Morgan Stanley’s 2025 Top 50 Watch Brands Report: Rolex Leads Amid Rising Market Polarisation

Morgan Stanley and LuxeConsult's 2025 industry analysis indicates that the largest brands have gained further market share, while the vast majority suffers...

Just a couple of days after the publication of Vontobel’s Luxury Goods report, listing the 10 largest watch brands for 2025, as well as analysing the watch industry’s evolution over the last 12 months, it’s now time for another eagerly awaited report to be published. We’re talking about the in-depth annual analysis produced by Morgan Stanley and LuxeConsult (Oliver Müller). As in previous years, this highly detailed report examines how the watch industry has evolved and ranks the top 50 watch brands by turnover and unit sales, based on rigorous estimates. Following record sales reported by Morgan Stanley in 2023, and the first signs of a contraction in 2024, the 2025 report only emphasises this trend, as well as another very important one, the strong polarisation of the market – a development common to nearly all segments of the luxury goods sector – with the top 4 brands accounting for more than 50% of the overall Swiss watch market.

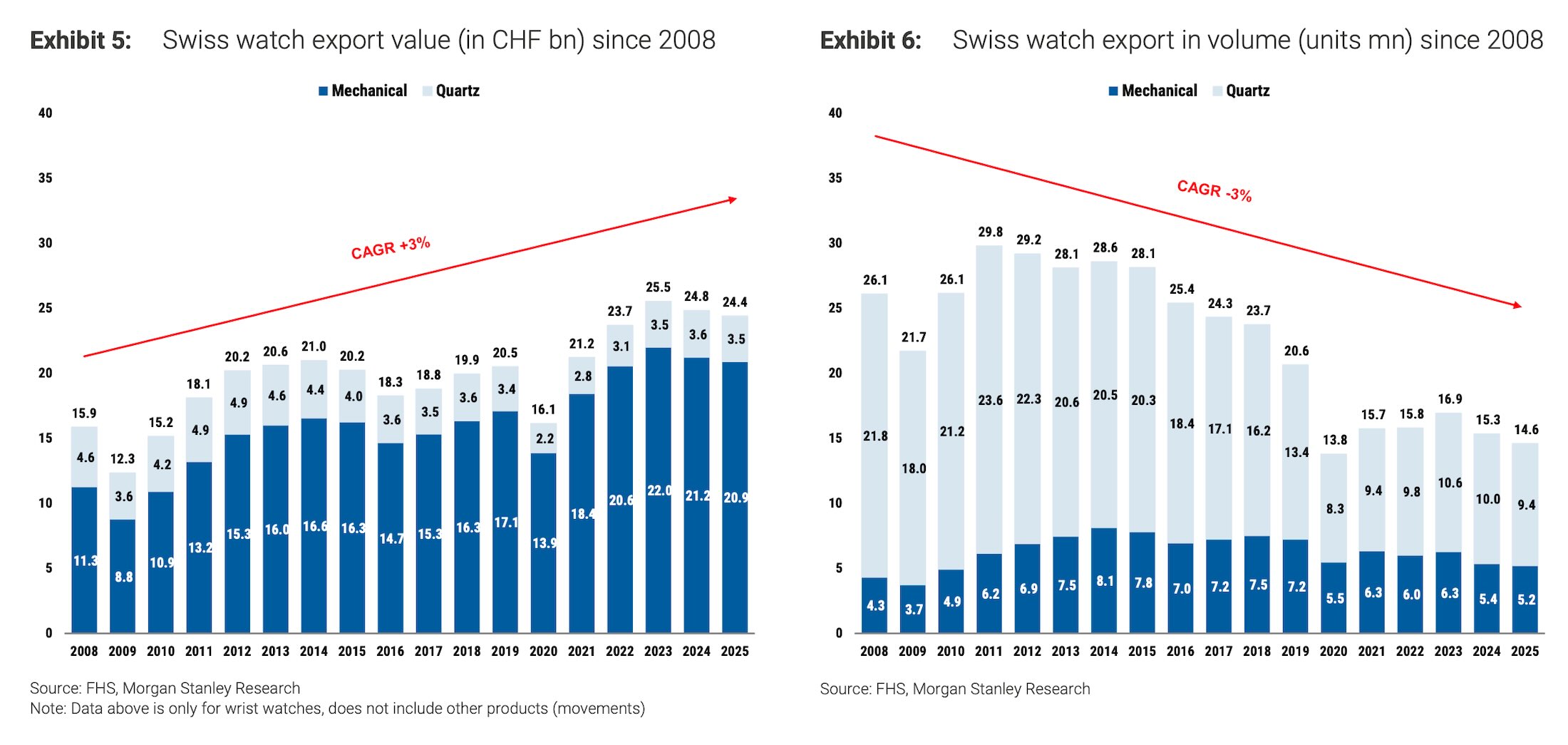

What are the key takeaways of Morgan Stanley x LuxeConsult’s 2025 Swiss Watcher report? Well, as we’ve seen earlier this year, following the publication of the Federation of the Swiss Watch Industry (FHS) export numbers, and for a second year in a row, the Swiss watch market is contracting – exports down -1.7% in value terms – and the total retail value of the market now reaches, according to estimates in the report, about CHF 49 billion (excl. VAT). Morgan Stanley estimates that “the wholesale market for Swiss watches worldwide stood at ~CHF 25.9bn in 2025”, while exports of Swiss watches are reported at CHF 24.4bn by the FHS. This marks the second consecutive year in which the market is contracting in value. More importantly, MS x LC indicates that industry volumes have more than halved since 2011. “The total number has declined by a cumulative -44% since the 2008 recession and -51% since the most recent peak, in 2011. The number of quartz watches has essentially halved, while the number of mechanical watches exported is more or less stable”, the report adds.

