With Tariffs Now in Place, Swiss Watch Exports to the U.S. Have Dropped 56% in September 2025

This massive contraction in the U.S. is, however, partially cancelled out by growth in many regions.

This announcement shouldn’t come as a surprise and was largely anticipated by the industry. Yet, now that the 39% import taxes imposed by the U.S. administration on Swiss goods entering American soil, also known as the tariffs, are effective (since the beginning of August), we clearly see the effects. And yes, there is no other way to say it: the impact is shocking. Compared to the same period in 2024, exports of Swiss watches to the U.S. plummeted, with less than half the amount recorded a year ago. It’s not all negative for the watch industry, though, as some markets that were previously in difficult situations seem to be recovering, and, as always, it is necessary to look at the bigger picture.

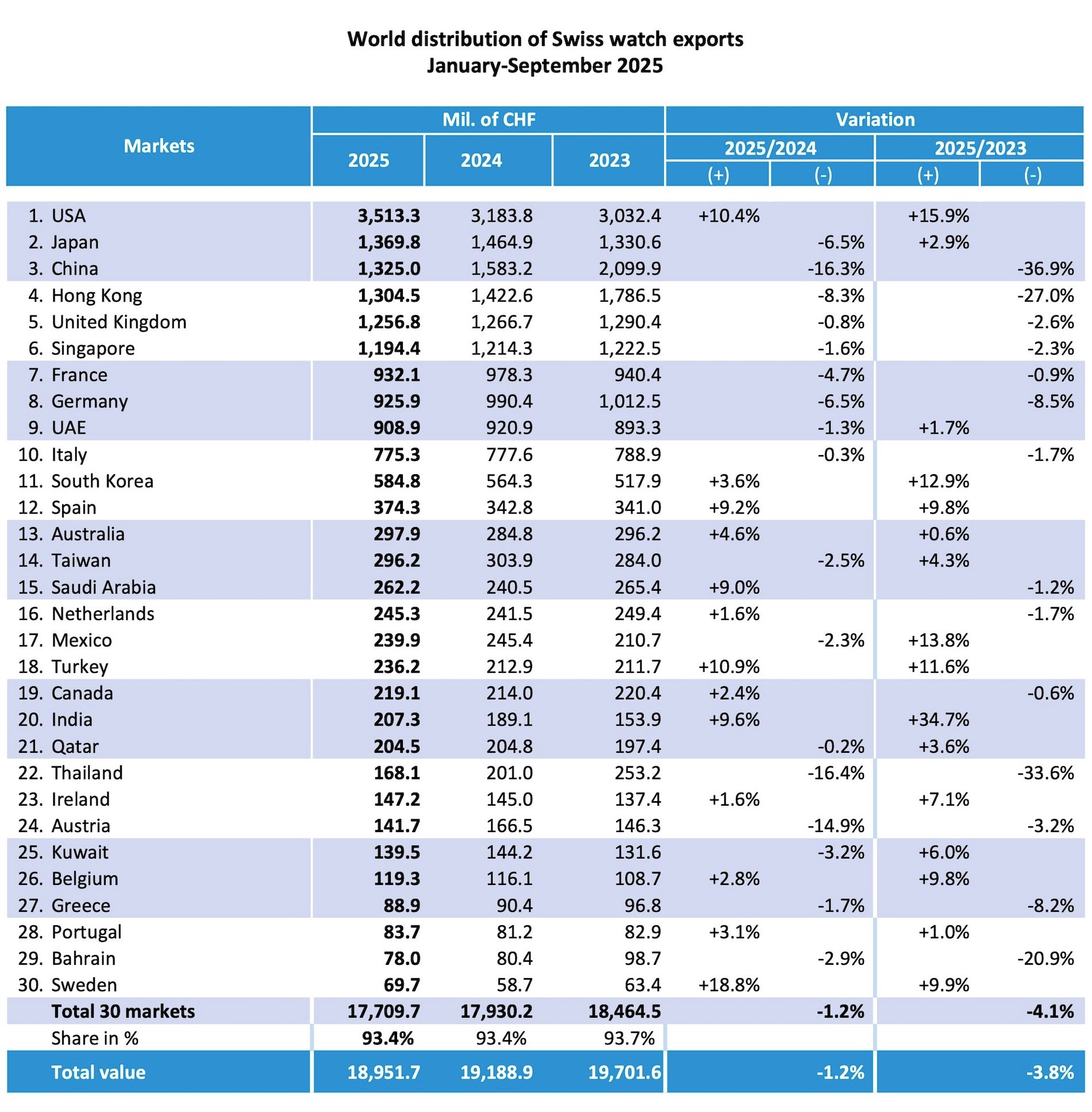

Let’s quickly recap what has happened in the past few months. First of all, we should keep in mind that the watch industry as a whole is currently facing a slowdown, which is mostly due to the decline in sales in China and Hong Kong amid the real estate crisis in the Middle Kingdom. Indeed, according to the Federation of the Swiss Watch Industry, China and Hong Kong, historically two of the largest markets for Swiss watch exports (long positioned in the top 3 to top 5), have dropped respectively by -25.8% and -18.7% in 2024 compared to the previous year. As a reminder, 2023 was an all-time record year for Swiss watch exports, and Greater China performed particularly well. 2024, however, saw the first decline in multiple years, as exports were down 3% globally, with China and HK as the main drivers of this decline.

