Richemont’s 2020/2021 Yearly Results Show Resilience Despite the Complex Situation and Signs of Recovery

A difficult start in 2020, and strong recovery in the past six months.

There’s no denying that the year 2020 has been difficult for all industries, including luxury goods. Due to closures of points of sales, logistics centres and manufacturing sites, as well as the halt in international tourism resulting from the Covid-19 pandemic, luxury powerhouses have seen sales contracting drastically. Yet, the end of 2020 and the first months of 2021 are clearly showing strong signs of recovery. Following announcements by LVMH and Swatch Group, it is now time for the other major player in the field of luxury watchmaking and jewellery to announce its yearly results. And indeed, while the situation has been difficult for Richemont, the end of the financial year is on the rise, surpassing sales of the prior year.

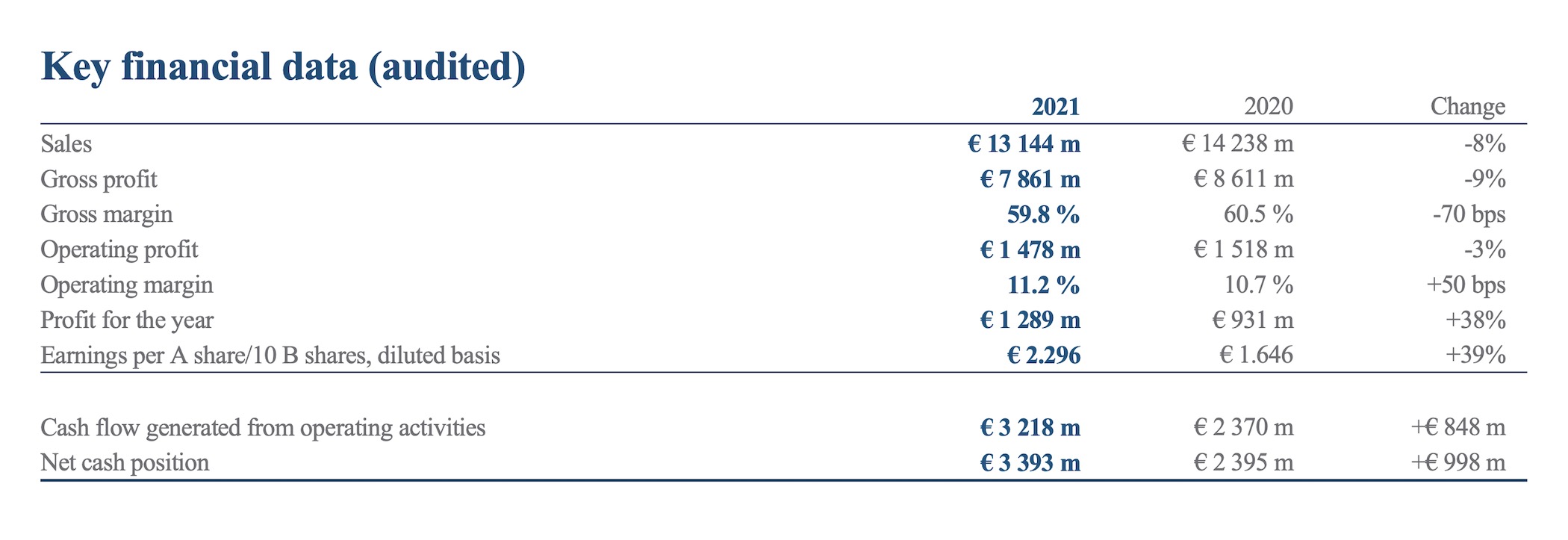

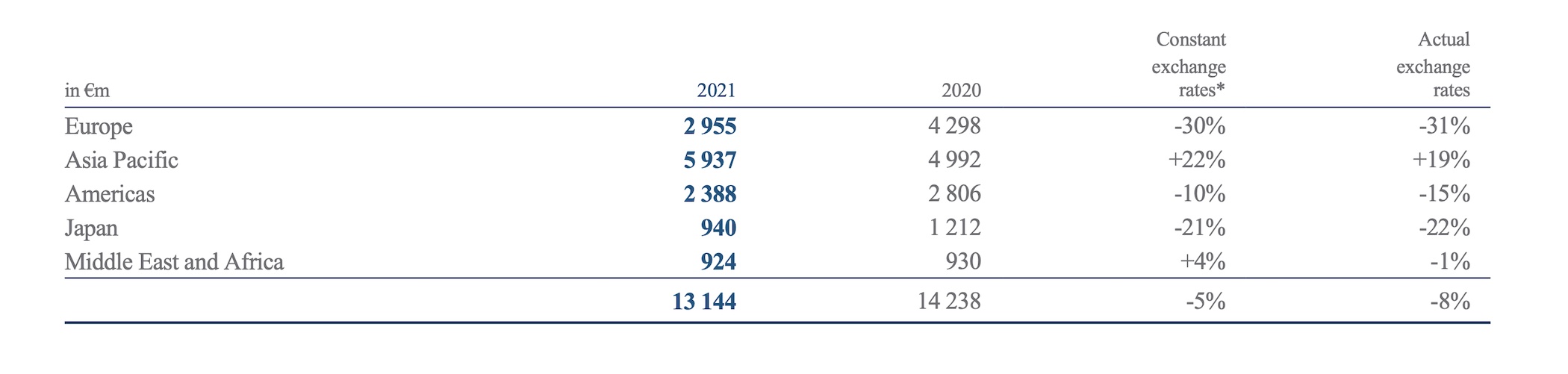

Keeping in mind that Richemont’s financial year starts on April 1st and ends in March 2021, the results for the first half of the financial year 2020/2021 directly reflect the impact of the closure of shops and manufacturing centres. Sales contracted by 25% at constant exchange rates and by 26% at actual exchange rates for the first six months (April-September 2020) of business. Yet, as soon as initial lockdown measures began to ease in certain areas, sales recovered and grew by 17% and by 12% at constant and actual exchange rates, respectively, in the second half of the financial year compared to the same period in the prior year. Overall, for the 2020/2021 financial year, sales for the Richemont Group were down in a relatively controlled way, with a decline in full-year sales at 5% at constant exchange rates and 8% at actual exchange rates. Overall, Richemont’s sales for this year have been EUR 13,144 million versus EUR 14,238 million for the period April 2019-March 2020.

Specifically, sales during the last quarter (corresponding to Q1 2021) show impressive growth, with sales up 36% and 30% at constant and actual exchange rates, respectively, and Richemont reports a strong start in the new financial year with accelerating trends across all business areas. Also, despite the decrease in sales, the group reports improved profitability than in past years, with an operating margin up 50bps and an overall profit of EUR 1,289 million for 2020/2021 versus EUR 931 million for 2019/2020, as well as a significant increase in net cash position.

