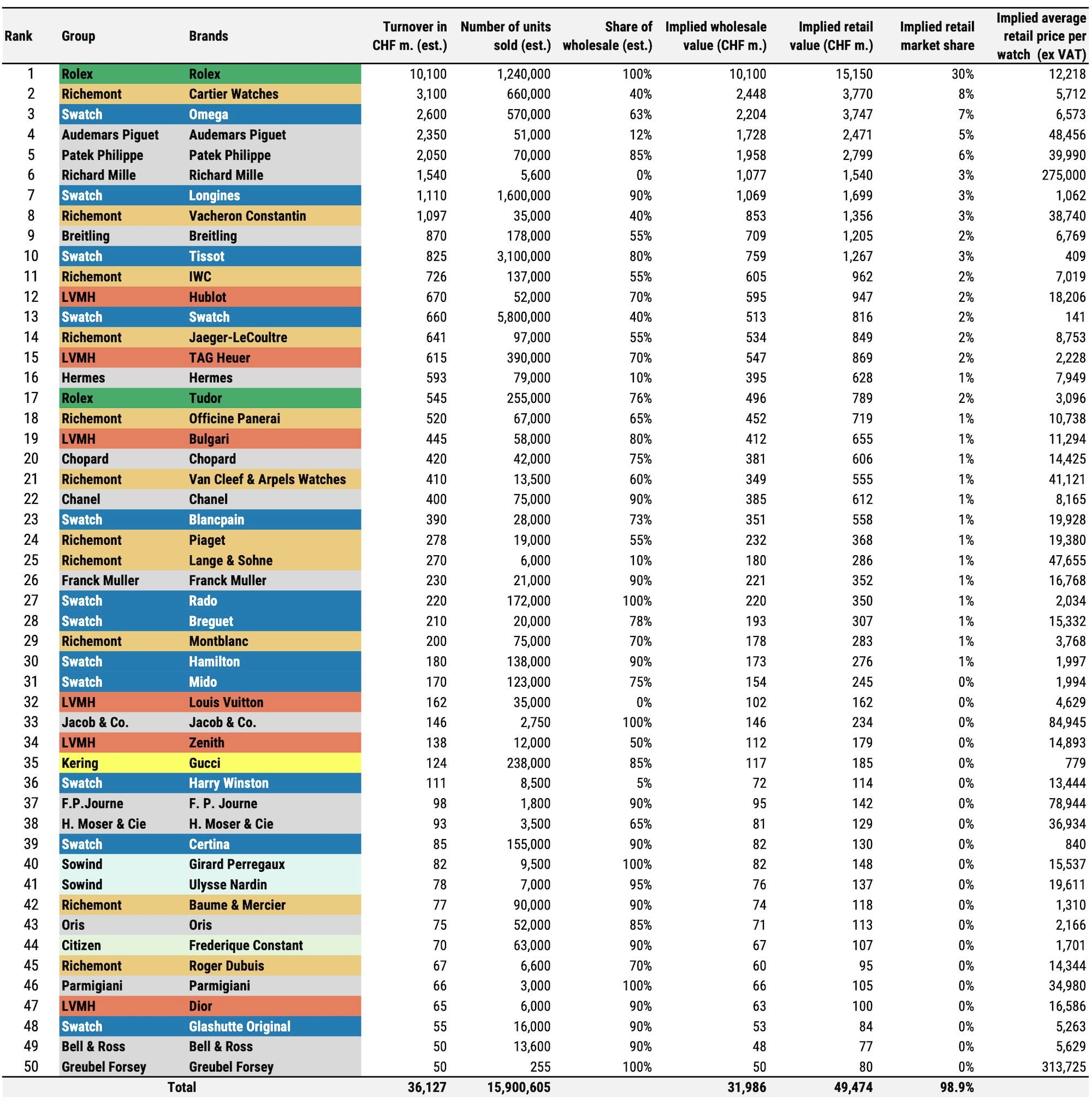

Morgan Stanley’s Top 50 Watch Brands for 2024, Rolex Still by far the Leader, Overall Market Suffered

Morgan Stanley and LuxeConsult's latest industry report brings mixed feelings about what happened in 2024 and what to expect in 2025.

