The Top 50 Swiss Watch Brands of 2020… And the Invincible Hegemony of Rolex

Polarisation, diverging trends, successes and failures, 2020 only reinforces an ongoing tendency.

2020 has been a difficult year for the Swiss watch industry, and for the entire luxury market. As we reported recently, the industry has had to face its steepest decline since 2009, with exports plummeting 21.8% in value, below the level of 2011. Certainly, the COVID-19 pandemic has had a strong impact on the watch industry. However, there was more than just a decline in sales in 2020. As always with a crisis, there will be losers and winners, brands that will collapse and brands that will emerge from the situation even stronger. Thanks to a detailed analysis of the Swiss watch market published by Morgan Stanley Research, in collaboration with Oliver Müller/LuxeConsult, we can now take a closer and more comprehensive look at what really happened in 2020… Increased polarisation, premiumisation, strong resistance of privately owned brands, detailed figures regarding the top 50 Swiss watch brands per market share and turnover… and the continuous overperformance (not to say hegemony) of Rolex. Here’s the state of the Swiss watch industry in 2020.

Note: the following article is based on a report published by Morgan Stanley and not on our own data. Also, the market share and level of sales are estimations, based on Morgan Stanley’s own research, and are not to be taken as official numbers, even though we consider them rather accurate according to our knowledge of the industry.

