Richemont Announces 2020 Half-Year Sales Down 26%

Sales impacted by COVID-19 - Gradual improvement in July & August.

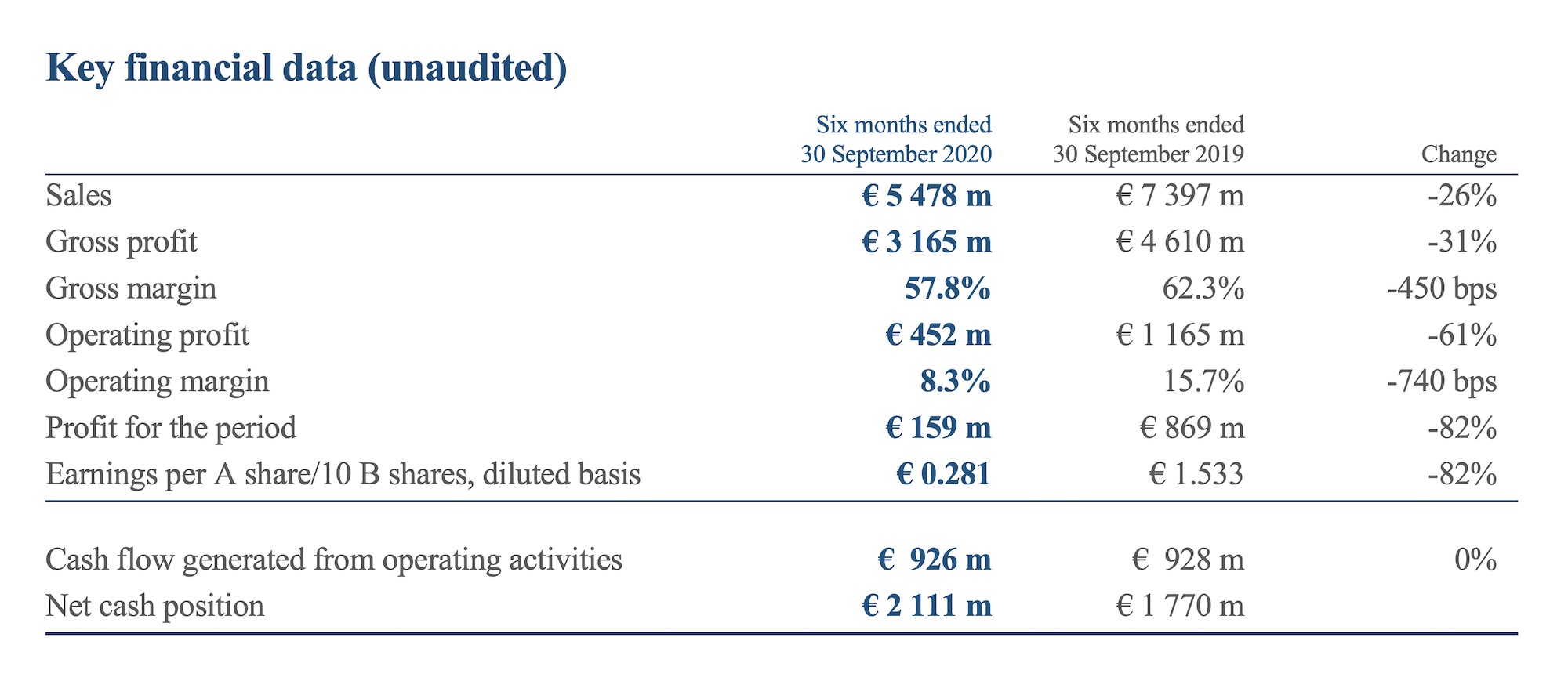

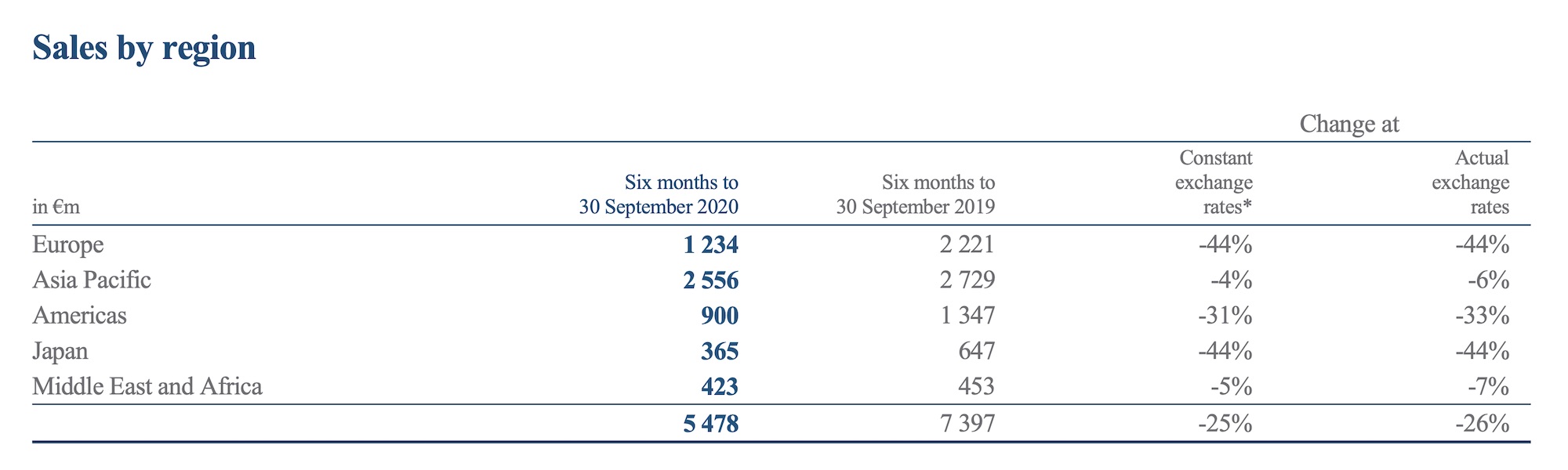

Switzerland-based luxury conglomerate Richemont Group has just issued its trading update for the six months ended 30 September 2020. As expected in these uncertain times, sales are down. COVID-19 impacted activities but the situation has improved over the past months helped by Chinese demand. For the half-year, sales decreased by 26% at actual exchange rates to EUR 5,478 million and by 25% at constant exchange rates. The Group operating profit is down to EUR 452 million with an 8.3% operating margin and the profit for the period is down to EUR 159 million.

The owner of multiple high-end watch brands, such as IWC, A. Lange & Söhne, JLC or Cartier, reports a more positive trend throughout the second quarter of 2020, with sales down by 5% at actual exchange rates and 2% at constant exchange rates, following a 47% decline (at actual and constant exchange rates) in the first quarter of 2020. This was also reflected by other industry indicators. In particular, the statistics released by the FHS (Federation of the Swiss Watch Industry) also indicate an improvement of the situation over the past months helped by Chinese demand. As both overseas travel and daigou activities are greatly affected, the COVID-19 pandemic is accelerating the reshoring of luxury spending in China. As a consequence, Mainland China has become the number one destination for Swiss watches. Exports to China increased by 10.6% over the 9 first months of 2020 while these were collapsing for all other major markets with a decline of 28.3% at CHF 11.4 billion in total. Richemont sales in China were up 78% over their first semester.

The owner of multiple high-end watch brands, such as IWC, A. Lange & Söhne, JLC or Cartier, reports a more positive trend throughout the second quarter of 2020, with sales down by 5% at actual exchange rates and 2% at constant exchange rates, following a 47% decline (at actual and constant exchange rates) in the first quarter of 2020. This was also reflected by other industry indicators. In particular, the statistics released by the FHS (Federation of the Swiss Watch Industry) also