The Continuous and Insane Rise in the Price of the Rolex Daytona 116500LN (And It’s Getting Worse Recently)

It simply doesn't stop... and it continues to climb.

The Rolex Daytona is a watch that I’d love to own one day. Along with the Speedmaster, it is one of the most iconic chronograph watches on the market; and one of the best in terms of quality and specifications. But I am never going to pay a 100% premium over retail price to acquire a watch (really, NEVER). Still, I occasionally track the prices of the Rolex Daytona 116500LN on the second-hand market. Last time I checked, these were listed at around EUR 25,000 or USD 30,000, which I thought was already quite insane (that is double the retail price). This morning I woke up, and an ad for a Daytona popped up in my Facebook feed with a price of EUR 35,000. First, I thought it was a joke or a mistake. How could the price have jumped EUR 10,000 in just three months? To my surprise, it was not a mistake, and I confirmed it by looking at Chrono24’s tracking tool. Indeed, the Rolex Daytona 116500LN has become even more inaccessible than I had ever imagined.

As far as I can remember, I’ve been following the watch market for about 10 to 12 years and have been actively searching and writing about watches for seven years now. My track record isn’t the longest, but it’s already long enough to remember what it was like “in the old days” when a stainless steel Daytona (back then, reference 116520, with a steel bezel) could be yours, on the second-hand market, for about EUR 9,000 or USD 10,500. I’m not talking about three decades ago. I’m talking about average prices in 2013 or 2014 when the Daytona was certainly not the easiest watch to get from your authorised dealer, but a watch that was attainable at retail price (if you were patient) and could be bought for about the same price on the second-hand market. Those days are long gone, and the introduction of the steel Daytona with a Cerachrom bezel in 2016 changed the market drastically!

I can distinctly remember being at the Rolex booth when this watch was launched. The watch generated incredible tension, something that I never experienced again. Everybody was looking at it as a true gem, a watch that, from day one, was destined to succeed. This was also the day I discovered the pressure exerted on authorised dealers. I can remember hearing people in front of the booth, looking at the display windows, calling their AD to reserve one of the first examples. And this is when the whole speculation started. From day one, as soon as the watch was introduced, the situation was sealed. You want a 116500LN? Sure, put your name on the waiting list, wait for an undefined period of time – without the guarantee of getting one in the end – or pay a premium. Period, basta, over and out.