Like every year and for now eight consecutive times, Swiss watch industry consultancy firm LuxeConsult and financial institution Morgan Stanley have worked together to bring their annual report of the Swiss watch industry, and the estimated revenues of the top 50 brands. While the 2023 report showed records for the market, it also indicated the potential slow-down of sales for 2024, with macroeconomic and geopolitical headwinds and demand uncertainties in the US, Europe and mostly China. Well, not only this has been confirmed by the export statistics for the past years, but the new annual report of Morgan Stanley makes sure that all know that the watch industry isn’t at its best anymore – well, there are exceptions to this rule, as the hegemony of Rolex is still undisputed. Some brands, on the other hand, have had and will have difficult times ahead.

As we’ve seen, according to the Swiss Federation of the Watch Industry (FHS), exports of Swiss watches in 2024 were down 3%, something you could see as a consolidation after record years in 2022 and 2023, or maybe the beginning of a recession for the entire industry. While the FHS give a wide image of the entire industry, the yearly report done by Oliver Müller/LuxeConsult and Morgan Stanley – known to be pretty accurate and well-researched – brings a more detailed image per brand and segment. But as a whole, first, “the market contracted in 2024, after three years of a post-Covid rebound” indicates the report. What strikes most, however, is the polarization of the market, with the big players hardly suffering or even continuing to grow, while multiple second-tier brands reported strong decline in sales – “the largest brands generally gaining further market share (a development common to nearly all sub-segments of the luxury goods sector),” says the report. It is also clear that the higher-end segment of the market is performing better than the mid-range and low-end markers, as “watches with a retail price tag exceeding CHF 50,000 accounted for 33.5% of the total value of Swiss watch exports but for an impressive 84% of the growth in 2024.”

Below, for the sake of comparison, the top 50 brands in 2023 and 2024.

As we can see from these charts, there are clear winners (only 11 brands out of 50 with estimated growth) and many brands impacted by the slow-down of the luxury market. First, not only the combined estimated turnover of the top 50 brands has contracted over the course of 2024 – from 36,127 billion CHF to 35,258 billion CHF – but what impresses is the number of units sold, which moves from close to 16 million units to now a tad over 13 million units. This indicates that the average price of the watches has grown drastically over the year.

Now if we look in detail, Morgan Stanley’s report confirms a trend it already evoked in the past; polarization. We can see that the leading privately owned brands (Rolex, Patek Philippe, Audemars Piguet and Richard Mille) are still growing in this challenging environment, while all three listed groups lost market share – LVMH and Richemont, but mostly the Swatch Group, which reported sales down 14.6% in 2024, are reporting a decline of (estimated) sales. On the other hand, Rolex is still the largest watch brand by some margin, with an estimated turnover breaking the 10.5 billion CHF barrier (an additional 500 million CHF compared to 2023).

The so-called “Big Four” (Rolex, Patek Philippe, Audemars Piguet and Richard Mille) are “capturing an impressive aggregated 47% market share. The acceleration of the long-term trend for the four largest privately owned Swiss watch brands (is demonstrated by) a very impressive increase of +1,020 bps from 36.8%” compared to 2019,” according to the report. Rolex, even though its growth is less drastic than in 2023, “further expanded its dominant position (…), no other luxury brand can claim such a dominant position in its respective sector.” The same can’t be said about its sister brand Tudor, losing traction and recording a difficult year according to Morgan Stanley’s estimates.

