Selective Normalisation in 2026 – Overview of the Watch Industry with Jean-Philippe Bertschy, Head of Vontobel Equity Research

What can we expect for the watch industry in 2026? Something named "Selective Normalisation".

Each year, this report is eagerly awaited as one of the leading guides (alongside LuxeConsult and Morgan Stanley) for the watchmaking and luxury industry, helping it navigate what can currently be described as choppy waters. Luxury Goods, the annual report by Vontobel Equity Research, has just been published. An extremely detailed analytical compendium covering the past year, along with forward-looking perspectives for the year ahead. After a very turbulent 2025 – declining exports, depressed markets outside the US, a sluggish Mainland China, and deep structural changes among industry players – 2026 is shaping up with little visibility and, above all, without any clear signals of recovery. So, is 2026 set to become another annus horribilis for watchmaking and luxury? Interview and outlook with Jean-Philippe Bertschy, Head of Vontobel Equity Research.

Pascal Brandt, MONOCHROME – You have just released your annual report Luxury Goods 2026. You refer to “selective normalisation” for 2026. How would you define this assessment?

Jean-Philippe Bertschy, Head of Vontobel Equity Research – By referring to “selective normalisation” for 2026, we mean that the sector is not returning to a regime of homogeneous growth, but that the normalisation process remains largely confined to structural leaders. Concretely, this means that normalisation is primarily visible among maisons with strong brand power, integrated retail networks and a highly engaged customer base, which are gradually returning to growth and margin profiles close to their historical standards. By contrast, a large number of players continue to face pressure on volumes, reduced visibility and a more demanding promotional environment. In other words, 2026 marks a return to a more readable trajectory for a limited circle of winners, but not a broad-based “return to normal” for the entire category, which justifies maintaining a strong selection bias within portfolios.