A year of overall decline and of higher average prices

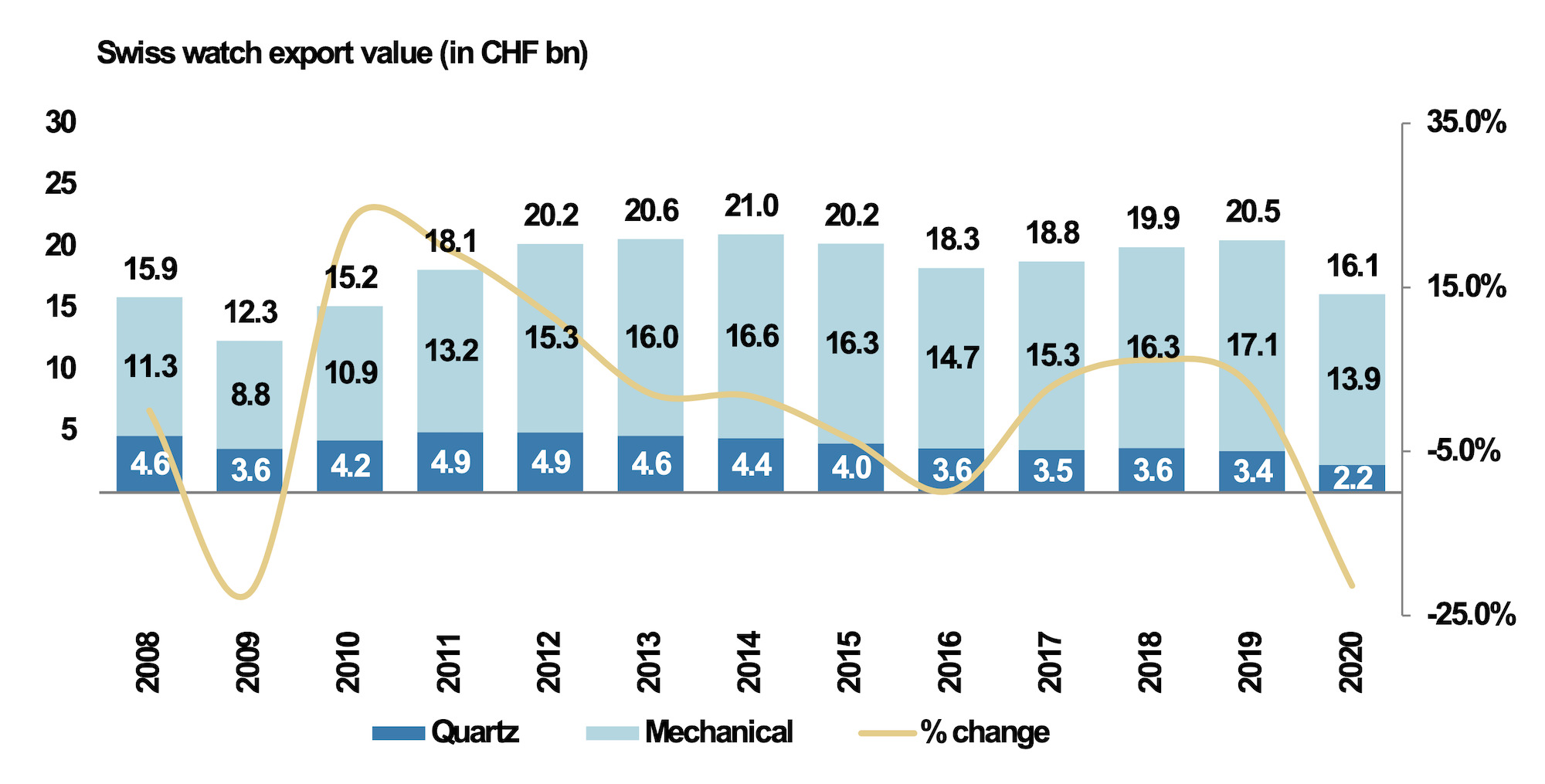

As mentioned in the introduction, the entire Swiss watch industry has been dramatically affected by the pandemic during 2020. This has resulted in a generalised downturn in turnover to levels unseen since 2011, and barely superior to that of 2008, when the industry faced a global financial crisis. In 2020, sales of Swiss watches amounted to about CHF 32 billion in retail value, excluding taxes (final price for the customer excl. VAT) or CHF 16.1 billion in export value (price of the watch when it leaves the manufacture, before being sold to a distributor or a retailer). The decline in sales is about 22%. Although the full impact of the coronavirus outbreak cannot be calculated accurately as yet, the current sanitary situation certainly accounts for a large part of this decline in sales.

The situation regarding the volume of watch exports isn’t better but requires a different approach. Indeed, the number of exported mechanical wristwatches dropped to about 5.5 million units in 2020. If we include quartz watches in the equation, a total of 13.8 million watches were exported in 2020, compared to 20.6 million in 2019 representing a total decline in volume of about 33%. The volume of watches exported has never ceased to decline since 2011, while sales were up. The situation was once again visible this year, if not accelerated, with minus 22% in turnover versus minus 33% in volume. This indicates a polarisation of the market towards high-end watches, with a premiumisation and a more difficult market for entry/mid-price mechanical watches (priced below CHF 3,000), where sales have contracted more drastically. This is even clearer for quartz wristwatches, where sales have contracted by 36%.