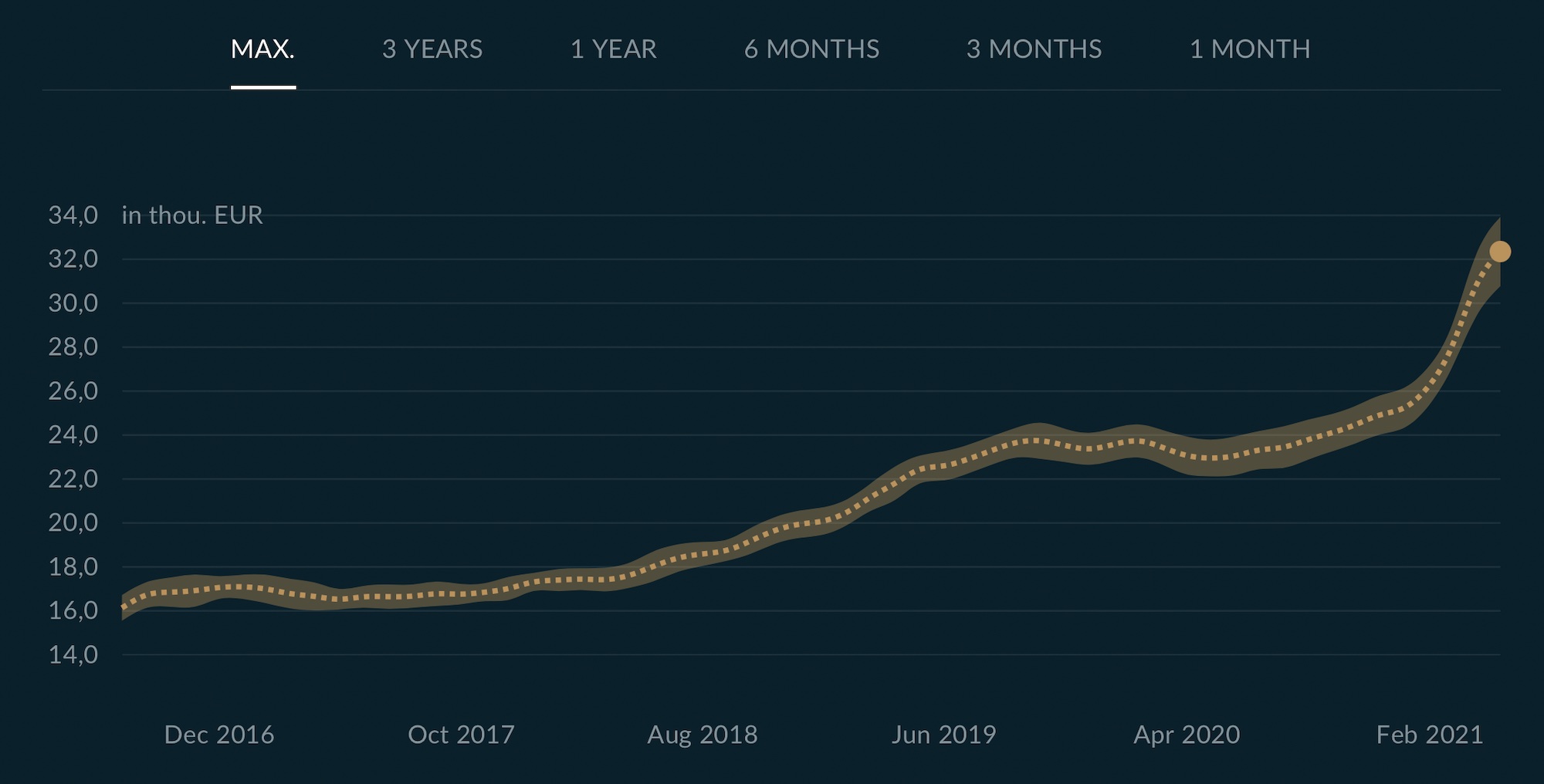

As you can see from the Chrono24 report for an unworn white dial 116500LN (which basically averages the price of all equivalent models for sale on this platform), as soon as the watch was introduced, it was already selling on the second-hand market at a premium. We were still talking about EUR 17,000, compared to a retail price in 2016 or EUR 11,300. That meant a 50% premium over retail price. The situation remained steady for a couple of years until prices started to climb again in 2018 to reach approximately EUR 20,000 and then about EUR 23,000. And this trend continued for another couple of years.

