The 10 Largest Watch Brands in 2025 – Rolex is Still the Undisputed King

Vontobel's report and estimates are clear about Rolex's market share dominance...

As we have seen recently, when we analysed the Federation of the Swiss Watch Industry’s report and its export data, the watch industry isn’t at its best; exports are down, sales are declining for large conglomerates, and there are challenging times ahead for 2026. Outlooks remain cautious, as the industry is likely to continue facing headwinds from a strong Swiss franc, inflation, and economic and political uncertainties. However, this doesn’t appear to affect a handful of brands and groups, in particular Rolex, which remains, undoubtedly, the unrivalled market leader, with sales exceeding CHF 10 billion. This is one of the many takeaways from Vontobel’s recent report, but the analysis needs to be nuanced – especially when looking at the top 10 watch brands for 2025.

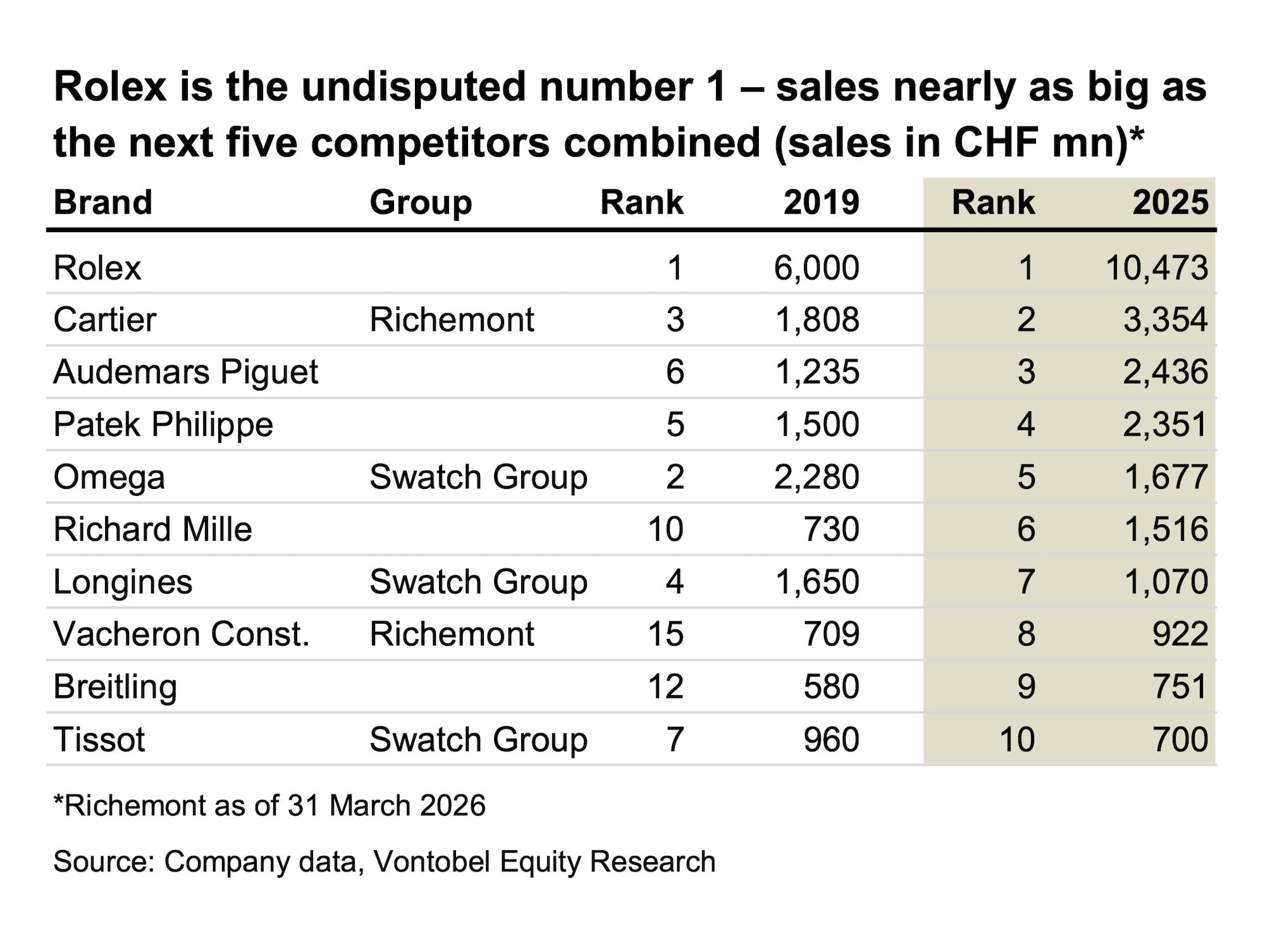

Swiss bank Vontobel is one of a handful of organisations with genuine credibility in producing an annual report on the watch industry and luxury goods more generally. Together with Morgan Stanley and LuxeConsult’s report, Vontobel’s analysis is a must-read. Led by Jean-Philippe Bertschy, Head of Swiss Equity Research at Vontobel, the latest report provides clear indications of the current transformation of the industry. Of course, the highlight remains the following chart, ranking the top 10 watch brands in 2025, according to Vontobel’s estimates (most of these brands do not publish their financial results).