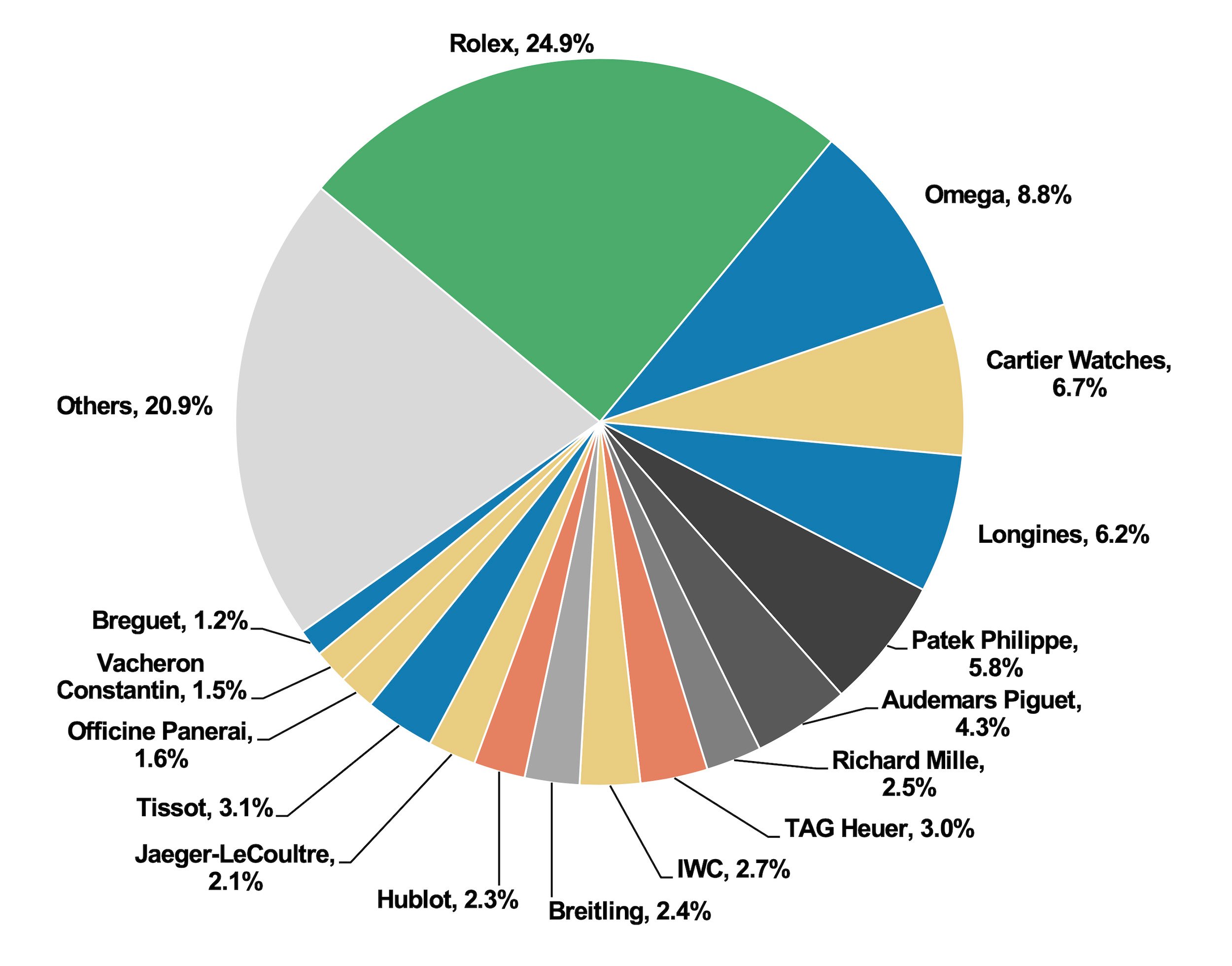

The Top 50 Watch Brands of 2020 – Estimated Market share and sales

Unsurprisingly, Rolex is still on top of the list with a market share of almost 25%. This year, for the first time ever (at least according to Morgan Stanley), the Rolex Group (Rolex + Tudor), has become more successful than the entire Swatch Group conglomerate with its 27% share of the market. Morgan Stanley estimates the total turnover of Rolex at about CHF 4,420 billion (in wholesale value) or CHF 7,956 billion (in retail value), with an approximate 810,000 units sold in 2020. This results in an average price of almost CHF 10,000 per watch (excl. VAT).

Coming in behind Rolex are two usual suspects: Omega and Cartier. However, an important gap has to be noticed between the second and third positions of this ranking. Omega had an estimated production of 500,000 watches in 2020, resulting in a wholesale turnover of CHF 1,758 billion or a retail value of CHF 2,813 billion. Besides the lower production numbers, the average retail price for Omega of CHF 5,600.is revealing. Still, it appears that Omega has gained market share in 2020, with an increase of 30bps to reach 8.8% of the market. The same can be said about Cartier, with almost half a million units sold at an average price of CHF 4,400, resulting in a retail value of CHF 2,150 billion. The estimated market share in 2019 was 5.5% and is now, in 2020, 6.7%.

Looking at the rest of the ranking – and taking a closer look at retail value and average prices – we can see that Patek Philippe, Audemars Piguet and Richard Mille have performed impressively. All three are on the higher end of the spectrum and, despite average prices of over CHF 35,000 (and even over CHF 180,000 for Richard Mille), they all managed to feature again in the top 10 Swiss brands for 2020, equalling or even surpassing brands such as Longines or Tissot, respectively producing 1,500,000 and 2,400,000 units last year.