Looking in detail at the performance, we can see that the situation is not as rosy in all regions. For instance, over the period, sales in Europe were down 30%, the most severely impacted by the pandemic, given travel restrictions, curfews and the temporary closure of stores as well as a number of distribution centres in the first quarter of the financial year. However, sales recovered in the final quarter of the financial year, narrowing the year-on-year sales gap to 7%. In the same vein, however, in less dramatic proportions, sales in the Americas declined by 10%, reflecting the aforementioned pandemic-related factors, primarily in the first quarter of the financial year. Yet, the region also benefited from three consecutive quarters of improvement and a comfortable 21% growth over the fourth quarter. Without surprises, the best performing region is Asia Pacific, with sales up 22% over the period, and three consecutive quarters of growth during the fiscal year and a 106% increase in the final quarter of the financial year. Asia, and specifically Mainland China, was the first region to see sales rebound sharply as early as May 2020. Triple-digit sales growth in mainland China more than offset declines in locations affected by a halt in tourism, notably Hong Kong.

As for the group’s businesses, there is a strong difference between the Jewellery Maisons and the Specialist Watchmakers. The first group of brands, with flagship companies such as Cartier, Van Cleef & Arpels and Buccellati, report sales of EUR 7,459 million, up 3% compared to the previous financial year. The watchmaking division of the group has been quite severely impacted with sales of EUR 2,247 million, down 21% over the period. Still, Richemont reports an improvement in the second half of the year, with sales up 10% year-on-year in the final quarter of the year. Surprisingly, online distributors (incl. Yoox, Net-a-Porter, Mr Porter) reveal that sales were down by about 9% over the period, explained by closures of distribution centres caused by Covid-19.

For more details, please visit www.richemont.com.