What’s happened since January 2021?

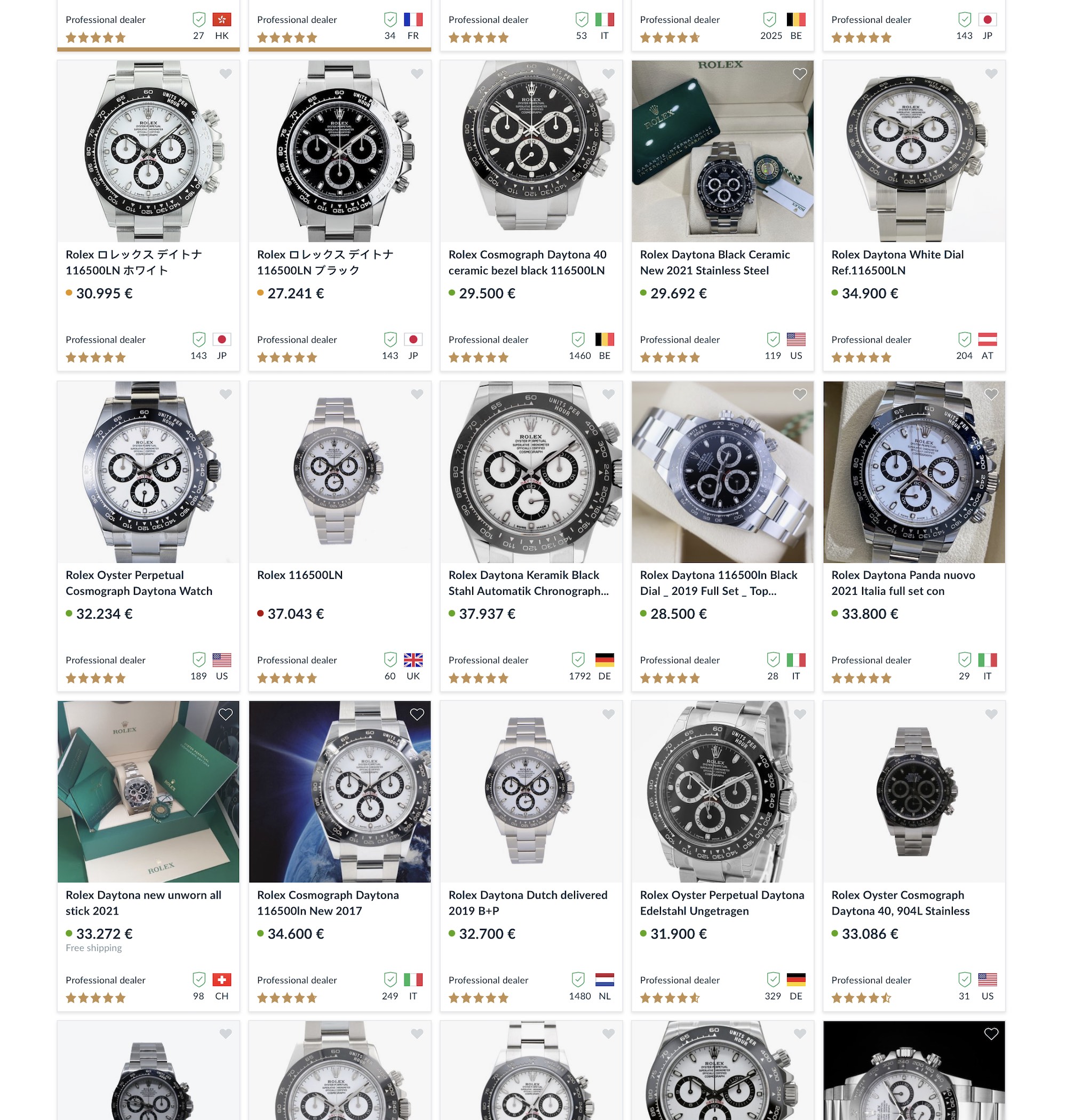

Earlier this morning, as I was taking a closer look at the current state of the market for a steel Rolex Daytona, I discovered that prices have skyrocketed to unprecedented levels in the past couple of months. We’re not talking about a 1K or 2K increase; we’re talking about a 10K increase: prices have risen about 30% since the end of 2020. See for yourselves… EUR 28,000 or USD 34,000 is about as low as you’ll have to pay (at least according to the listed watches) for a black dial Daytona. And the white dial, as always, is about 3K more.