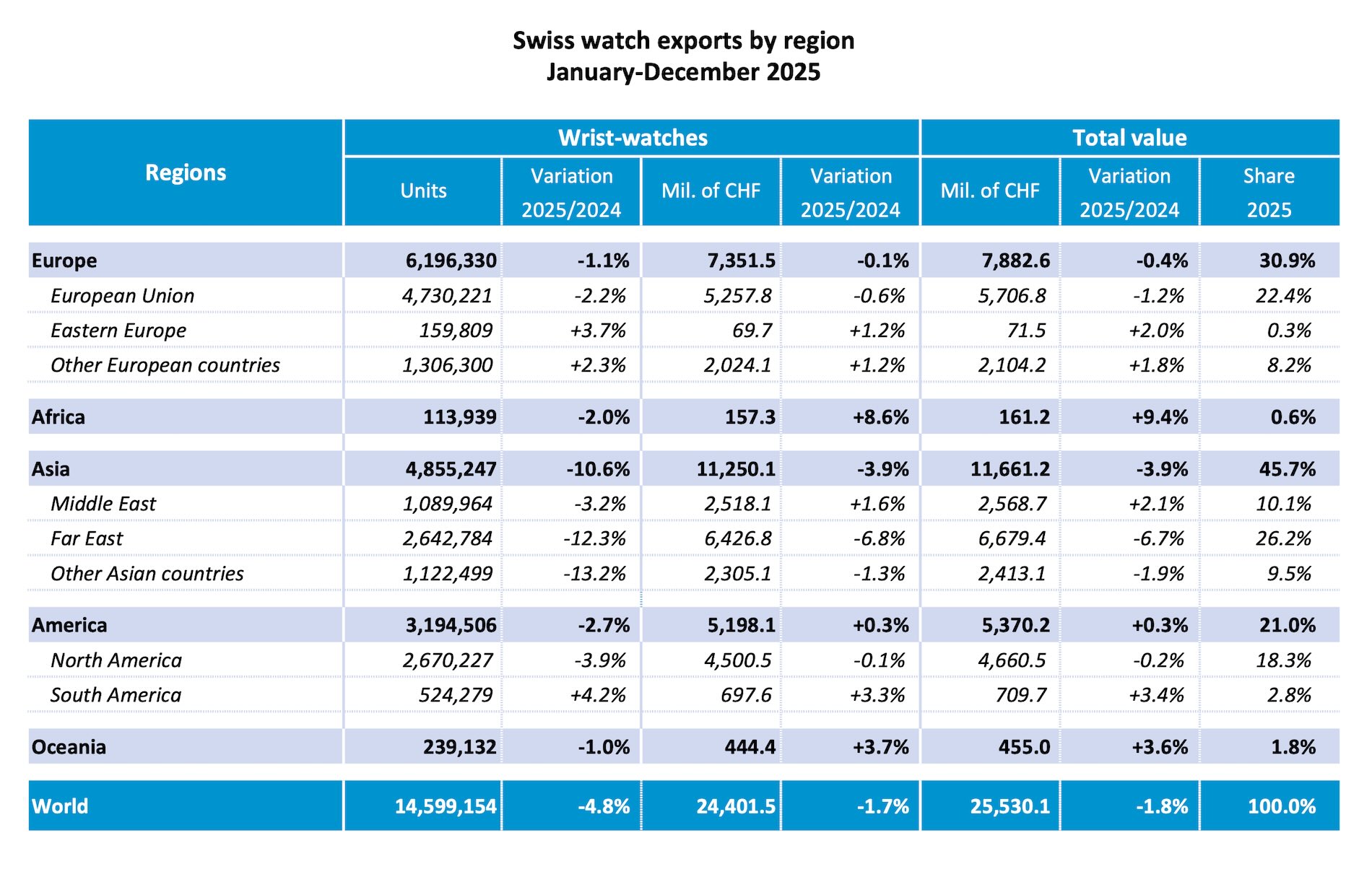

Volumes are falling, value is rising. Is this a threat to the watchmaking industry?