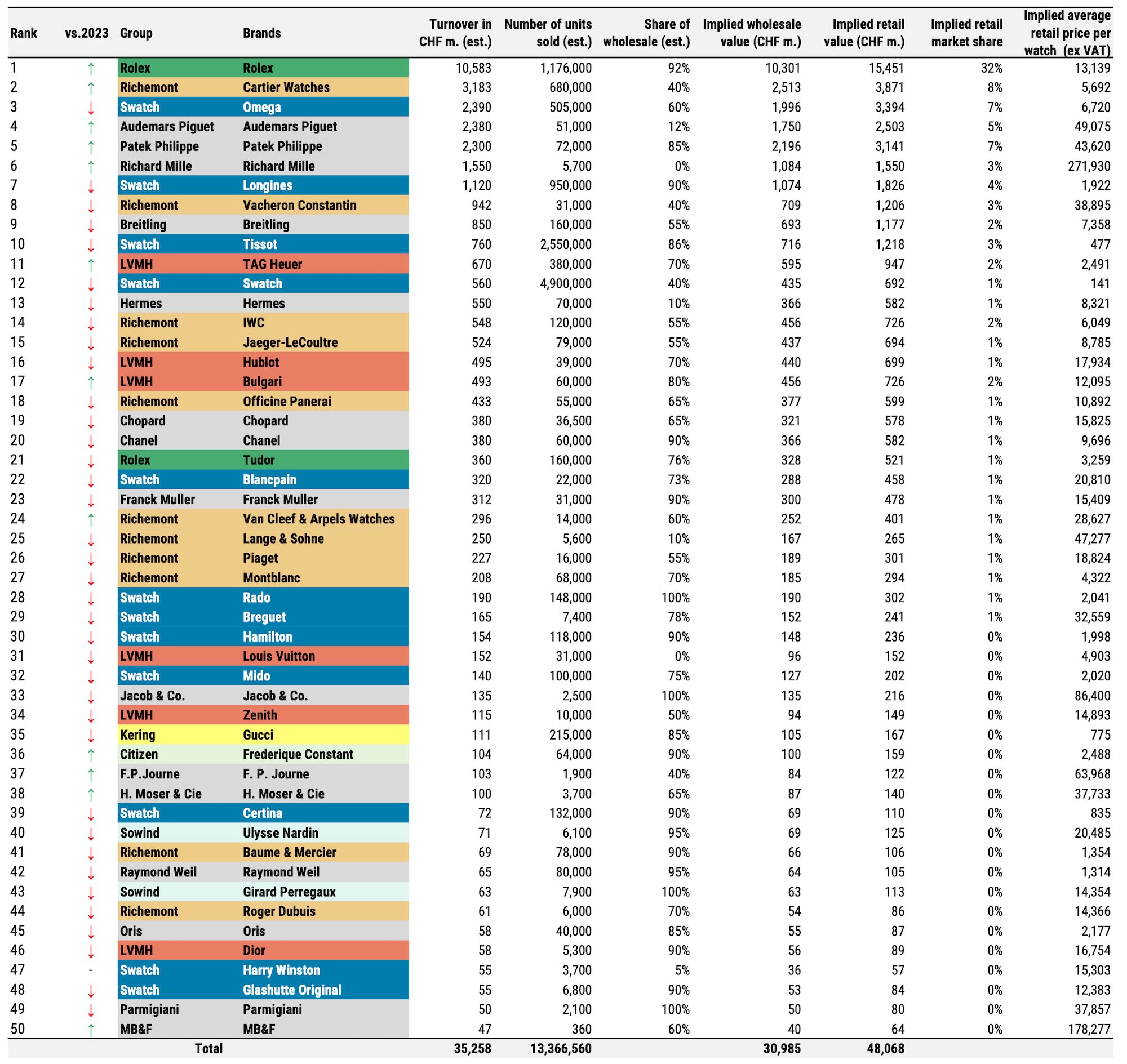

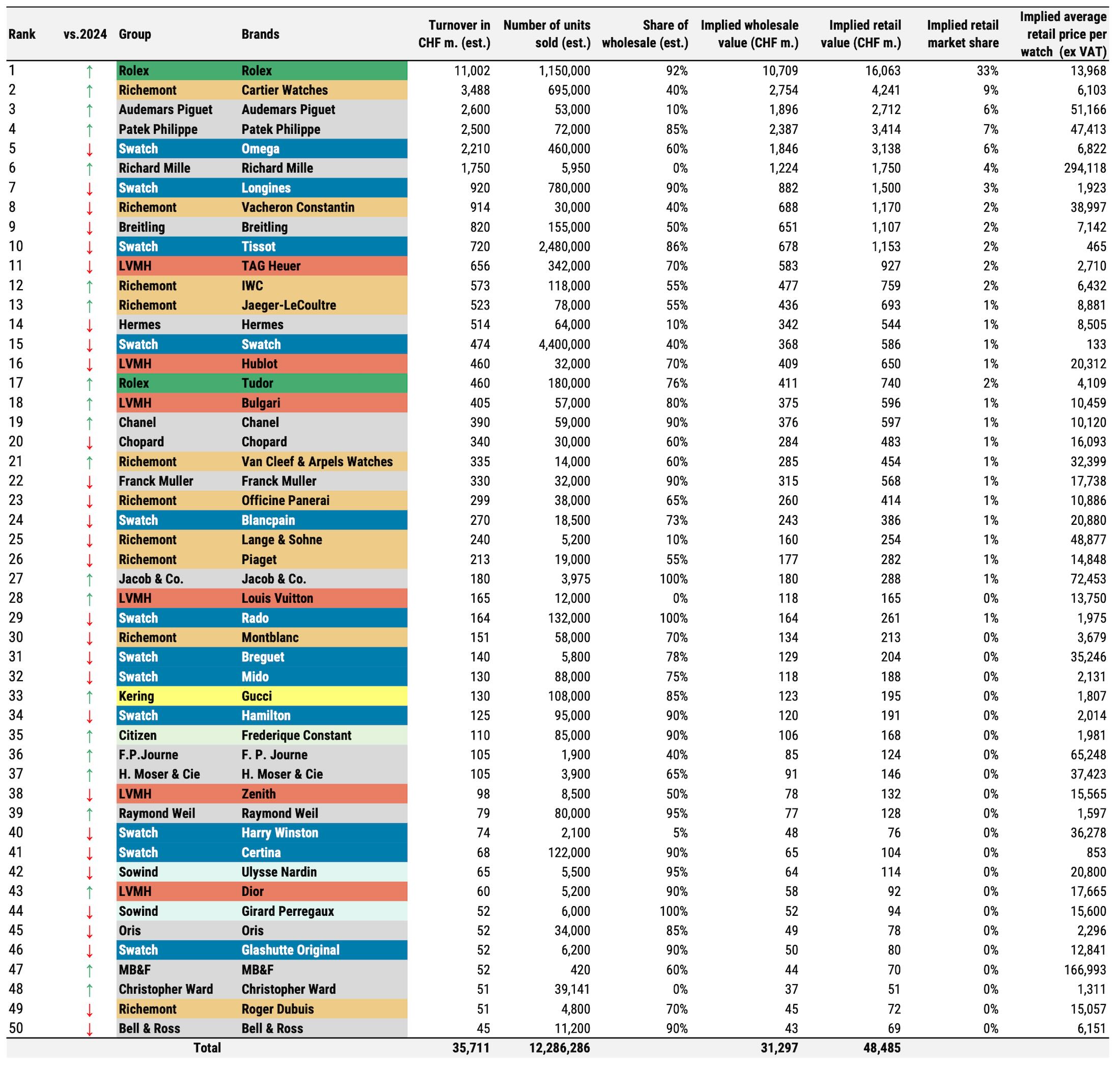

But let’s now focus on the part of the report we are most interested in, the estimates of the top 50 brands’ turnover and retail/wholesale values in 2025. Here, too, the situation is twofold. As in previous years, there are two clear segments: a few key actors that have gained market share and the vast majority of brands, which are experiencing declines in sales.

So what can we see here? As in previous years, the market is dominated by 6 key players: Rolex, Cartier, Audemars Piguet, Patek Philippe, Omega, and Richard Mille. Yet two of these 6 brands are owned by Groups (Cartier by Richemont and Omega by Swatch Group), and among these 6 leaders, 4 are privately owned. Following the trend of the past four to five years, these are the clear winners in the watch industry, as they have “continued to gain market share, while listed groups generally lost market share”. What is usually referred to as “The Big 4” of the watch industry (Rolex, AP, PP, and RM) appears to be relatively impervious to market changes and continues to perform strongly, despite market uncertainties and a challenging geopolitical and economic environment. That said, their growth was relatively limited in 2025, and, for instance, Morgan Stanley’s report indicates