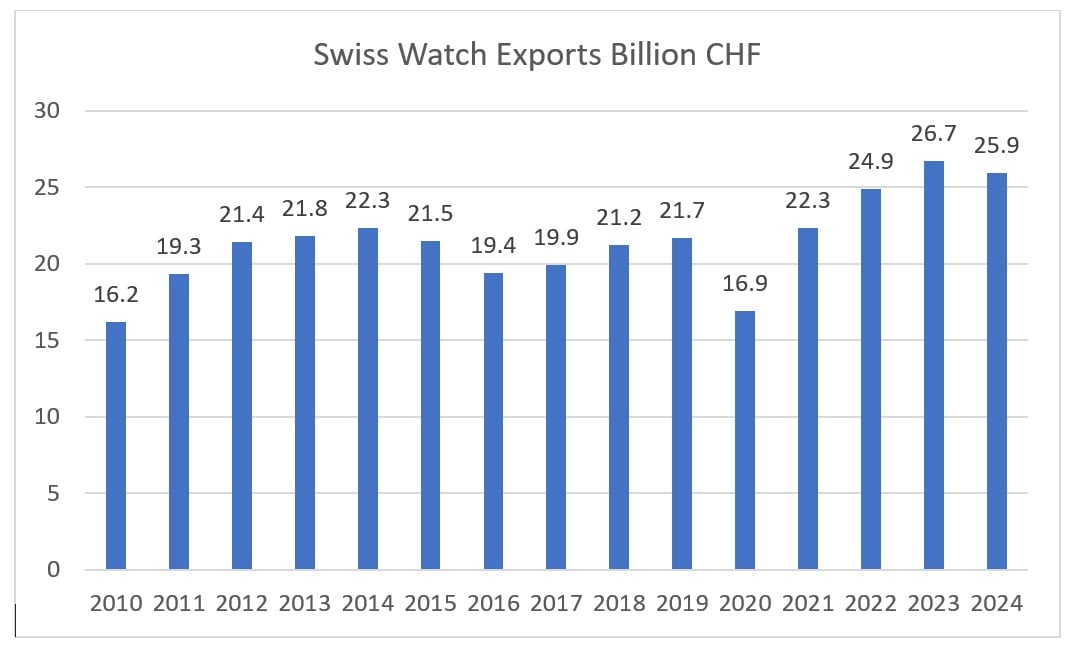

Swiss Watch Exports down 3% to 25.9 billion Swiss Francs in 2024

Consolidation after robust growth and record years in 2022 and 2023.

The Federation of the Swiss Watch Industry has just released their export statistic for 2024 – December ended the year on a negative note with exports down 5.4%. For the year as a whole, the Swiss watch industry exports recorded a decrease of 2.8% compared to 2023. Following two years of robust growth and all-time records, the industry faces headwinds. The trend was particularly affected by the Chinese market with a significant decline in exports weighed by economic uncertainties and changing consumer behaviour.

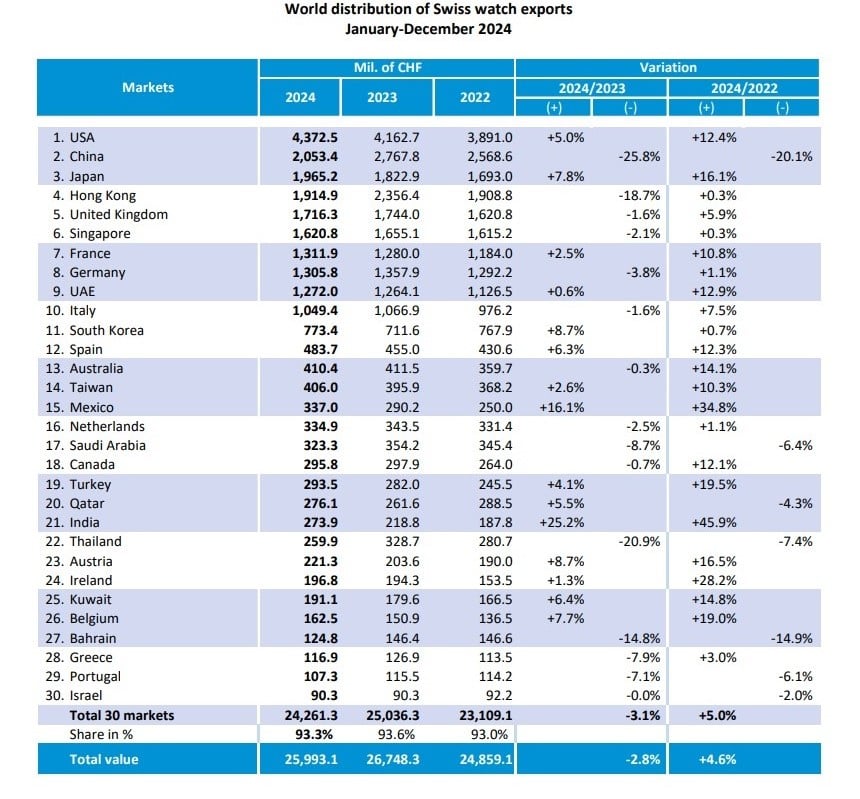

Taking a look at the geographical breakdown, the trend is positive for the USA (+5%) alongside the luxury boom in the market. The trend is also positive for Japan (+7.8%) thanks to favourable currency rates and touristic activity. The business is overall stable in Europe (-0.1%). In contrast, the exports towards China (-25.8%) and Hong-Kong (-18.7%) are experiencing a sharp contraction. Last but not least, the trend for India confirms the rapid expansion of luxury in the country (+25.2%).

The number of watches exported came at 5.4 million, confirming the drop in volumes exported (-14.5%) and evidencing the trend for lower volumes and higher prices.

A key barometer of the market dynamics, the secondary prices have continued to contract in 2025. In this respect, Morgan Stanley/Watch Charts reports that these were down -5.7% in 2024, after being reported at -13% for 2023 and -9% in 2022. Not much improvement is to be expected in 2025 and the watch market should remain challenging. Bain & Company believes that we’ll see a slightly improving context for the luxury industry throughout the year, depending on macroeconomic scenarios. Morgan Stanley expects the watch primary market sales to continue to decline over the first semester of the year and the secondary market prices to continue to fall. The industry is likely to remain impacted by a strong Swiss franc, inflation and, economic and political uncertainties. The need to address changing consumer preferences and stay relevant to the new generation is also a key challenge.

Earlier this month, Richemont reported sales of EUR 16.2 billion, up 4% at constant exchange rates and 3% at actual exchange rates over the nine-month period ending December 2024 but -8% for specialist watchmakers. LVMH reported revenues up 1% for 2024 at EUR 84.7 billion on an organic basis but down 2% at EUR 10.5 billion for their Watch and Jewelry Business Group. For the Swatch Group, 2024 sales were down 12.2% at constant exchange rates to CHF 6.735 billion.

For more information, please visit fhs.swiss.