LVMH Sales Down 5% in 2025, Good Resilience of Watches & Jewelry Division

After lacklustre results in 2024, LVMH is now reporting sales down for the first time in years.

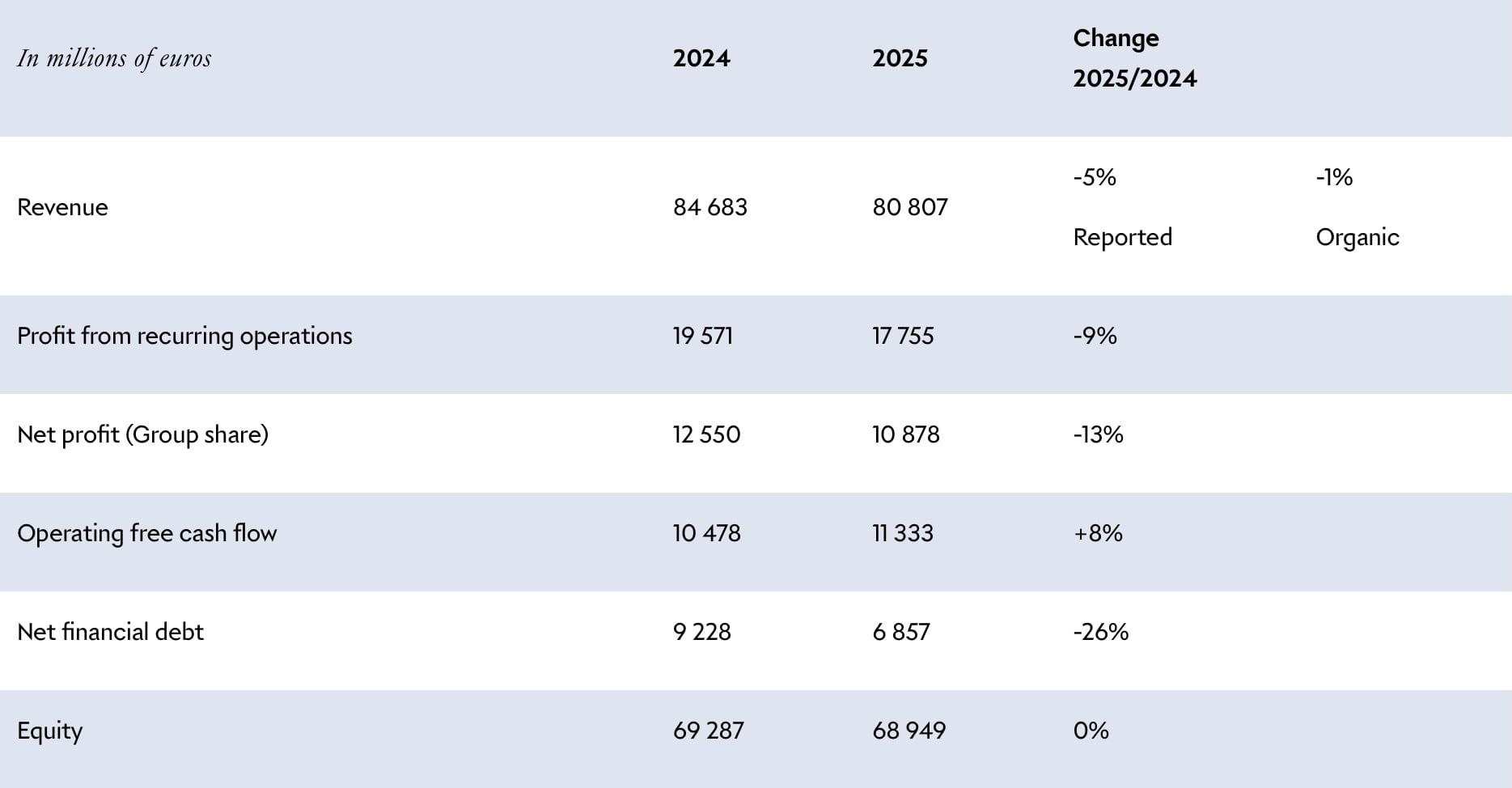

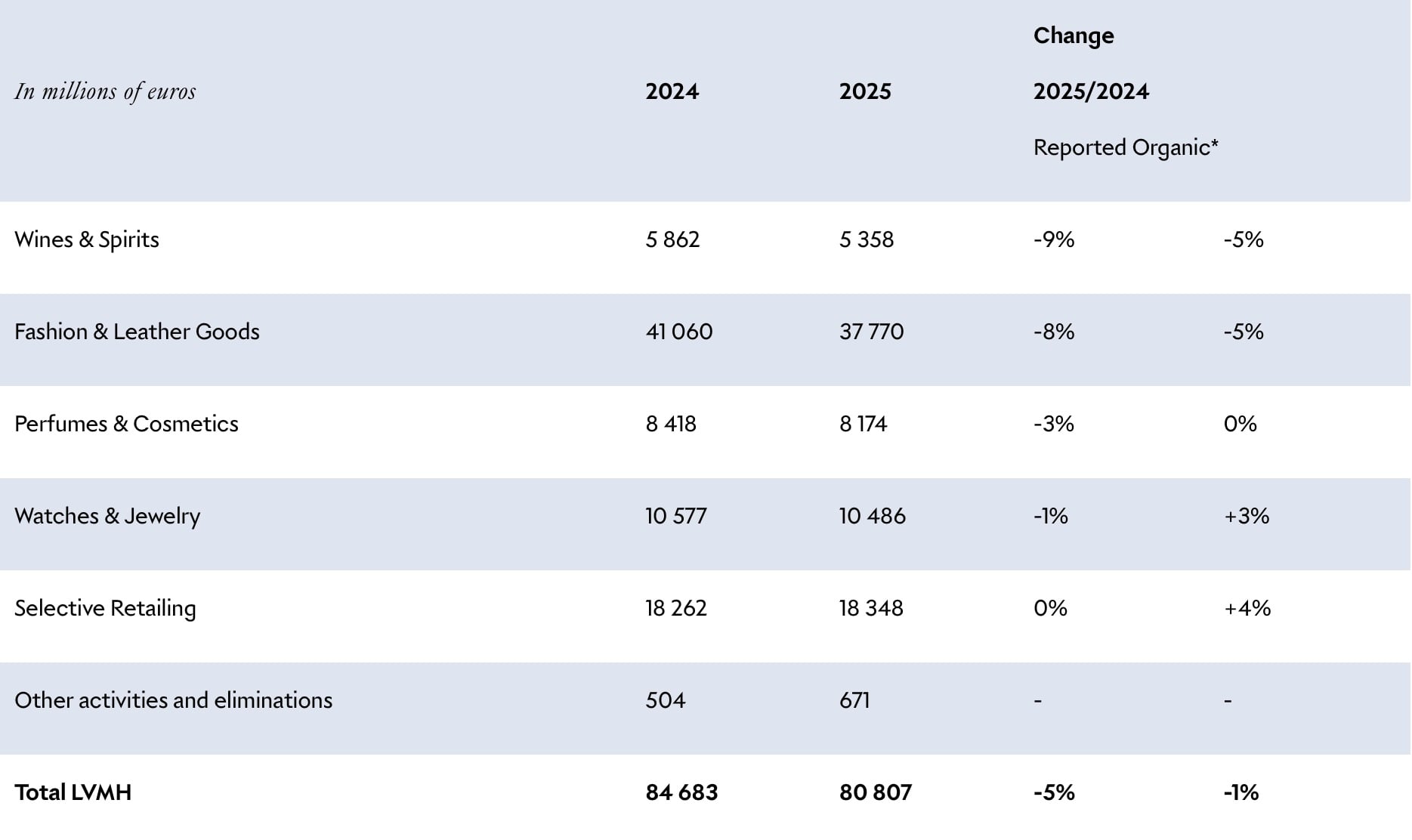

There’s no denying that we’re currently facing a global decline in the luxury goods demand, with sales affected by uncertainties in China, the undeniable effect of US tariffs on exports to the region and several conflicts around the world. Last year, despite this challenging environment, powerhouse LVMH, the world’s largest luxury conglomerate, reported a moderate growth of 2% of sales, yet revenues were down 2% for the Watches and Jewelry Group. This year, as indicated by the group’s 2025 financial report, and for the first time after continuous years of record sales, revenues of LVMH are down 5% (reported) and 1% (organic), at EUR 80,807 million. However, a certain resilience of the Watches & Jewelry division must be noted.

Following all quarterly announcements, it was expected to see revenues and profits of luxury powerhouse LVMH down for the full 2025 year. It is no secret that the whole luxury industry, whether fashion, wines or watches, has been affected this year by several geopolitical and economic factors. While LVMH is the first to publish its yearly report, the same trend is to be expected for other groups, such as Kering, Swatch or Richemont. As for LVMH, the group reports sales down 5% compared to 2024, at EUR 80.8 billion, versus EUR 84.6 billion, explained by “a disrupted geopolitical and economic environment.” In the same vein, profit from recurring operations for 2025 came to EUR 17.8 billion (down 9%), equating to an operating margin of 22%, affected by currency fluctuations.

The group reports a decline in demand in the second half of the year for Europe, while the United States saw growth, benefiting from solid local demand. Japan, which was performing particularly well in 2024 due to a weak yen and was consequently boosted by growth in tourist spending, now sees its sales down. On the other hand, the rest of Asia saw a noticeable improvement in trends with respect to 2024, with a return to growth in the second half of the year. The group’s results are particularly affected by the weaker demand in leather goods and fashion (down 8%), as well as wines and spirits (down 9%).

For what is our interest here at MONOCHROME, the Watches & Jewelry division reported flat sales despite the economic challenges (US tariffs, slow demand in China) and geopolitical factors. The organic growth is said to be up 3%, while the reported revenues are down only 1% at EUR 10,486 million, versus EUR 10,577 million in 2024. One important factor to take into account in 2025 is the massive exports done by watchmakers prior to the implementation of the tariffs in the US, which might positively affect revenues. 2026 will be a year to follow, in particular for sales on US soil.

For more details, please visit www.lvmh.com.

1 response

Couldn’t happen to a more worthy luxury conglomerate!! Ha! Just don’t have much respect for the way they treat a customer!