that “Rolex proactively (was) managing scarcity to maintain brand desirability and was thus also partially supply driven: we estimate that Rolex volumes were down -2% to 1.1m watches. To our knowledge, this is the first time in over 20 years that Rolex’s volumes declined for two consecutive years”.

Looking at the detailed picture, we can see that some brands had a particularly difficult time in 2025. As the report indicates, “within the Top 50, we estimate that 10 brands experienced a contraction of their turnover of 15% or more in 2025: Longines, Swatch, Hamilton, Blancpain and Breguet (all part of Swatch Group), Panerai and Roger Dubuis (part of Richemont), Zenith (part of LVMH), Girard-Perregaux and Franck Muller”. Also, Omega, which was once the second-largest brand behind Rolex, is now ranked fifth, not only because its sales have declined over the years but also because sales of its competitors have increased faster than those of the rest of the industry.

The overall situation is that of an increasingly polarised industry. While Morgan Stanley estimates that about 450 watch brands are active in Switzerland, the top 4 brands accounted for over 50% of the market (55% in 2025, up from 52.4% in 2024, according to the report). Another point to note is that the so-called “billionaires’ club” (brands with revenues over CHF 1 billion) has contracted this year, as Longines is now out of this group, following Vacheron Constantin’s exit in 2024.

Another key takeaway has to do with the ultra-premiumisation of the market, in the sense that “watches priced above CHF 50,000 represented 37% of export value and contributed 89% of total growth in 2025, despite accounting for only 1.4% of volumes”, Morgan Stanley x LuxeConsult indicates. As in previous years, ultra-luxury doesn’t appear to suffer, while the core range of the Swiss watch industry, once dominated by the Swatch Group, is facing difficult times. That said, the group remains dominant at the entry- and mid-tier levels, with approximately 8.8 million watches sold in 2025, accounting for about 60% of the Swiss watch industry’s volume.

Finally, high-end independent watchmakers continue to thrive, as brands such as F.P. Journe, H. Moser & Cie. and MB&F seem to have increased revenues in 2025 (at least according to estimates). Notably, we observe the arrival of Christopher Ward among the top 50 brands, as one of the few mid-range independent watchmakers to increase its value.

For more details, visit Morgan Stanley and LuxeConsult. All numbers listed above are estimates from LuxeConsult and Morgan Stanley Research and were not provided directly by the brands.