Beyond Rolex’s impressive sales, which still exceed CHF 10 billion, the most notable aspect of this chart is the relative scale of Rolex compared with its competitors. Rolex’s sales are equivalent to the combined sales of the next five competitors. This shows that there is a real polarisation of the industry, or that “the industry is becoming increasingly oligopolistic”, as Vontobel puts it. Almost all are positioned at the higher end, except Tissot and Longines, which operate in the lower segment of the industry. As the report indicates, in the “premium segment above CHF 500, the top ten brands now account for nearly 70% of export volumes, while concentration rises above 80% in the segment above CHF 3,000, underscoring the systemic importance of a handful of dominant players for the watch supply chain.” Over the past couple of years, only a handful of brands managed to maintain or grow volumes – unsurprisingly, these are large independent firms such as Patek Philippe, Audemars Piguet and Richard Mille, with Cartier also benefiting from a strong momentum.

Also noteworthy, Vontobel’s report indicates that an increasing share of Rolex’s revenues comes from its Certified Pre-Owned program, now a major contributor, with “estimated sales of CHF 500 mn in 2025.” Things have changed quite drastically over the past decade. Indeed, as Vontobel adds, “back in 2019, Swatch Group was the biggest watch company measured by watch sales. Six years later, both Rolex Group (incl. Tudor) and Richemont’s watch sales surpassed those of the traditional bands, thanks to exceptional growth at Rolex and Cartier in particular.”

