Swiss Watch Exports Show Maintained Momentum for the Luxury Watch Industry

The situation is improving in many areas, but issues aren’t entirely solved yet.

Following a historic contraction in 2020, the luxury watch industry experienced a V-shaped rebound, with Swiss watch exports reaching record levels in 2021. For the first five months of 2022, the value of exports rose by nearly 13% with the US and Europe largely leading the growth. On the other hand, China’s luxury spending is impacted by COVID-19 restrictions in several major cities, a situation that redistributes the geographical breakdown of exports.

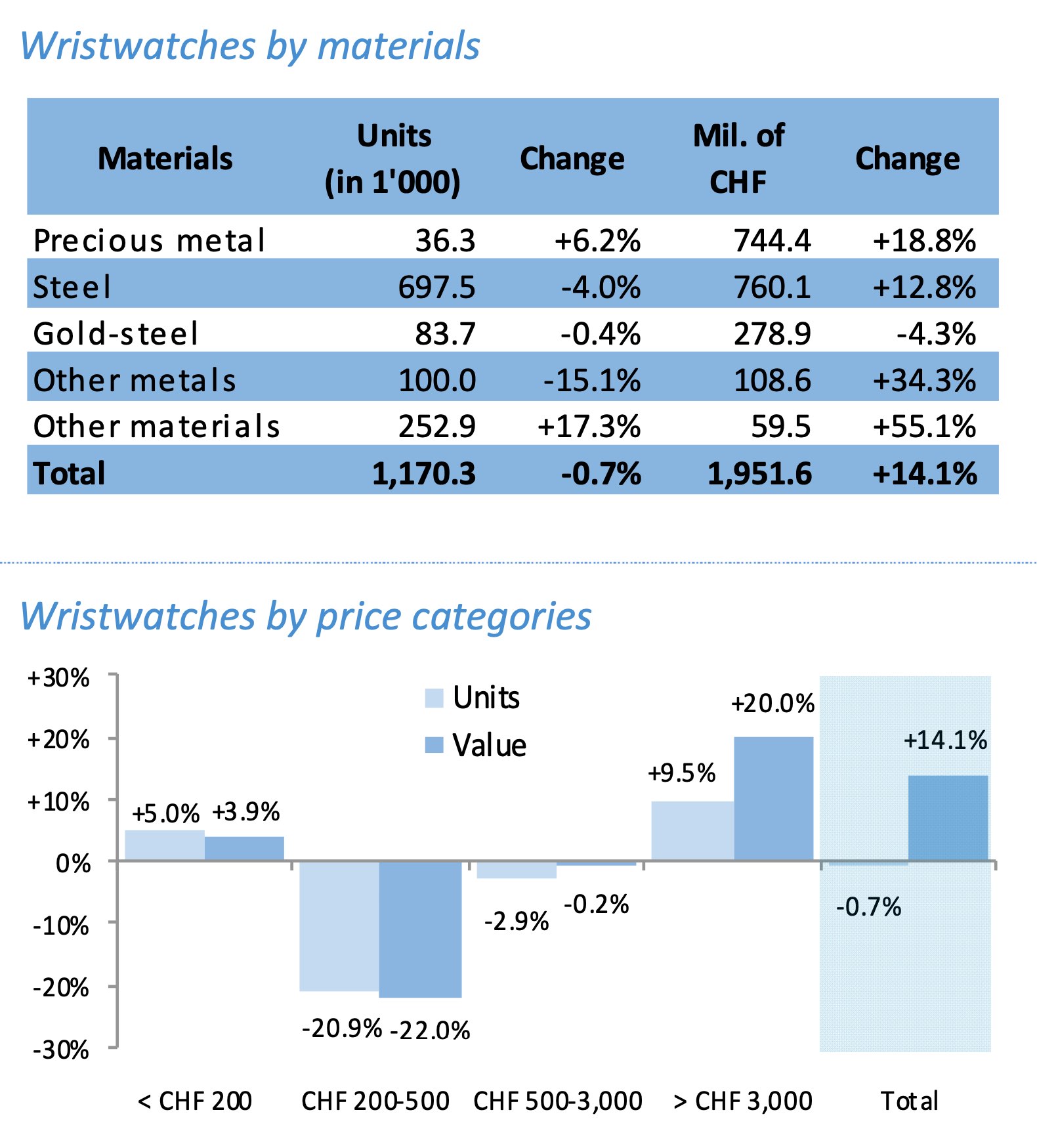

While several challenges remain – including the return of inflation, slowing global growth, and the Russia-Ukraine conflict – the luxury watch industry experiences sustained momentum. The value of Swiss exports rose by 12.8% to CHF 9,772 million over the first five months of the year. The growth was driven almost exclusively by high-end watches (export price > CHF 3,000) as the number of units exported increased by just 2.3%. Watches in the CHF 200-500 range are the most impacted, and remain on a sharply downward trend (-22.0%).

The trend was reflected in the financial statements of key industry players. In May, Richemont reported sales up 46% at EUR 19.2 billion for the year ending 31 March 2022. For the first quarter of 2022, the organic growth for the Watches and Jewelry Division of LVMH was 19%.

The US and Europe lead growth – China impacted by COVID restrictions

The American and European markets lead growth. For the first five months of the year, Swiss watch exports rose by 34.8% for the US (CHF 1,539 million) and by 24.7% for Europe (CHF 2,900 million). These markets saw steady demand driven by a back-to-normal attitude. They also benefited from the reduction of deliveries to China impacted by the measures to quash COVID-19 infections.

Indeed, Swiss watch exports to China (CHF 874 million; -30.2%) and Hong Kong (CHF 829.5 million; -7%) are down quite importantly. According to its latest report on the luxury industry, Bain & Company believes that the domestic spending from Chinese consumers will likely recover through the second half of the year.

Last, exports to Russia are down 55.6% as commercial activities have been suspended as a consequence of the invasion of Ukraine. Switzerland banned the export of luxury goods to Russia in March.

For more information on Swiss Watch Exports, please visit www.fhs.swiss.