The second on the podium, Cartier (owned by Richemont), consolidated its position and the report indicates a similar trend for jewellers/watchmakers, as “brands Cartier, Bulgari and Van Cleef performed the best, gaining market share.” Omega, which closes the podium, follows the trend of the Swatch Group (yet in less dramatic proportions than some sister brands). As other important trends, LuxeConsult and Morgan Stanley indicate that larger independent watchmakers/brands continued to grow in 2024, after a spectacular rise in the previous years – this is true for FP Journe, H. Moser & Cie or MB&F, which has just entered the report.

However, the concentration of the market is undeniable, with now “four groups accounting for over three-quarters of the Swiss watch industry’s sales,” namely Swatch, Rolex group (the brand Rolex alone accounts for 32% of the market), Richemont and Patek Philippe, while LVMH is now positioned 5th with a market share of just under 6%.

For more details, visit Morgan Stanley and LuxeConsult. All numbers listed above are estimates from LuxeConsult and Morgan Stanley Research and were not provided directly by the brands.

22 responses

What does the share of wholesale column mean in this chart? Also would be interesting of they made a report that included all countries including Japan and China.

Officine Panerai clinging on to relevance.

Who cares about what Morgan Stanley thinks of anything, least watches…

@Arthur – considering it’s one of the most accurate reports about the state of the industry (knowing that most companies do not officially publicized their sales figures), quite some people actually… But if you don’t find it interesting, it’s all fine 🙂

The share of wholesale corresponds to the share of watches that are sold via retailers/distributors and not directly by the brands in self-operated boutiques – for instance, Rolex watches are sold at 92% by retailers (the brand hardly operates in-house boutiques), Richard Mille is 0% (they only sell via their own boutiques), just to give you some examples.

Brice, who cares about facts and figures these days? It’s all a great believe-in-your-own-reality, everyone for themselves game, and Big Figures aren’t going to tell anyone where the Numbers are 😉

In addition, this is not a no where relevant to the secondary market current status. For those who will take this as a ranking reference.

I cant see the appeal in Rolex anymore. Every time I see one I assume its a fake.

I prefer the higher end Seiko’s.

Simon

Quick question for Rolex. Is Bucherer (Tourneau) considered an in-house boutique or a retailer. That may change some numbers.

@Olivier – very good question. I don’t have the answer to that. But I’ll ask Oliver Müller, who is behind the report.

@brice goulard thanks for forwarding the question: we included indeed the sales of Rolex watches by Bucherer for 2024. The additional estimated sales are the captured margin previously given to Bucherer.

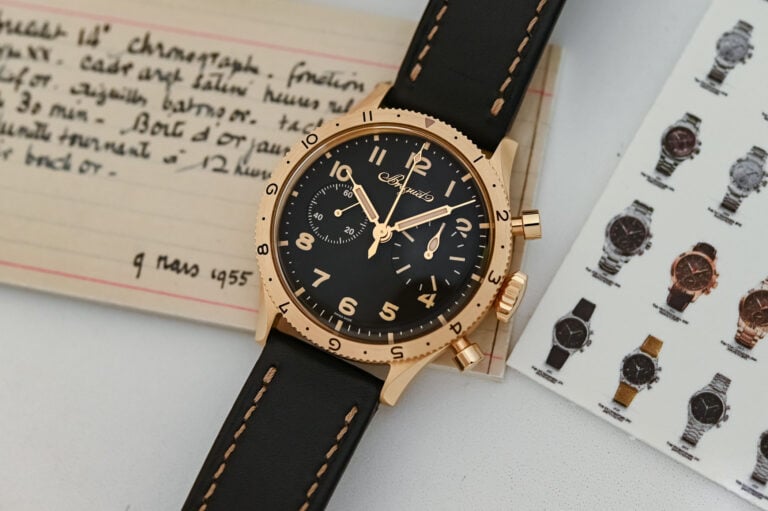

Looking at 2024 vs. 2023 figures, I found a rather peculiar big change of Breguet and wondered if something might be wrong? Or am I reading it wrong? The number of its unites sold plunged from 20,000 to 7,400 between 2023 and 2024. And the IARP per watch jumped incredibly from 15,332 to 32,559 which is quite remarkable even considering the price increases of most Swiss watches in general last year!

