Swiss Watch Exports Down 1.7% to CHF 25.5 billion in 2025, Uncertain Outlook for 2026

Mild contraction of exports in 2025 amid challenging times for the watch industry.

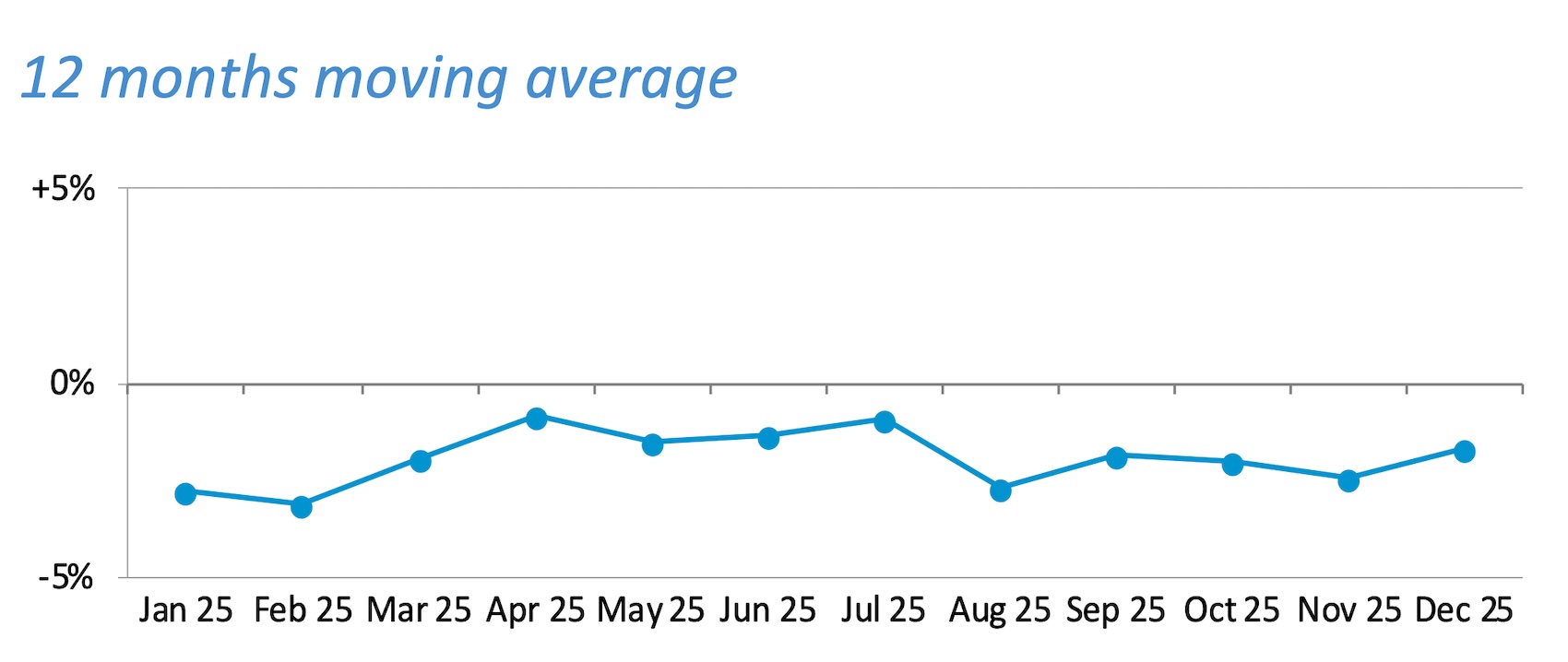

The Federation of the Swiss Watch Industry (FHS) has just released its export statistics for 2025. December ended the year on a positive note with exports up 3.3% after four consecutive months of sharp decline. For the entire year 2025, the Swiss watch industry exports recorded a decrease of 1.7% compared to 2024. Following several years of robust growth and all-time records in 2021, 2022 and 2023, the industry is facing headwinds since 2024. Indicating tough times for the industry, exports to the top four markets are down. The trend is still affected by the Chinese market, with a significant decline in exports weighed by economic uncertainties and changes in consumer behaviour. Exports to Japan are also down, impacted by a stronger yen than in previous years and declining Chinese tourist spending. Last but not least, the ever-evolving U.S. tariffs represented a major disruption for Swiss watchmakers, affecting activity and trade with their largest market.