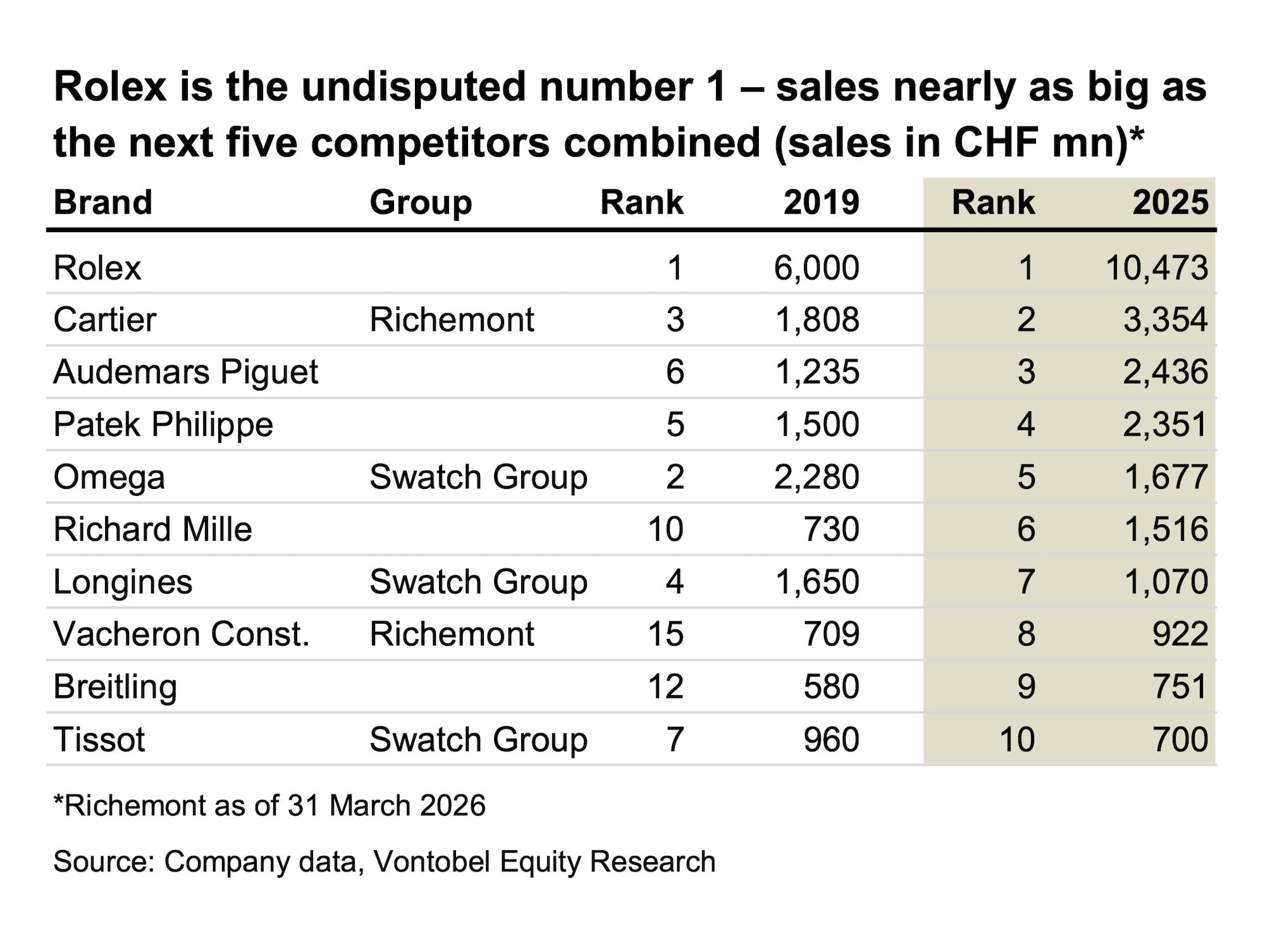

No, this is not an existential threat to the industry, but it is clearly a risk for part of the ecosystem. The combination of sharply declining volumes and rising value confirms a model of “fewer watches, but more expensive ones”, which remains sustainable – and even favourable – for large integrated groups and the strongest brands that are able to defend their pricing power and concentrate demand. Conversely, it weakens the entry-level and mid-range segments, as well as subcontractors most dependent on volume, in an environment where the Swiss watch industry is increasingly built around a narrow core of brands priced above CHF 500 and an oligopoly of leaders capturing the vast majority of value.

The structural landscape of players in the watch market has evolved significantly – you refer to an oligopoly with a few “majors” (around ten brands) accounting for roughly 70% of production volumes and 80% of worldwide market share. That leaves very little for everyone else, despite the fact that the watchmaking universe includes several hundred brands. Paradoxically, newcomers continue to enter an already very difficult market, often at high price points. Are there simply too many brands?

No, the issue is not so much “too many brands” per se as the extreme polarisation between a handful of “majors” and a long tail of structurally fragile labels. In a market where around ten brands capture approximately 70% of volumes above CHF 500 and close to 80% of value, the economic space left for others is mechanically very limited. In this context, high-end newcomers are possible, but they should operate more like niche micro-maisons — with a clear, differentiated offering, limited volumes and focused distribution — rather than aiming to become future generalists. For a large part of existing players, the real question, therefore, is not “are there too many brands?”, but rather “how long can a model without critical size or genuine desirability survive in an environment where value is increasingly concentrated in a handful of global franchises?”

Rolex CPO (Certified Pre-Owned) is a relatively new phenomenon, with estimated revenues of CHF 500 million in 2025. Do you expect the trend to continue in terms of growth?