Also, it is worth noting that the top 10 Swiss watch brands alone represent 68% of the market… Making this industry more and more polarised.

More premium, more polarised

This year, the complex situation of the market consolidated the ongoing trend of privately owned brands outperforming the rest of the industry. Indeed, the combined market share of Rolex, Patek Philippe and Audemars Piguet is estimated to have increased by +340bps to reach almost 35% of the market, confirming a trend that was already in place in 2019. AP’s performance was particularly solid; sales of AP were down by only a single-digit – when most of the brands registered 2-digit declines – bringing the brand to a level of sales close to Patek Philippe – CHF 1.1 billion vs. CHF 1.2 billion. Analysing the collections of these three brands, with some of their models in high demand (and a shortage of supply) leading to massive premiums on the second-hand market, it doesn’t come as a surprise.

As we mentioned before, the market is turning more and more towards premium products. This can be explained by stiff competition in the entry-level segment provoked by the strong growth registered by smartwatches. In 2016, the Swiss watch industry was still producing about 25 million watches; that same year 22 million connected watches were sold. In 2020, only 13.8 million Swiss watches were exported, while about 75 million connected watches were produced. And this has a direct impact on the sale of Swiss quartz watches and entry-level mechanical Swiss watches.

On the other hand, Swiss watches priced over CHF 7,000 (retail price, excl. VAT) account for 70% of sales in value, but only for 10% of the volume of watches produced.