Main statistics to understand

Swiss watch export figures for 2025 provide an official and reliable indicator of industry trends, but they do not fully reflect actual sales, as they measure shipments rather than end-consumer purchases. This distinction is particularly relevant this year, as the evolution of U.S. tariffs led brands to accelerate shipments to the U.S. ahead of the duty increase. For reference, Richemont’s 9-month sales (3rd quarter ended in December 2025) are up 5% and up 1% for the Group Specialist Watchmakers at actual rates. LVMH just announced an organic growth of 3% for its Watches and Jewelry division.

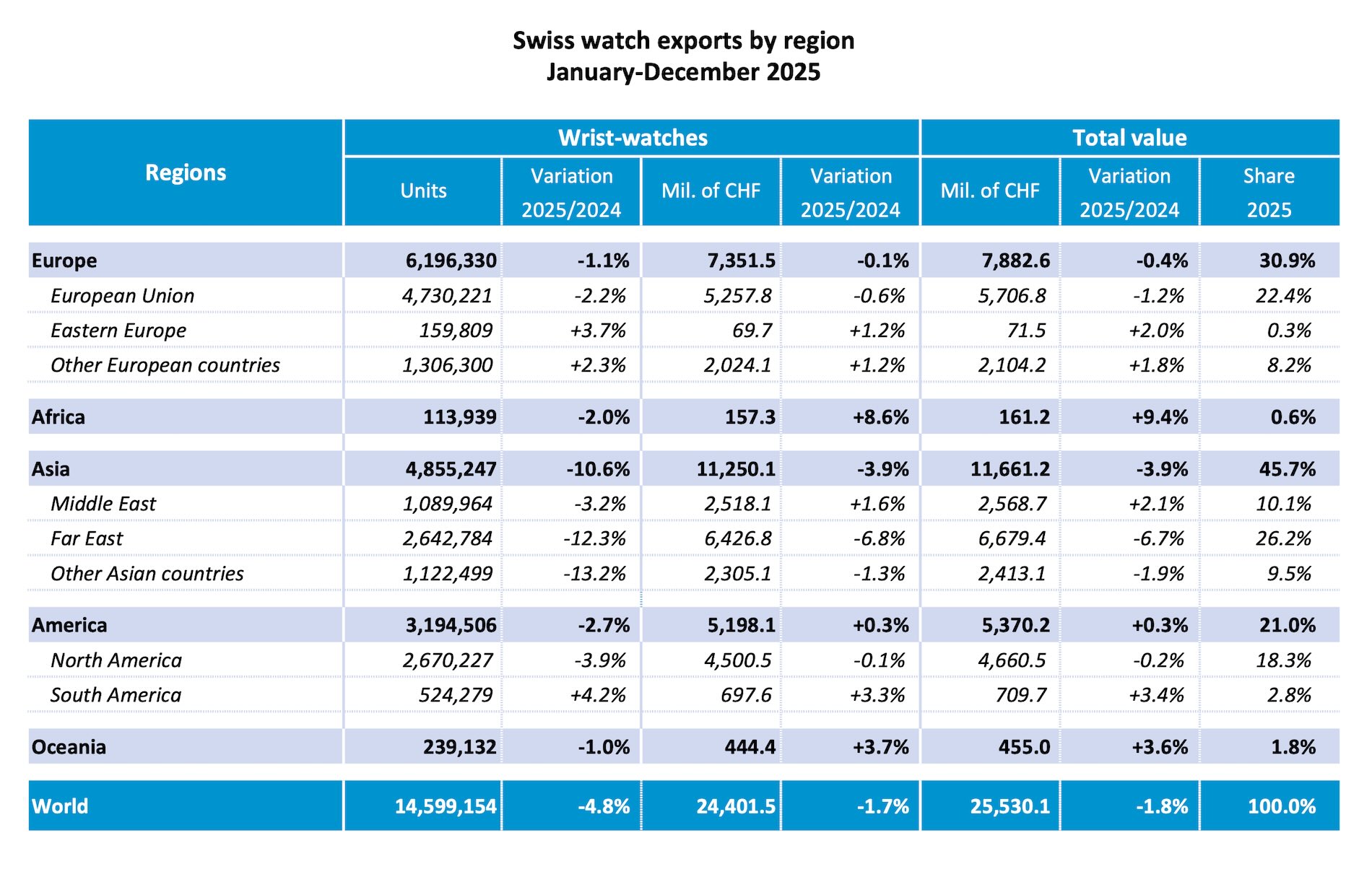

For the year 2025, total exports of Swiss watches accounted for CHF 25,552 million, down 1.7% compared to 2024 (CHF 25,993 million) and 4.5% compared to 2023 (CHF 26,748 million). Looking at figures in volume of wristwatches exported by the Swiss watch industry, we can see a steep decline in numbers, down 4.8% compared to 2024, at 14,599,154 units, which indicates a large price per unit, in line with the continuous rise in price of watches.

Watches priced at over CHF 3,000 (export price) set the tone with a decline of 1.9%, negatively impacting the total value of exports. At the same time, the CHF 500 to 3,000 (export price) segment remained stable, while watches below this threshold fell more sharply, decreasing by 4.5%.