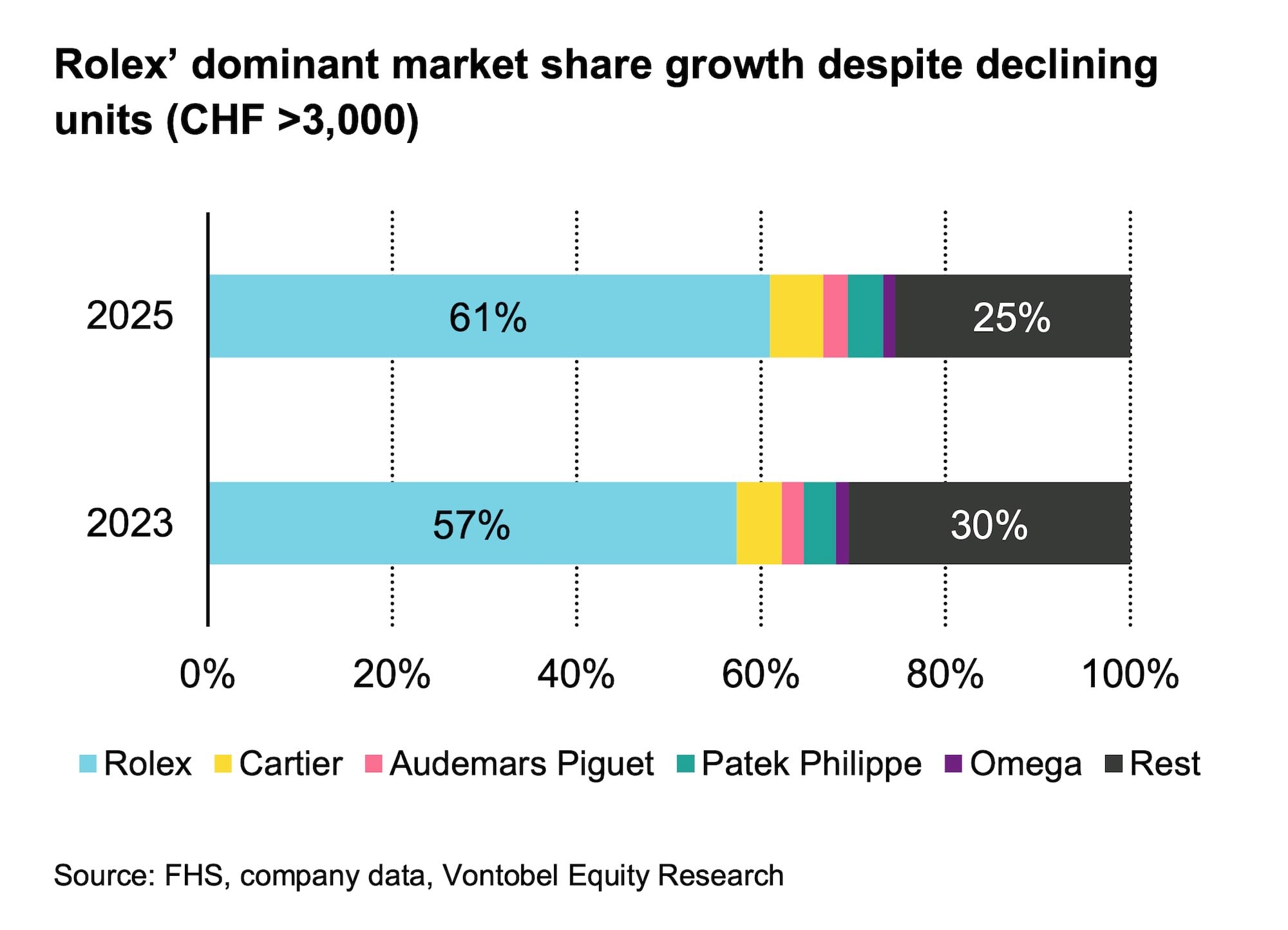

But the situation is two-fold. While major brands report higher results, this growth masks a decline in volume in the traditional core segment of luxury Swiss-made watches (export price above CHF 3,000). As Vontobel explains, “over the past two years, the segment above CHF 3,000 has exported roughly 220,000 fewer watches, a decline of just over 10%, confirming that even the high end is not immune to volume pressure.” But that’s only one side of the coin, as in the meantime, Vontobel “estimates that watches priced above CHF 20,000 have increased substantially over the same period, by nearly 50,000 additional pieces. This implies that the “core” high-end segment between CHF 3,000 and CHF 20,000 has shrunk even more sharply.” This reinforces the idea that ultra luxury is absorbing a growing share of the industry while the core range of Swiss watches suffers, with volumes squeezed.

Last but certainly not least, Vontobel indicates that Rolex has trimmed production in 2025 for the second year in a row, but “most likely by design, as the brand prioritises scarcity and pricing power over incremental unit growth.”

