FHS Export Statistics Confirm 2022 As An All-Time Record For The Swiss Industry

With sales up by over 11%, 2022 marks an all-time record for the Swiss watch industry. But can it last?

Last month, right after the Federation of the Swiss Watch Industry released its monthly press release with watch export statistics, we indicated (in this article) that the Swiss watch industry was about to record its best-ever export performance over the course of a year in 2022. By the end of November 2022, exports were up by 11.9% compared to 2021 (and far more compared to 2020). This morning, the FHS has just released its statistics for the full year 2022, and we can confirm that exports are up massively, and 2022 is indeed a record year for the Swiss watch industry.

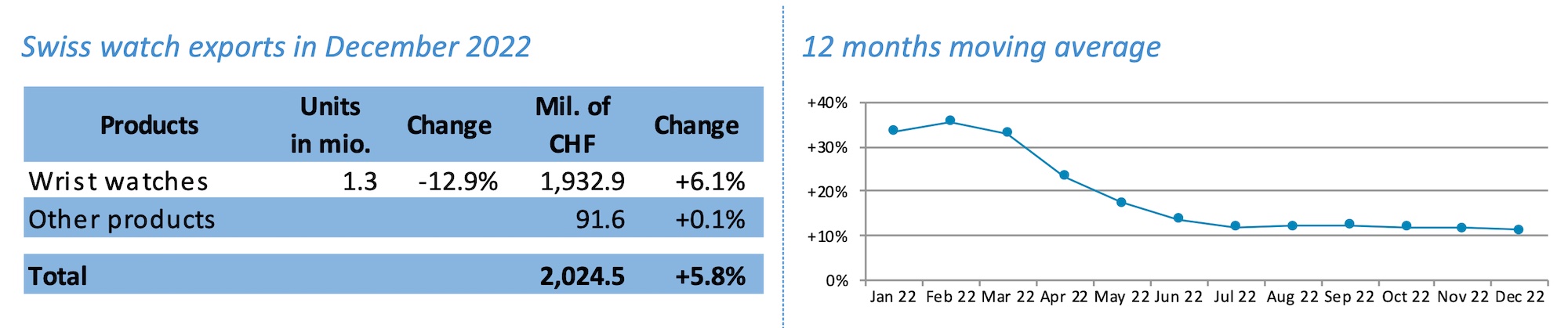

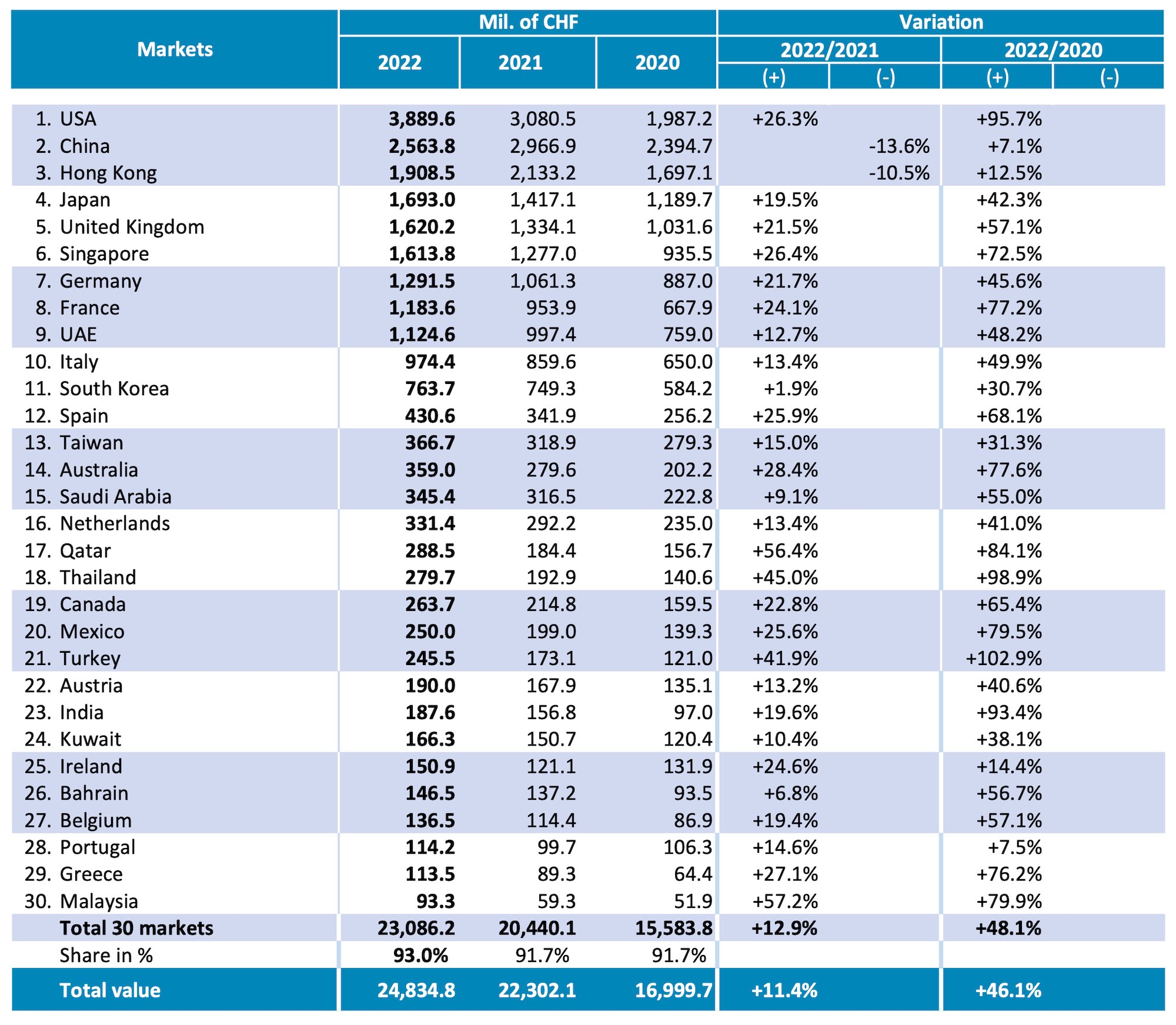

Exports of Swiss watches continued to grow in December 2022 (+5.8%), though at a slower pace than the annual average – this can be explained by the fact that watches sold for the Christmas season are usually shipped in October and November. Still, exports in December again broke the Swiss Francs/CHF 2 billion bar, which had never occurred previously at this point in the year. Overall, exports of Swiss watches, according to the Federation of the Swiss Watch Industry, produced CHF 24.8 billion for the whole of 2022, an increase of 11.4% compared to 2021 and 46.1% compared to 2020 (which was a very difficult year due to the pandemic). As a reminder, 2021 was already a record year for the Swiss watch industry, which bounced back after the pandemic, and recorded higher exports than record years such as 2009 and 2014 (the latter being the previous record).

To make the situation clear, the industry has never seen such exports numbers in the past, and 2022 is, without a question, the best year ever for Swiss watches – remember that we’re talking about exports, which cover the entire spectrum of the industry minus the Swiss domestic market. December 2022 also marks the sixteenth consecutive month of growth for the industry.