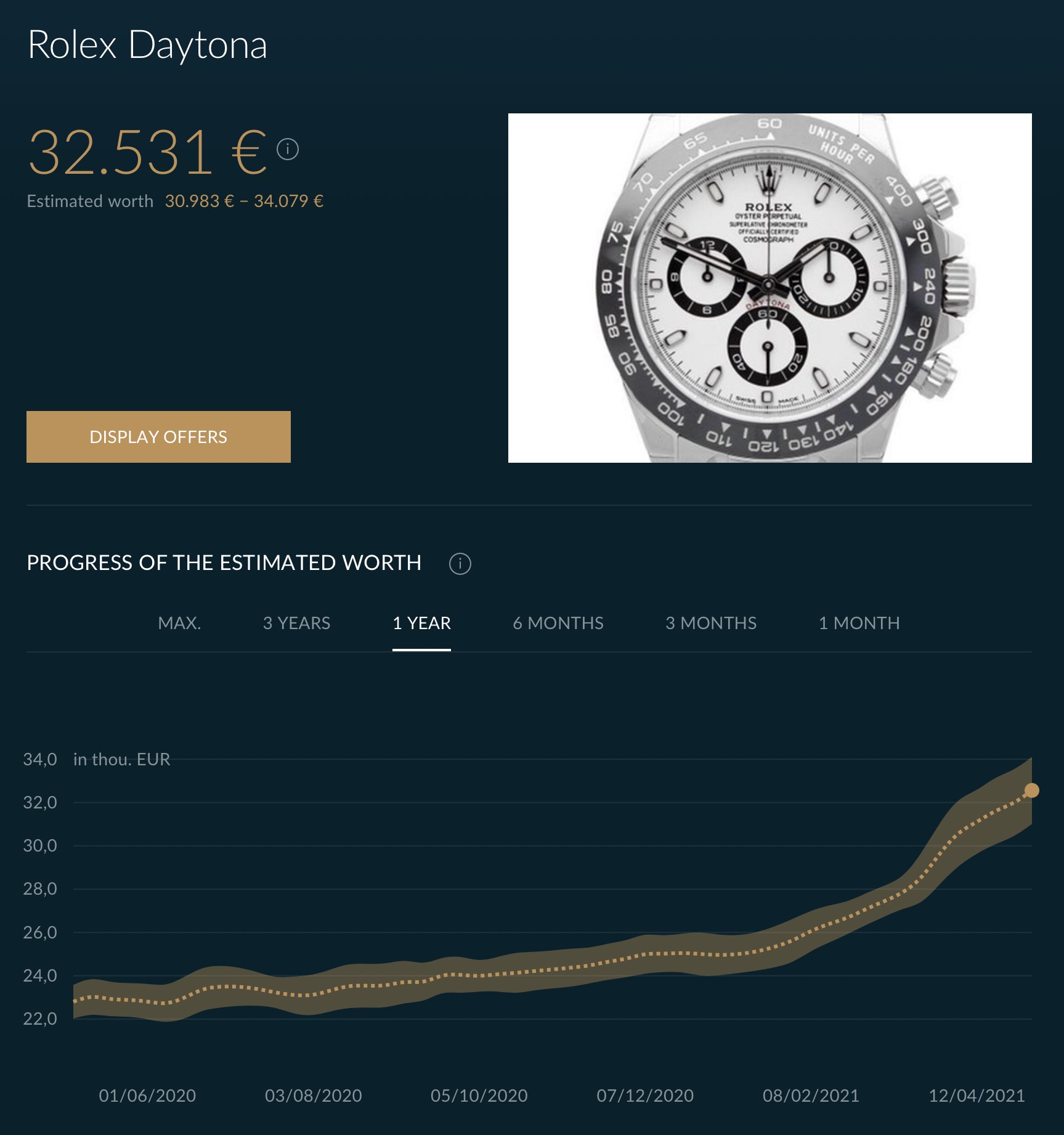

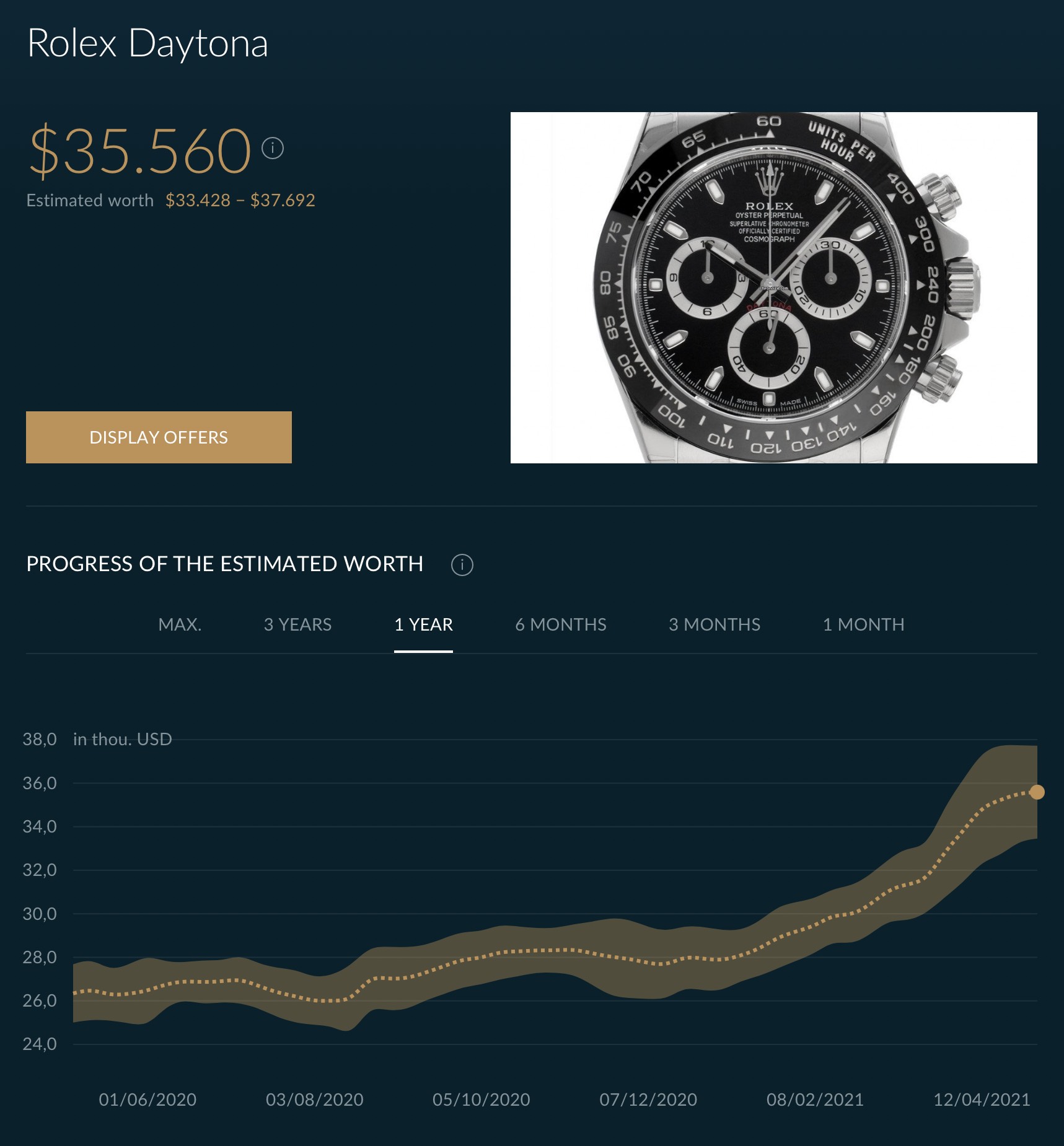

Looking closely, here’s what you’ll get when using the tools offered by Chrono24 – which, I must say, are very practical. Let’s start first with the most coveted of the two steel Daytonas, the white dial edition (prices in EUR and USD)