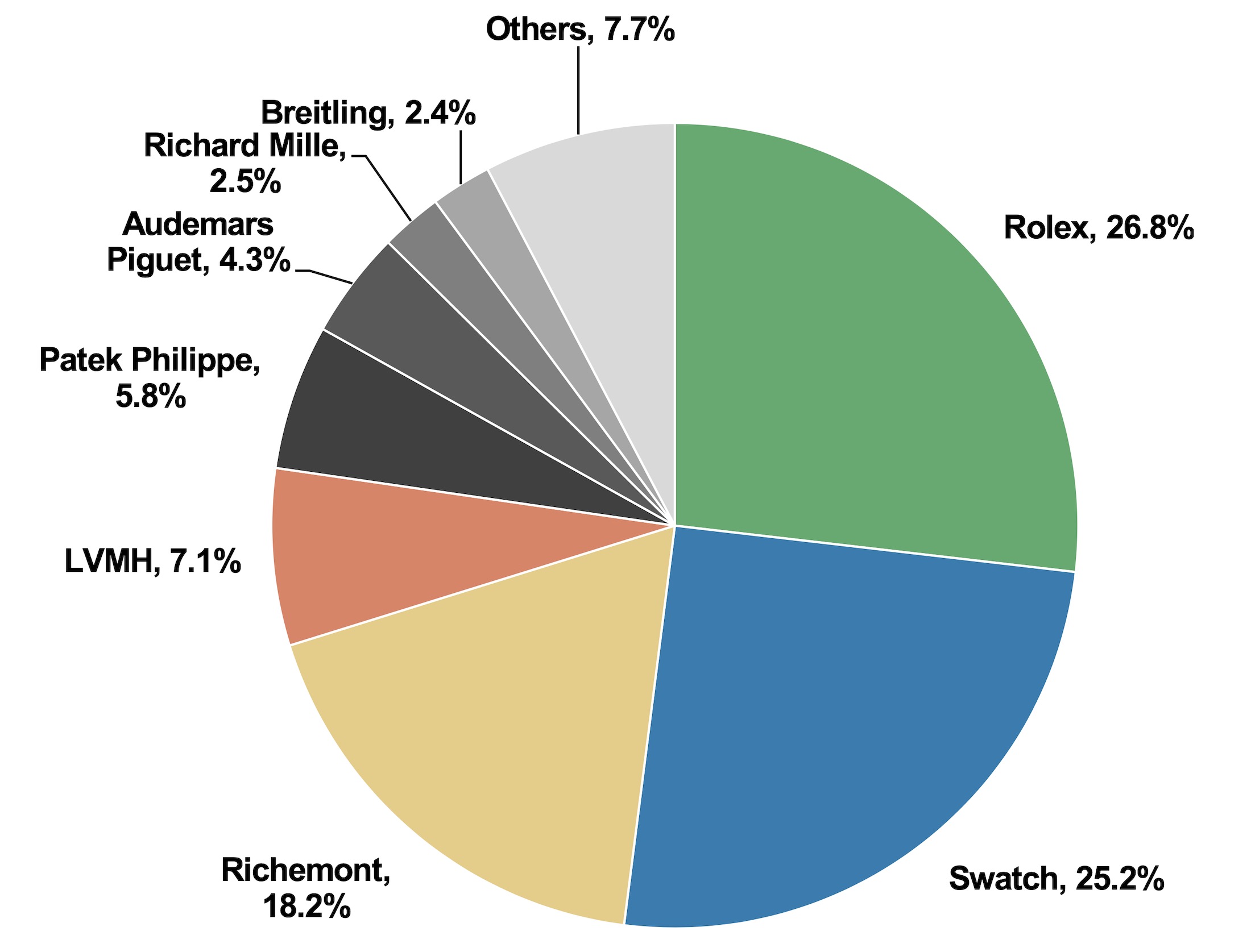

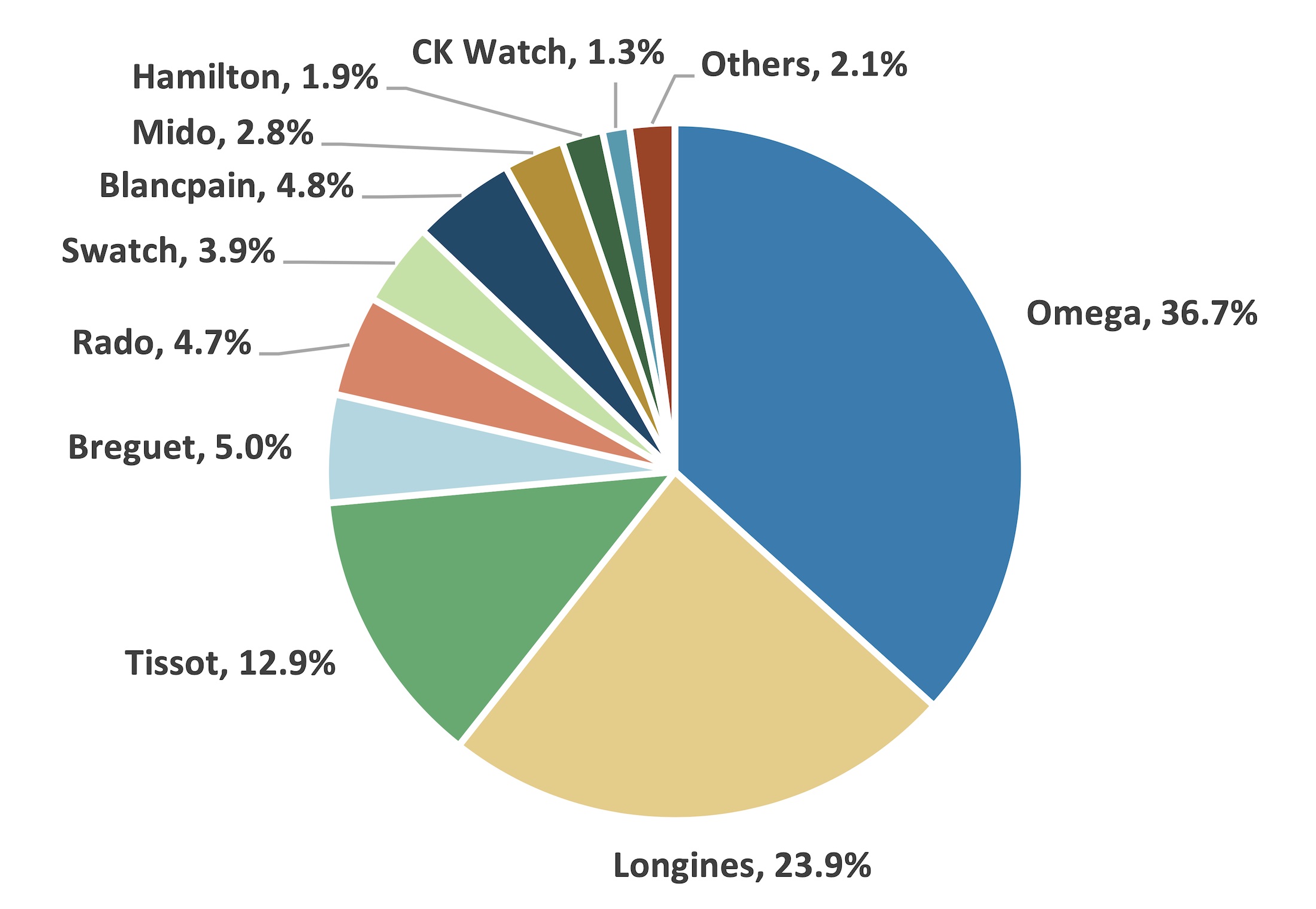

What should be noticed, echoing the stronger position of privately owned brands, is the decline of publicly listed groups – Swatch Group, Richemont and LVMH. For instance, Swatch Group is estimated to have lost about 250bps of market share over the year, to 23.9% of the market. This situation can be explained by a strong exposure in the lower price segment – with brands such as Tissot, Hamilton, Rado, Mido, Certina or even Longines. However, it appears that the Richemont Group has been slightly less affected, as the Specialist Watchmakers Division of the group is estimated to have lost about 90bps of market share, representing an estimated 9.9% of the Swiss watch market. This can be explained by the strong performance of Cartier in 2020, with strong sales in China (sales only dropped by 13.6% in 2020). IWC, the second largest brand of the group, is also expected to show relatively good results in 2020. LVMH is also estimated to have lost part of its market share but in a relatively controlled way – minus 80bps for 7.1% of the market, driven by good performances of TAG Heuer and Hublot.

As for brands that have performed particularly well in 2020, Tudor stands out. Indeed, Rolex’s sister brand shows an estimated sales growth of 11% in 2020, which could be explained by the overall attractiveness and quality of the watches, but also by the scarcity in stores of a large number of Rolex Oyster Professional models.

Rolex is still there, on top