I believe there is an error for the top 20 sales chart. Shouldn’t Omega be 2nd per that year’s report?

https://monochrome-watches.com/top-50-swiss-watch-brands-2020-market-share-sales-editorial/

@brice Hi, always enjoy reading your article. Would you please help clarify my question above? Thanks!

@Weitsu Fan – I’ll try to answer the best way possible… but that’s not going to be very precise, sorry for that. So… yes, there’s a massive drop of sales at Breguet, and many people in the industry know that the brand isn’t doing very well currently. On the other hand, the brand has cut a lot of its entry level models (the old Type XX and Type XXI, replaced by the more expensive new Type XX). In the same vein, the other collections have increased in price and, finally, it is known that the higher-end segment is more resilient than the 20-40k segment. This could explain why the number of pieces has dropped impressively, while the average price has gone up.

That being said, we are not the authors of this report and keep in mind that these are estimates, to be taken with the right amount of precaution. Hope that helps (and sorry, the brand will certainly not comment on these numbers, Swatch Group never does)

@Brice. Thanks so much for your detailed reply.

Yes, if Breguet’s 2023 and 2024 figures in MS’ reports are indeed correct, it means Breguet must have sold a higher percentage of watches with high price tag (100K+) within the 7,400 units to bring IARP to $32,559 last year, comparing with those in previous years. In this case, does it mean that Breguet is in the process of drastically changing its business strategy or could it simply be the result of chaos? What surprised me the most is how dramatic the drop of volume it endured between 2023 and 2024, i.e. from 20,000 to 7,400, which seems to be much bigger than the norm, if not the biggest, in the industry!

Any way, they have a new CEO since last October and 2025 is their 250 anniversary. I just wish them the best and hope they could return to the glory when George Daniels was its watchmaker in the 80s or when Nicholas G. Hayek was in the reign two decades ago.

@Weitsu re Brequet changes. I might have to do with Swatch’s Nick Hayek slamming last year’s report with completely fictitious numbers, saying that the Swatch brands in the report were out by 40% in volumes and out by 30% in sales with notable mention of Breguet’s numbers being totally wrong, esp average value being half what is should be. Clearly Oliver has decided to correct the record 😉

https://www.horolonomics.com/2024/05/mr-hayek-concurs.html

The most incredible drop we see in mid-tier brands like IWC, JLC and HUBLOT. Years of stagnation, boredom and slight color changes start to cost them dearly. I don’t understand what these brands are doing.

@brice goulard Hello, I don’t understand the signification of wholesale implied value and retail implied value. For instance, for Rolex, revenues are deemed at 10.583 bn, with wholesale value at 10.3bn and retail value at 15bn. I’m a bit confused about the meaning of the “implied value” columns and their relation with revenues.

Thank you for your help !

@Eytan – The answer is pretty simple, but I do understand the confusion. We have to keep in mind that Rolex (headquarters) is a company that doesn’t sell watches directly to customers, but to distributors and retailers. This means that the turnover of Rolex corresponds to the value of watches sold to retailers, not to customers – this corresponds to the “wholesale value”. However, by a “simple” calculation, considering the margins applied by retailers, you can deduct the “implied retail value”

@brice goulard Thank you for this reply, that is what I had mostly understood !

Following this logic, I therefore don’t understand why wholesale value and retail implied value are different for Richard Mille, since the brand only sells via their own boutiques, as you mentioned earlier. Both value should be equal, right ?

Looking forward to reading you !

@Eytan – at this point, it goes beyond my knowledge, since we are not the authors of the study, but Morgan Stanley and LuxConsult are. Maybe they can answer, as I can’t find the correct answer for you. Sorry.