All markets are up, with the exception of one very specific region. Swiss watches were mainly exported to the US market in 2022, accounting for CHF 3.9 billion alone, an increase of 26.3% over 2021. Singapore and Japan also recorded impressive growth (+26.2% and +20.4%, respectively), while Europe, usually a rather complex market, remains strong, with exports up by almost 15%, despite the lack of tourists. The situation remains complex in Mainland China and Hong Kong, which are the only two markets showing diminishing exports compared to 2021 (-13.6% and -10.5%, respectively). This can be explained by the country’s zero-Covid policy, which seems to have attenuated in recent weeks.

Breaking down the market per value, watches priced between CHF 200 and 3,000 (export price) declined sharply in December, including a -16.2% fall in value. Surprisingly, products priced at less than CHF 200 saw their export volumes increase by 9.7%. However, most of the growth is driven by watches priced over CHF 3,000 (export price), which were up by 13%. Finally, growth is driven mostly by watches made from precious metals (+14.3%), while steel products (-4.3%) lost ground.

Looking at the big picture of the luxury market, Bain and Company (an American management consulting company), in its latest analysis projects strong growth for the global luxury market in 2022, with sales up 21%, reaching EUR 1,400 billion, while “the personal luxury goods market is expected to show accelerated growth of 22% to €353 billion“. Despite recent economic turbulence that will apply to the year to come, Bain also projects further growth in 2023, with a market up by 3 to 8 % and with a continuous trend up until 2030. In this instance, the results of the world’s largest luxury group (LVMH) will be released this coming Thursday (26th January 2023), with sales that are expected to be up by over 25%.

For more details about Swiss watch exports, please visit www.fhs.swiss.

1 response

Considering just how many Americans live paycheck to paycheck and a good portion of them don’t even have enough money to cover a $500 emergency, the sales numbers in this article are absolutely astonishing.

Wow, then this proves just how much credit card debt is being fueled and will implode like a dying star when this all goes awry.