No debate. Rolex, which has been the number one Swiss watch brand for some years already, has managed to consolidate its position in the current, highly complex market. Its formidable might means that a single brand alone can almost rival the market share of the giant Swatch Group conglomerate. And if you factor Tudor into this equation, the Rolex Group is now the largest producer of watches in Switzerland, according to Morgan Stanley.

Rolex has an estimated turnover of CHF 4.4 billion (net sales, at wholesale price) or close to CHF 8 billion in estimated retail value. In 2020, sales were certainly impacted by the sanitary situation, with a reduction in turnover of 14% (again according to MS, as Rolex doesn’t disclose its financial statements), thus outperforming the market. The report also estimates production of 810,000 units, down 19% compared to 2019, showing once again a premiumisation of the production, with an average retail price estimated at CHF 9,820.

Since the arrival of Jean-Frédéric Dufour at the helm of Rolex in 2014, the performance of the brand has been remarkable and 2020 shows once again that the brand can generate value, at least compared to the performance of its peers. Without going into extensive detail, the report lists several factors that explain this performance: a continuous focus on improving the quality of the watches; a streamlined collection; a highly consistent communication focused on the brand’s value; an impressive continuity in the products (which are improved regularly but rarely discontinued); and the rarity and scarcity of certain models increasing the desirability of these watches. It also points to the brand’s recent strategy of cleaning up its retail network with fewer points of sales, yet with better selection, and underlines the brand’s initiatives to tackle the grey market issue and authorised retailers who are not playing by the rules.