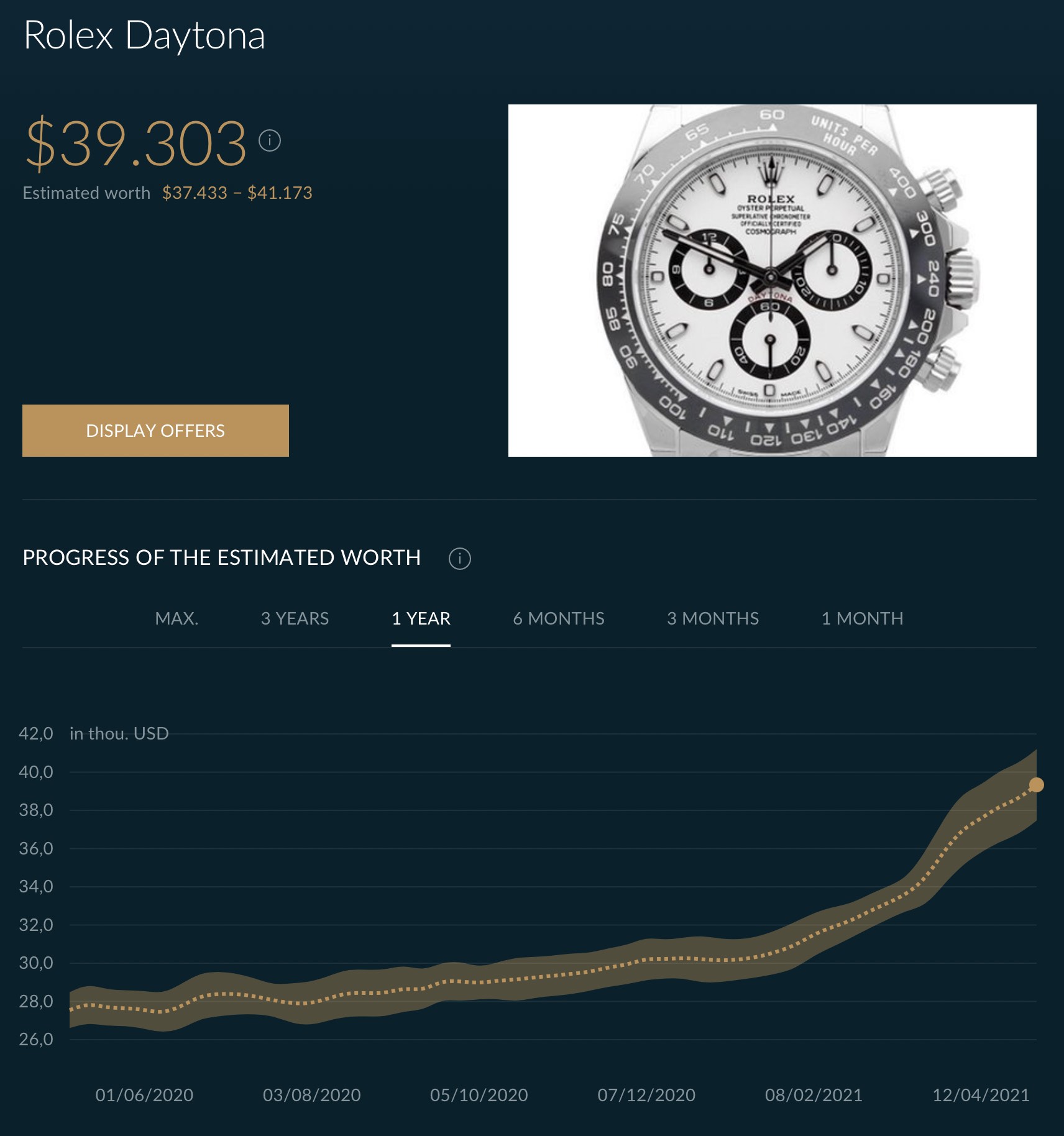

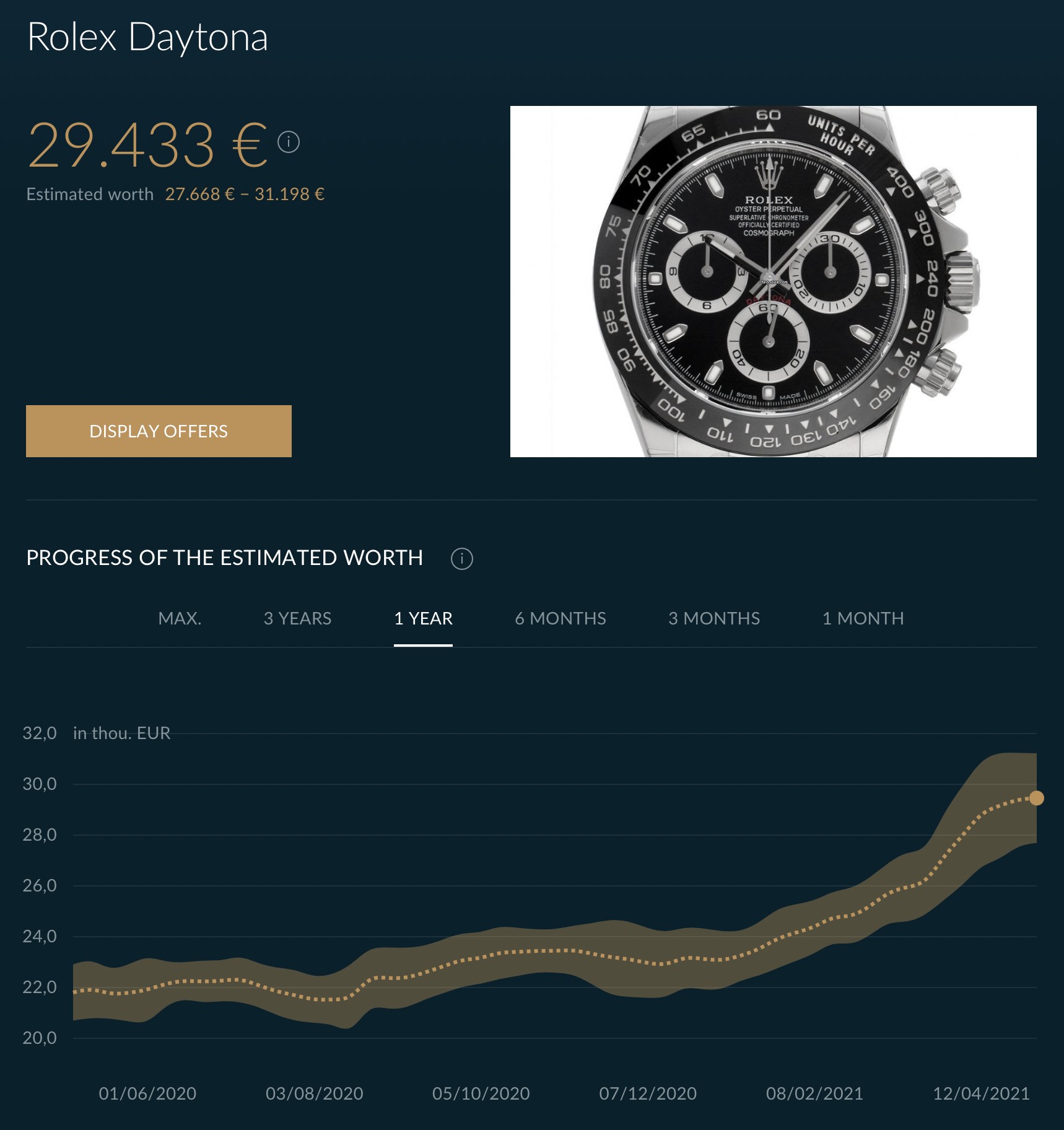

And then, the same applies for the slightly less – relatively speaking – sought-after black dial Daytona 116500LN. Funnily enough, the black dial 116520 used to be the most praised of the two versions, and the introduction of the ceramic bezel reversed the market.

The graphics above, depicting the situation of the market over the past year, are clear and irrevocable. Since late January, the price for the steel Daytona has inexorably climbed to reach the levels of a new gold Daytona. Remember that a 116500LN is listed at about EUR 12,400 or USD 13,500. We’re not talking anymore about a 100% premium over retail price, as we reported in this market analysis in late 2019. The steel Daytona is now facing a completely insane (at least to me) premium of 162% – yes, that’s about 2.6 times the retail price for a steel watch produced in several thousands of pieces a year.