Challenges in most main markets

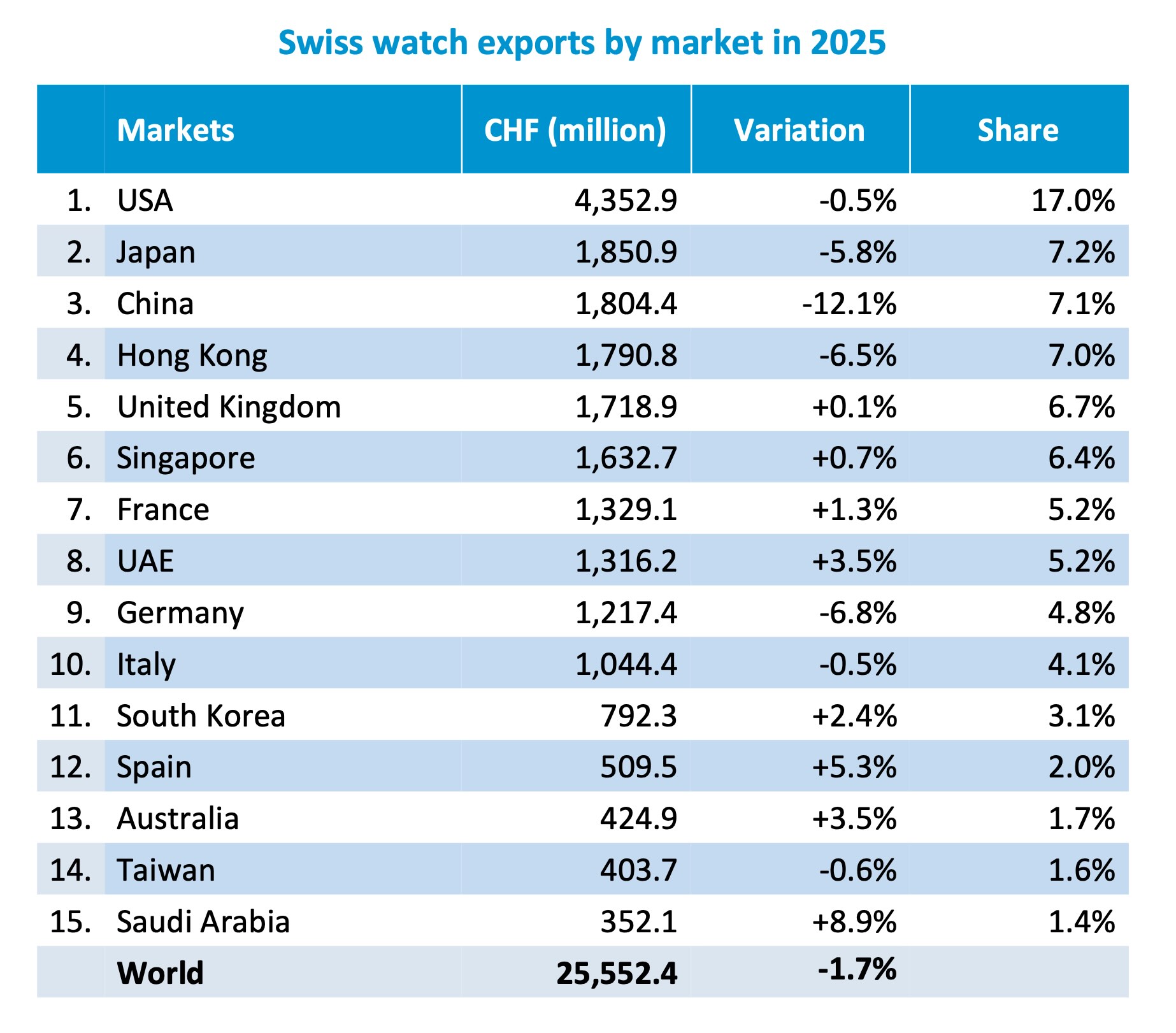

Taking a look at the geographical breakdown, the trend is negative for all top markets. Exports to the USA, which account for 17% of the global exports, were strongly affected by the evolving tariffs: first with a surge of shipments in anticipation of the increase to 39%, followed by a period of significant slowdown, before the duties were ultimately reduced to 15% at the end of the year. In total, exports of Swiss watches to the USA are down only 0.5% by the end of the year, offsetting some of the incredibly slow months. The strong performance in the United States in December (+19.2%) suggests a more favourable outlook, although fears associated with the decisions taken by the US government remain.

Exports towards China (-12%) and Hong Kong (-6.5%) are still experiencing a significant contraction. Exports to Japan are also down 5.8%, impacted by a stronger yen and declining Chinese tourist spending.

For Europe, the trend is either mildly positive or flat on most major markets (+0.1% in the UK, +1.3% in France, -0.5% in Italy), with the exception of Germany, which recorded exports down 6.8%. The trend is, however, quite positive for the Middle East, as Saudi Arabia reported exports up 9% over the year.

Last but not least, the trend for India confirms the rapid expansion of luxury in the country, with exports up 8.9%, after increasing by 25.2% in 2024.

Uncertainties for 2026