Source (for all graphics and data): Morgan Stanley and LuxeConsult.

12 responses

Interesting insight in the inner workings (financial and production numbers) of the Swiss watch industry.

Slightly surprised on the comment that the gap between 2020 sales of Swiss watches amounting to CHF 32 billion in retail value, excluding taxes (final price for the customer excl. VAT), versus CHF 16.1 billion in export value (price of the watch when it leaves the manufacture, before being sold to a distributor or a retailer).

That equates to a 50% retail margin, which seems very rich, even for this luxury industry?

@ Adriaan

It can be that high in the case of certain brands, although the wholesaler or distributor takes their cut too. A contact I had at a large AD once told me it was usually 30%-40% margin on luxury watches, but it wasn’t that big an earner for them compared to diamond jewellery.

Just to add: I was told the higher margins at 50% are typically the less prestigious Swiss watches made in the highest volumes (more ‘designer’ than ‘luxury’ in some cases).

Hi Brice. Very interesting article indeed. I have two questions if I may.

1. Any idea of the size (in value) of the second-hand market? According to some sources it would be bigger than the “new” market’s.

2. Any idea of the net margins of the retailers after all the costs they are incurring since the Brands require an expensive location rent-wise, a minimum stock of products, a privileged space in the shop window, a compulsory contribution to the advertising investment, qualified staff, and on top of that set high sales targets which if not reached might allow them to withdraw the franchise!

Thanks for your view on these issues.

@Lucien – thanks for your comment. And to answer you, the second-hand market is rather difficult to size, since it involves thousands of actors around the world, with no official statements, and the fact that many transactions are done between private owners too. It, however, wouldn’t be surprising that this market could (I really have to say could) be as large if not larger. Some recent estimates (Boston Consulting Group) give numbers in the EUR 21 billion. But it’s hard to tell.

The second question is also rather impossible to answer, or at least, the answer would be different for every brand, and every retailer. We have an idea of the gross margin of retailers, which is said to be around 45% (on average, depending on the brands of course). Of course, this is GROSS margin and doesn’t reflect what the retailers have to take into account, such as rent, stocks, staff… So, sorry that I can’t help more, since there isn’t a single possible answer on this net margin question… plus, let’s be honest, retailers are not really willing to answer this question either…

Thanks, super interesting. Would be nice to have a general overview of the market worldwide, especially how Swiss watch industry is performing compared especially to the Japanese competitors.

@Ale – Thanks for the comment. And just like you, we would really be interested in finding out about Japanese brands performances, however, we didn’t manage to find a reliable source so far, except the financial statement of Seiko Holdings Corporation (which includes more than just watches). The 2020 Q3 report of Seiko states “a year-on-year decrease of 28,7%” of watches sales, which is in line with the Swiss industry, and also doesn’t include Q4, which is known to be better than the rest of the year 2020. If you are interested, you can find the report here https://www.seiko.co.jp/en/ir/2021/02/16/e_fstaFY2020q3.pdf

@Ale

Hi, I was quite interested in the comparison between the Swiss and Japanese watch industry too so I did a little research about Casio, Seiko, and Citizen by reading their Japanese annual report. As Brice said, since the 2020 version has not been released yet, here are the net sales numbers of 2019, which is released last May.

Casio : 164.3 billion JPY

Seiko : 135.4 billion JPY

Citizen : 141.6 billion JPY

As the JPY/CHF rate is about 110~120, all of them should be just between Cartier and Patek in terms of turnover.

Hope the data helps. 🙂

Thanks @Miao for this! These Japanese brands are quite some large companies indeed!

Hi, Im looking for some Swiss brand but not in luxury or highend segment. just low and middle end but also have good brand in Swiss and in world wide.

very appreciate if you can help. thanks you

Nice one, good work. With all that data, graphs etc., can anybody figure out the fundamental question? What to buy, not to lose money? Rolex buyers from 10 years ago seem to be super happy and large chunk of them would not be to afford their Subs and Explorers now. Is there a Warren Buffet of horology to know the most undervalued pieces and brands?

Really hope some similar article for this Years! 🙂