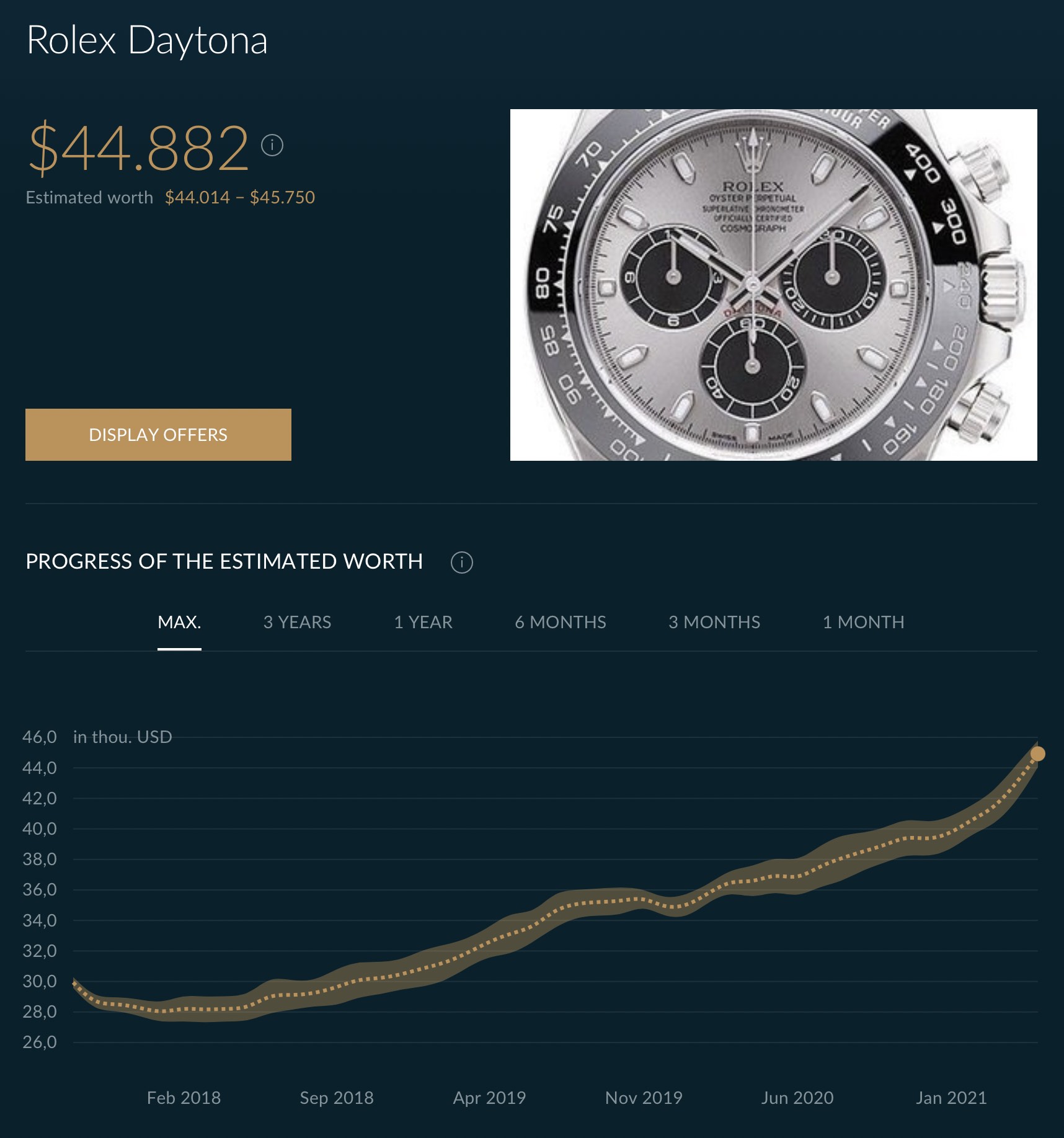

The situation doesn’t stop here. Not only does it affect the steel models, but also the Rolesor (in smaller proportion) and some of the gold editions, too – we won’t even discuss the ultra-exclusive Daytona Rainbow 116595RBOW here, which is sometimes listed for about four times its retail price. For instance, the white gold ceramic model worn on an Oysterflex bracelet, the reference 116519LN, has a retail price of about EUR 28,000 or USD 30,000. For some years, it was a watch that you could find on the second-hand market at retail price levels, often for slightly under official retail prices. But since early 2021, it is facing the same situation as the steel editions, with a continuous and impressive increase in price, as you can see below:

Surely, the premium is only 30%, which is still low compared to what’s happening with the steel models, but this simply reflects the overall market situation. PS: don’t use this as a piece of advice to invest in these gold 116519LN.

What’s happening?

I might disappoint some of our readers here, but the more I think about it, the less I understand this market. Before devoting myself to watches, I used to work in finance and to manage funds. If I apply everything I learned at university, I still can’t come up with a tangible explanation. I simply can’t find a logical, consistent reason for the desirability surrounding this watch. Don’t get me wrong, the Daytona is an excellent watch, and I still believe that, at retail price, it delivers superb value for the money. The watch is superbly crafted even though it is primarily machine-made, and the look (always debatable, of course) is great. The movement is one of the best in this category, and the bracelet is excellent. Objectively speaking, if you manage to pay 12K Euros (retail price) for one, the Daytona is a watch that is worth every penny. But is it a watch that is worth EUR 35,000? In my opinion, absolutely not. This kind of money can buy (pick your favourite) 1. precious metals 2. hand-finished movements 3. complications 4. soul-driven independent watchmaking.

So, what could be the explanation behind the recent increase? We all know that the current sanitary situation is not helping markets, and volatility has been high on stocks – “has been” is essential here. If you look at the VIX index, which measures the level of stress on the stock exchange markets, it has returned to relatively standard levels. So, that’s not the reason. Also, the sanitary situation had affected production in March/April 2020, but since then, all Swiss manufacturers, including Rolex, are producing watches at nominal capacities.

The only reason I can think of is what I’d call “the sheep effect”. It all comes down to the simplest of notions in economy: supply and demand. That really is the only reason I can come up with. It is all due to a snowball effect, where the more sought-after an item is, the more desirable it becomes; the higher the demand, the lower the supply. And lower supply translates into desirability. And the fact that the watch can be seen everywhere on Instagram, while not being available to a broader audience, only creates frustration and the desire to want one – and not for tangible reasons anymore. Just like the Nautilus 5711 or the Audemars Piguet 15202ST, these watches are not desired by those who really love the watch (the object and what it represents in terms of horology) but by those who think it is something to own, and that has become a tool for speculation. Here it is, I said it, the Daytona isn’t, for now at least, a watch in the strictest sense of the term. It is an investment vehicle for owners or wannabe owners.