Yes, we believe the trend will continue, even though growth is expected to normalise from an already very high base. With revenues of around CHF 500m in 2025, Rolex CPO remains modest at the group level, but it has already established itself as a pillar of the ecosystem: it captures part of the secondary market, helps set resale prices more accurately, and strengthens confidence in authenticity. In the coming years, growth should remain solid, driven by the gradual expansion of the network, an increase in eligible inventory and strong client appetite for certified pieces, before converging towards a more normalised pace once the model reaches critical scale.

Another very recent development: Richemont’s sale of Baume & Mercier, and discussions around a potential MBO of Jaeger-LeCoultre. Do you see groups divesting certain brands in an overcrowded watch market to focus on jewellery, which remains relatively under-branded and therefore represents a major growth opportunity?

Yes, this can clearly be seen as a structural trend rather than a coincidence of individual cases. In an overcrowded watch market where a handful of brands concentrate most of the value, it is logical for large groups to rebalance their portfolios in favour of their strongest assets and accept divesting intermediate labels that lack critical size or a convincing growth trajectory. Conversely, branded jewellery remains a far less saturated field, with room to build global platforms and capture attractive structural growth. In this context, we expect groups to reinforce their focus on jewellery maisons and to use divestments, MBOs or dormancy to simplify their watch portfolios and reallocate capital towards the most promising growth poles. That said, this does not mean that all “non-core” watch brands are candidates for disposal. We strongly doubt that LVMH would consider selling Zenith, given the group’s clearly reaffirmed ambitions in watchmaking. Similarly, it seems unlikely that Richemont would divest Jaeger-LeCoultre, given the brand’s desirability, long heritage, history of innovation and high-end positioning, which make it a strategic asset rather than dead weight within the portfolio. If, contrary to our expectations, a sale of Jaeger-LeCoultre were to materialise, it would open an entirely different debate about Richemont’s future strategic roadmap and would likely imply significant shifts in direction.

Or, on the contrary, a reinforcement for others? (One thinks of LVMH, which remains a relatively small player with its three pure-player brands – TAG Heuer, Hublot and Zenith – which appear to be struggling)

We do not believe many candidates are willing to acquire watch brands; beyond LVMH, appetite appears limited given the sector’s structural challenges and the high execution risk associated with turnarounds. In LVMH’s case, it is difficult to imagine Bernard Arnault is satisfied with the current situation, with TAG Heuer, Hublot, and Zenith performing at best in line with the market but well below true leaders in profitability, pricing power, and cultural reach. It is an open secret in the industry that Patek Philippe sits at the very top of its list of ideal targets, even though the brand is not for sale. The work carried out by his son Jean Arnault at La Fabrique du Temps, with a strong focus on high watchmaking and technical content, sends a clear signal: in our view, LVMH is primarily seeking to strengthen its position – particularly at the very high end – rather than to divest watchmaking assets.

Finally, your view on markets for 2026. Stimulus in Mainland China? Maintaining cruising speed in the US? Europe, Middle East? And India, often cited as having very strong potential?

For 2026, we maintain a scenario of very gradual recovery and selective normalisation rather than a fully synchronised “grand cycle”. Mainland China should stabilise, with more mature demand driven by the high-end and the most engaged clients rather than by volumes of occasional buyers; we believe the era of broad-based double-digit rebounds is behind us. The United States remains a key pillar, but at a more reasonable cruising speed after several exceptionally strong years; we expect moderate growth with greater dispersion between brands, rather than another market boom. Demand there remains highly correlated to equity markets and financial wealth, implying increased sensitivity to any stock-market turbulence. Europe should remain broadly sluggish, with reasonably resilient demand in major tourist capitals and among affluent local clients, but a more challenging environment for secondary retailers. The Middle East, meanwhile, retains a solid growth profile, supported by a very high-end clientele and an undiminished appetite for iconic pieces. As for India, the potential is real, but it remains a long-term theme: the base is still small, regulatory and distribution constraints are significant, and India will not replace China in the short term – but it can become an attractive structural growth relay for groups able to invest early and patiently.

For more details, you can consult our article here.