly concerning vintage, highly important rare watches – stainless steel Patek Philippe chronographs, unique Breguet pocket watches, Rolex prototypes… While these timepieces still hold an important share of the sales at auctions, there’s a new trend coming and that is important and rare models from top independent watchmakers. And this covers watches that, for the largest part, have been produced post-quartz crisis, if not post-2000.

In 2020 and 2021, we’ve seen already important names like Philippe Dufour, F.P. Journe, De Bethune, Derek Pratt, George Daniels and Roger W. Smith, Richard Mille (to name a few, but this trend concerns many other great names) achieving much higher prices than a couple of years ago… and even surpassing some important watches produced by established brands. The results achieved by some of these indie watchmakers at Only Watch 2021 are also confirming this trend.

The watches that were already unattainable in 2020 are even more unattainable in 2021…

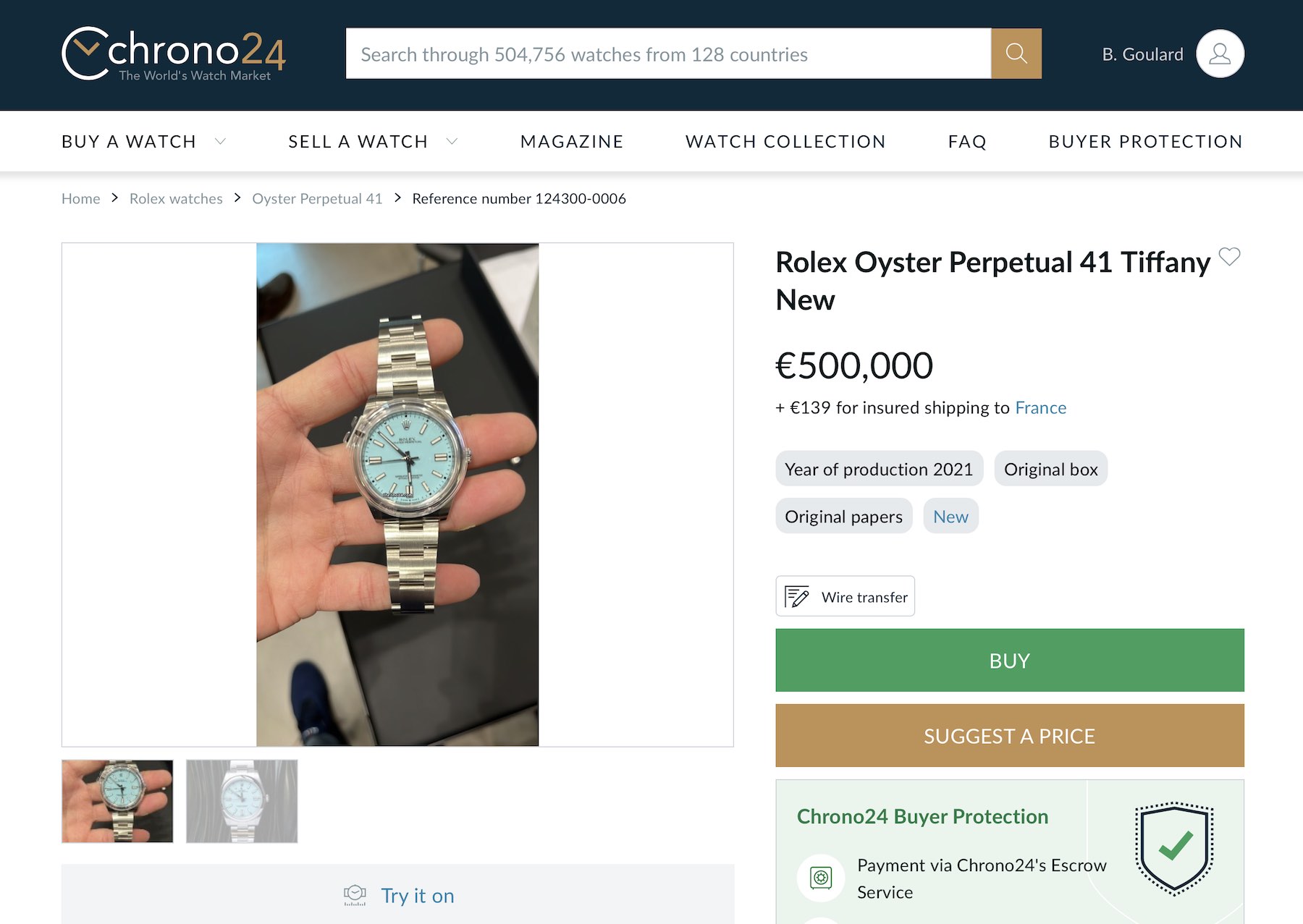

Indeed, the situation that we explained already on multiple occasions, regarding sports Rolex, the Audemars Piguet Royal Oak, or the Patek Philippe Nautilus, is getting completely out of hands. Simply, the watches that were already impossible to acquire at retail price in 2020 are now even more unattainable and are coming with insane premiums – think 200% over the retail price or more.

A Rolex Daytona ceramic bezel will cost you about EUR 35,000. A Royal Oak 15202ST… That’ll be an easy 100k euros. And a simple blue dial Nautilus 5711 (remember, it’s a steel sports watch with a time-and-date movement) will come at about EUR 130,000. And don’t even get me started on the Olive Green version, which is coming at irrelevant prices.

But this situation is true for many more models, with a fabricated scarcity (who’s to blame, this is a very complex question, with no easy answer). There are Rolex Oyster Perpetual 124300 with light blue dial (which is NOT a Tiffany watch) now listed for EUR 70,000, or even far more than that… And that came just after the sale of the Nautilus Tiffany by Phillips. Where is the rationality? I don’t know anymore.

…And a simple Nautilus can cost more than the most complicated wristwatch ever made by the very same brand

Talking about the Nautilus Tiffany-Blue dial, while we’re at it, and to end this column on a light (not that light actually) note, how is that even possible that a steel sports watch can cost more than the brand’s most complicated wristwatch ever created – the Grandmaster Chime, and its variation, the 6300G – a watch with 20 complications, and listed for about USD 2.2 million?

I know the Tiffany-Blue 5711 was sold for a charitable cause, but still, I sometimes have a hard time understanding the ins and outs of the market… Thankfully, and if you read MONOCHROME on a regular basis, you’ll see that the watchmaking industry has far more to offer than these overly-discussed models.

From the entire team of MONOCHROME, we’d like to thank you for reading this magazine and for sharing your passion for watches with us. We wish you and your families all the best for the holiday season.

4 responses

Thank you, too!

What I would like to see in 2022 is more transparency regarding when a brand itself (usually through an agent) has bought one of its own watches at auction.

Fat chance though! Haha.

Thanks to everyone @ MONOCHROME for sharing your passion in horology with us. Wishing everyone a healthy, happy, and prosperous 2022.

That FHS graph you’ve chosen is hugely misleading. The reality is quite clear – https://www.fhs.swiss/scripts/getstat.php?file=mt3_210111_a.pdf

TLDR story is – “we’re nearly back to the levels that we were at when things were considered bad”

Typo « CHF 22 million, close to the CHF 22.4 million« it should be CHF billion ?

And it’s not CNBC which estimated the secondary market to USD 18-20 billion, but Mc Kinsey.

Lastly: it’s sad that Baselworld went bust, but when you manage to kill the goose laying golden eggs, you’re either too arrogant, dumb or greedy !

Thanks for all the great articles the whole Monochrome team manages to publish on a daily basis. One of the very few newsletters I’m reading every morning ?