Should we blame Rolex for this? We very often hear complaints regarding the unattainable status of steel Rolex watches, specifically the Daytona. And, judging by the frustration of many potential owners, it is somehow justified but not entirely relevant. Two things to keep in mind; one, Rolex produces A LOT of watches, more than it has ever produced in the past. Rolex is producing and delivering watches in large quantities; according to recent research, Rolex produced about 800,000 watches in 2020 despite halting its manufacturing in spring (source: Morgan Stanley). But because of the high-quality standard of the brand and because of the size of its production unit, it might not be able to produce far larger quantities. The question is: would Rolex want to risk flooding the market? Potentially not the best solution.

Also, keep in mind that Rolex doesn’t sell watches direct to customers. It only sells to authorised dealers. When it comes to distributing watches to final clients, the situation is in the hands of these ADs, not in the hands of Rolex and only the can decide on allocations. Once the brand has delivered the watches to its local subsidiaries, which deliver them to local stores, Rolex can’t control the way the watches are sold and to whom. There have been some recent situations where Rolex removed certain dealership authorisations following bad practices. The brand is aware of this, but since we’re living in a free market, this won’t be an easy task. We might not be happy with that, but truth is that we, collectors and watch enthusiasts, have started the situation… helped by the presence of a few so-called flippers and unfair retailers.

If that’s a watch you’re looking for and not an investment, be reassured, the market has plenty of other models to offer. Just think about why you really want a Daytona…?

15 responses

In regards to the shifting of responsibility from Rolex to the AD when it comes to a customer being able to buy a certain piece, bear in mind that the number of popular models allocated by Rolex to an AD is often very few, depending on region. My AD gets about 2 or 3 steel Daytonas in per year. PER YEAR.

Maybe you need to remember the fundamentals of your old job, Brice, in order to understand the madness: perhaps it’s risen again simply because the market can bear it. Look at the ‘revenge spending’ especially in China where Swiss watch exports have almost doubled from last year. I dunno.

Thanks for the good article, Brice. I think it’s crazy and explained by the “everything rally”. People are ploughing cash into anything and everything, and making gains doing so as your article makes clear (so that also makes it rational). No interest on your cash in the bank (potentially negative in some countries depending on your balance), plus heightened inflation expectations creeping in. Prices you are seeing are pure investment drive, same with the 5711. Shame if you actually like these watches on their merits, also because to me at least it makes them less attractive to be so hyped and valuable as at the least the latter (both of you ask me) where this is inversely proportional to them actually being worn as intended.

An excellent article. I think you have nailed the issue. Rolex watches are essentially being treated as commodities like pork bellies or stock options on the one hand and as badges of wealth on the other. Looking at any Rolex objectively they are middle of the road watches, the movements are generally quite basic (with a couple of exceptions like the Cal.3195, Cal.4161 and Cal.9001) undecorated and average by most measures. The movements do not bear comparison to Audemars Piguet, Patek Philippe, A. Lange und Sonne, Jaeger Lecoultre or Glashutte Original, which are brands Rolex is attempting to position itself against. Even Omega’s in-house movements are better finished. As for the rest of the watch, again the cases and bracelets are very good but are not really any better than most of Rolex’s “natural” rivals, in other words those brands that Rolex ought to be measured against – entry to mid-level luxury brands like Omega, Cartier and Breitling. Compared to Vacheron Constantin, Audemars Piguet, Patek Philippe, Jaeger Lecoultre, Lange, Glashutte Original etc Rolex cases and bracelets are not in the same league. Given the objective qualities of Rolex products the mania over obtaining one can only be explained by factors other than the qualities of the products.

@SPQR

Rolex is not trying to position itself against any other manufacturer. In fact, almost every other middle-of-the-road sports watch maker tries to imitate Rolex and still can’t compete. They make some of the World’s best watches. Period. From the design to the execution they are truly world leaders, moreso even than PP. They are innovators although their innovation philosophy is quite different than their competitors. They’re like Apple: innovate in what really matters and not innovate just for the sake of innovation. They almost do it right every single time with a new watch they introduce. The madness to get a new sports steel Rolex is drived mainly by their design and execution perfection. Nothing else. They’ve built a name through decades based on that kind of perfection.

Folks, it’s a bubble. Plain and simple. Stop trying to understand it.

When every other post on social media is about “investing in watches” what do you think will happen? Look at the crypto market.

And now Zenith is giving people what they want – Zaytona!