On another note, the FHS also reports that “the number of people employed in the sector fell by 1.3% according to the annual survey carried out by the Swiss Watch Industry Employers’ Association at the end of September, reflecting the slowdown in the market.“

The question now is to understand what to expect in the coming months. Outlooks remain cautious, as the industry is likely to continue facing headwinds from a strong Swiss franc, inflation, and economic and political uncertainties. The FHS indicates that “2026 should remain steady, against a background still marked by significant uncertainty.” Adapting to changing consumer preferences and staying relevant to the new generation also remain key challenges. Hopes lie in a more stable situation in the U.S. and its import policies, and a gradual recovery in China. On a positive note, third-quarter sales of major Chinese retailer Chow Tai Fook, ending 31 December, rose 18% compared with the same period last year. A key barometer of market dynamics, secondary prices appear to be picking up. In their 4Q25 Watch Market Report, WatchCharts/Morgan Stanley note that for the full year 2025, secondary prices rose 4.9%, marking a meaningful recovery from declines of 6.1% in 2024 and 10.7% in 2023.

For more information, please visit fhs.swiss.

2 responses

There seems to have a small typo in “For reference, Richemont’s 9-month sales (3rd quarter ended in December 2026)…” Shouldn’t it be December 2025?

@weitsu Fan absolutely, thanks. And edited.