In order to understand more about the evolution of the luxury watch industry, we will interview Jean-Philippe Bertschy, Head of Swiss Equity Research at Vontobel, in the coming days. We also await the publication of LuxeConsult/Morgan Stanley’s reports.

13 responses

The above figures prove, if it was ever necessary except to the very credulous, that Rolex watches are neither rare nor exclusive. One look at secondary market websites should ram the point home – if Rolex watches are so rare why are many hundreds more for sale on each website than say, Breitling or Jaeger? Because there are lots of Rolex watches available. Only fools pay more than retail. What is interesting is that Tissot and Longines seem to be holding onto positions in the top ten despite lots of competition from micro brands and others “lower” end brands like Christopher Ward for Tissot and Tudor for Longines. It suggests that most non-enthusiast buyers would rather trust a lower priced “big name” brands than lesser known brands and that Tudor may appeal to the enthusiast market but not to general buyers who probably (and correctly) perceive it as the “poor man’s Rolex”. Hans Wilsdorf himself did set Tudor up to be exactly that and the idea seems to have stuck.

Rolex is a mass production luxury item.

They make 1.2 million watches are year. More than any other mid to high end brand.

Would love to see Japanese watch companies sales compared to the Swiss companies for same time period…!!??

@Donald Rossi Jr – so do we… Unfortunately, none of the large Japanese watchmaking companies discloses their sales figures.

Why was Tag Heuer left off of this list? They are reporting sales of CHF 1 billion for last year.

@Chris Attaway – As far as we know, TAG Heuer (like all brands from LVMH) doesn’t disclose sales numbers, and according to the latest estimates (at least for 2024), TAG Heuer has sales around CHF 650-700 million.

Rolex is the Tesla of watches. Not likeable, politically dubious and the vast majority of customers do not care about the product. They buy it to send a message.

Hence the old saying: „You can be a watch collector and Rolex lover, but being a Rolex collector does not make you a watch lover.“

A mass produced luxury item (Rolex) is an oxymoron. Tudor and many others have no luxury aspirations and scratch the itch for a scuba, with (subjectively) better looks on top. Indeed, I fail to see the point of a shiny sports watch.

I have a pretty good watch collection that includes Rolex. The Rolex watches are so

much more comfortable to wear. I can’t find a brand that is even close to looking as good either. Some of the Seiko watches are good looking and kind of comfortable. People must like them a lot according to these numbers.

Following up with one of SPQR’s points, just wonder how much percentage of Tudor’s sales figure contributes to being bundled up with Rolex in certain ADs? The same rationale goes to CODE 11.59 with Royal Oak which contributed to AP’s annual gross in recent years. The point does not mean to detriment the individual merits of either Tudor or CODE 11.59 but to reflect the existing as well as alleged market phenomena.

(This is a revision of my post yesterday to clear up a couple of sentences. Monochrome editor please delete my previous post.)

Following up with one of SPQR’s points, just wonder how much percentage of Tudor’s sales figure could be contributed from being bundled up with Rolex in certain ADs? The similar scenario could also be applied to CODE 11.59 with Royal Oak which helped to further elevate AP’s rising annual gross in recent years. The point does not mean to detriment the individual merits of either Tudor or CODE 11.59 but to reflect the existing as well as alleged market phenomena.

I agree owing a Rolex is synonymous to success and one need not be a watch enthusiast. In fact while I have been waiting for my desired Rolex at the local AD for a year or so, I got a Tudor GMT Pepsi during Christmas and knew right away why it’s called ‘poor man’s Rolex’. After wearing Rolex, I don’t think I will use Tudor.

Just for the reference Seiko-Epson had almost 2,6 billion in sales which is better almost then Omega and Longines combined.

Another insane stat is that Seiko profit margin in 2025 was 15%,it puts to shame Richemont with only 4%

Seiko sold also 57 million movements in 2025.Rolex and Seiko sales were very strong but that was expected considering they are two most recognizable brand in the world!!