@EBO Utter nonsense. Rolex do not innovate they evolve, unless you regard a yellow dial or a line of red script on the dial as an “innovation”. Rolex watches incrementally change so that it is hard to tell apart a watch from 2000 from one from 2010 from one from 2020. This is why Rolex has such a strong brand – it never changes much. Rolex is quite unlike Apple in almost every respect as a business. The only similarity is that Apple takes existing technology and presents it in a way that customers (with a lot of help from the marketing department) want. Apple does however invent new technology. Rolex does not as such Rolex is not an innovator except in the field of marketing. As far as manufacturing is concerned Rolex is no better than most other mass producers of Swiss watches. Design is not an area where Rolex excel either, remember the too short hand on the Explorer?, the Daytona is not a very legible chronograph compared to others such as the Speedmaster. The out of proportion “maxi case” Submariner? Of course all these flaws are overlooked while a watch is on sale then when it is replaced everyone decries the previous watch’s poor design. As far as the “execution” of their watches go Rolex are middling at best and poor in some areas. Their cases and bracelets are very good but not as good as Cartier for example, their dials are great but not in the same league as Glashutte Original or Audermars Piguet. Rolex movements are for the most part very basic. There are no grand complications or perpetual calendars or tourbillons. Equally there are no chronographs with a calendar or a moon phase or a second time zone. As for the finishing of the movements this is basic at best. Even Bremont can decorate a movement better than Rolex. Walter Odets’ review of the Rolex Explorer will give more details on the state of Rolex movements. Their movements are basic in design and basic in finish and for the money quite poor. Rolex’s materials technology is behind the times too, their ceramic bezels are quite basic these days compared to Liquidmetal bezels and their “two color” bezels are actually a one color bezel treated to become different colors. That is why the “Pepsi” bezel looks to have a purple tinge to the red, because the bezel starts out as all blue. Rolex have never made a titanium, ceramic or sapphire watch case, in this respect Hublot, Audermars and Omega are far beyond Rolex in the use of other materials, just look at Hublot’s bright red ceramic and compare it to the muddy purple of the “Pepsi” bezel. As for the use of 904L steel this is not an innovation either as the first watch to use 904L steel was the Omega Seamaster 600M “PloProf” in the 1970s. Using 904L steel also has drawbacks, one of the reasons Rolex watches are usually highly polished and rarely combine brushed and polished finishes on the same plane is that 904L steel is difficult to machine and so sharp transitions in finishes are not possible due to the high chromium content causing the steel to be more brittle and thus have an uneven finish at a microscopic level. With regard to copycats of the Submariner, well there is the Steinhart of course which is just that but the Omega Seamaster Diver was purposely designed to look nothing like a Submariner when Jean Claude Biver commissioned it and it succeeds, the Longines Hydro Conquest looks nothing like a Submariner nor does the Oris Aquis range. Certainly there is some plagiarism in design as between the Submariner and other dive watches, the TAG Heuer Aqua Racer being an example but given the design parameters set out by ISO6425 there is only so much designers can do, having said that look at the Glashutte Original SeaQ, nothing like a Submariner but better finished in everyway and ISO6425 compliant. Rolex’s marketing is an exercise in smoke and mirrors, for example neither Hilary nor Tensing wore a Rolex Explorer (mainly because it did not exist then) when they summitted Mt Everest in 1953 (they were wearing Smiths watches) but reading any Rolex ad for the Explorer you would think they were. I suspect the reason Omega incessantly bang on about the Speedmaster being the first watch worn on the moon is because if they did not Rolex would nip in with an advert about how the Daytona was part of the Apollo program (it was of course for about 3 to 4 weeks before it failed to pass the NASA tests). Ultimately your reaction to my post is as expected by a Rolex fan boy – “nothing is as good as Rolex and never will be” which is fair enough if someone wants a Rolex they want a Rolex and that is that. But look beyond the hype and the brand advertising and apply thought to the products you will quickly realize it is not really all that. All the hype and speculation also has a dark side to it, my own Rolex was worn daily for 10 years but in the last few years it is not my first choice any more because of the risk of being robbed.

@spqr – +1000 and i love my 16600, but ojectivity is very often just common sens ….

Funny how everyone try to find an explanation.People like Rolex daytonas

and they are willing to pay premiuns for it since there is not enough of them to go arround( rolex produce 800.000 watches but only a few are Daytonas )

Maybe for the guys making this comments

or writing this article doesn’t make sense to pay this prices.

But it looks to me that they are more people buying and willing to pay for this watches than people selling them. So is very simple why prices keep going up. It happen with Ferrari, Hermès,Audemars and Patek Philippe.

So if you like a watch and you can afford it

and you will wear it then buy it. No one knows what you pay .Besides you enjoy wearing it , and the guys that don’t want to pay will probably never get them and that is fine too. So let them buy other brands if that makes them happy because they pay less or no premium But it will never be a Daytona!!!!

It looks to me that the Gold Daytonas are going to move higher very soon when some people realize the few on the market

are very cheap now !

One important thing to mention they last forever I have some that are 60 years old and I wear them a lot.

Great article I enjoy reading.

Fake artificial demand is created by producing much less from what market can absorb, Rolex arrogance never ending. Investing in watches is a nonsense of a century compering to other opportunities,pure low marketing and investments approach to justify insane prices

There are more than 700 pieces for sales and still counting. Rare? Lmao

Stop buying Daytona, stop this insane.

The massive rise in crypto prices is a factor – the main beneficiaries are young guys who have made a to. Of easy money and want a status watch to impress their peers and the kind of Instagram model hot girls who are only interested in guys with money to burn… enter the Daytona!

Fact: If Authorized Rolex dealers are not seeing any Daytona’s and Rolex only sells to authorized dealers, then where are the secondary / used dealers getting them from? Obviously its from authorized dealers. So unless some here are grossly out of touch with reality, that is an undeniable fact. These watches do not walk out of the factory and into the hands of non authorized Rolex dealers or flippers by themselves. Time to get a grip on reality. All sport models are being manufactured and shipped to dealers. Evidenced by the fact that on every resale site in the world, there are “NEW IN BOX” Unworn, with factory warranty cards dated from the past few years to this year 2021. So while many here and elsewhere claim that dealers don’t have these or are not getting them, it is a plain and simple “untruth”.

In fact, there are so many sites where you can purchase these watches, it cannot be refuted. Lets not forget that even a late model used Daytona still had to initially come from an authorized dealer at some point in the past few years. Each of those years, the same claim that no dealers are seeing any of these, or maybe only 1 – 3 in a year. Yes, they may not see as many as they want, but there certainly are enough in the dealer pipeline to feed the secondary dealer markets. Also note that the moment one of these goes for crazy money, more and more come out of the woodwork.

Not here to debate, just mho.

hahaha you guys are funny if you think 800,000 watches a year is a lot compared to the 4.8b population. They know how to manipulate the market and supply. They were not born yesterday.