indicate an improvement of the situation over the past months helped by Chinese demand. As both overseas travel and daigou activities are greatly affected, the COVID-19 pandemic is accelerating the reshoring of luxury spending in China. As a consequence, Mainland China has become the number one destination for Swiss watches. Exports to China increased by 10.6% over the 9 first months of 2020 while these were collapsing for all other major markets with a decline of 28.3% at CHF 11.4 billion in total. Richemont sales in China were up 78% over their first semester.

If we take a look at the different segments, the Jewelry Maisons showed more resilience with sales down 18% at EUR 3,061 million. The decline was more pronounced for Specialist Watchmakers with sales down 38% at EUR 966 million. Richemont reports that IWC, Jaeger-LeCoultre and Vacheron Constantin were the watch brands that showed the most resilience. Sales for Online Distributors declined by 21% at EUR 934 million.

On another note, yesterday, Farfetch, Alibaba and Richemont announced a global partnership to provide luxury brands with enhanced access to the China market as well as accelerate the digitisation of the global luxury industry. Alibaba will launch Farfetch luxury shopping channels on Tmall Luxury Pavilion and Luxury Soho. As part of this partnership, Alibaba and Richemont will invest USD 300 million each in convertible notes issued by Farfetch Ltd and USD 250 million each in the newly formed Farfetch China. The Pinault family holding Artemis is also putting funds into the new venture increasing their existing ownership in Farfetch.

For more information, please visit www.richemont.com.

2 responses

Just wonder who are the “Specialist Watchmakers” within the Richemont group? While stating that the “decline was more pronounced for Specialist Watchmakers with sales down 38%..,” the article then states “IWC, Jaeger-LeCoultre and Vacheron Constantin were the watch brands that showed the most resilience…” So these three brands are not the so called “Specialist Watchmakers?”

@Fan At richemont, specialist watchmakers are IWC, Panerai, Lange, B&Mercier, Jaeger-Lecoultre, R. Dubuis, piaget, Vacheron Constantin. Cartier and VCA are part of Richemont’s Jewellery Maisons. More info on their website if needed.