The direct consequence of the 39% tariffs

Moving to 2025, global news revolved around the Trump Administration’s introduction of reciprocal import taxes on more than 100 countries and trading partners, including China, India, and members of the European Union. The announcement of these tariffs, made during a speech by President Trump on Liberation Day (April 2, 2025), showed a (now famous) chart listing a 31% tax on goods imported from Switzerland to the U.S. This announcement, made a day after the opening of the watch industry’s main fair, Watches and Wonders Geneva, had a massive impact on the global mood, yet there was still hope for negotiations. However, things didn’t go as planned.

Indeed, Switzerland’s situation didn’t improve; on the contrary. On August 1st, 2025, the White House announced even higher tariffs on Swiss goods imported to the U.S., now set at 39% of the import price, sparking immediate fear among Swiss politicians and executives, who expected significant economic consequences. Despite sending emissaries on-site to negotiate a better deal, the sentence became effective on August 7th, 2025. It has to be remembered, however, that these import taxes are applied on the import price of the said good, and not on the final retail price of, for example, a luxury watch. Also, the way these tariffs are handled and applied to end consumers differs by brand and the strategies they have in place (full impact on U.S. consumers, global price increases to absorb the costs, pressure on distribution to reduce margins…).

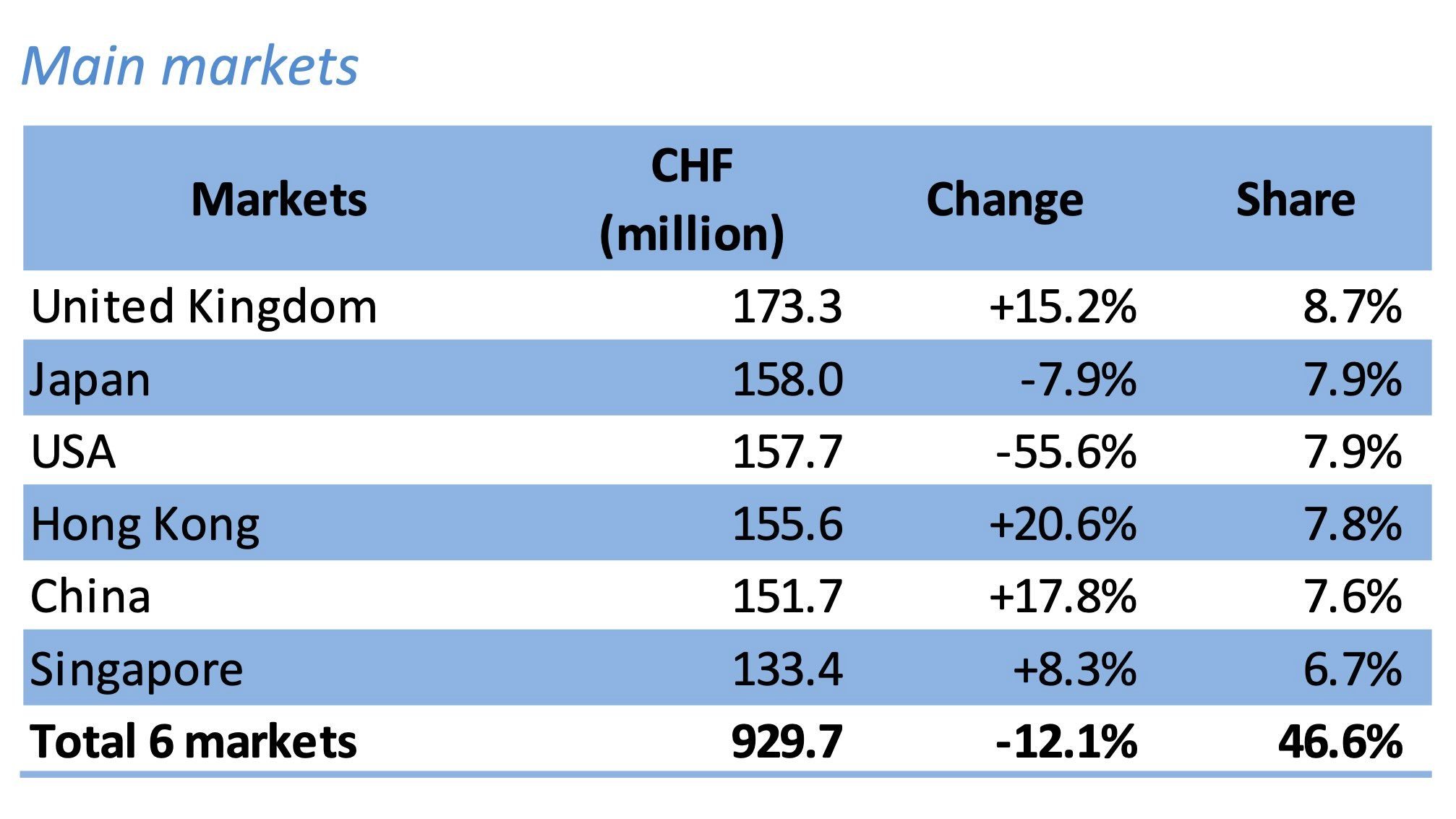

Exports to the U.S. down 55.6% in September 2025, but not on a year-to-year basis

With this situation in mind, now that the 39% tariff is in effect (since August), there has been an immediate reaction in the U.S. market, highlighted in the September report released by the Federation of the Swiss Watch Industry (FHS). Indeed, compared to the same period in 2024, exports of Swiss watches to the American market have dropped by 55.6%, from CHF 355 million to CHF 158 million. U.S., which used to be the first market for Swiss watch exports in 2024, has now fallen to third place, behind the United Kingdom and Japan.

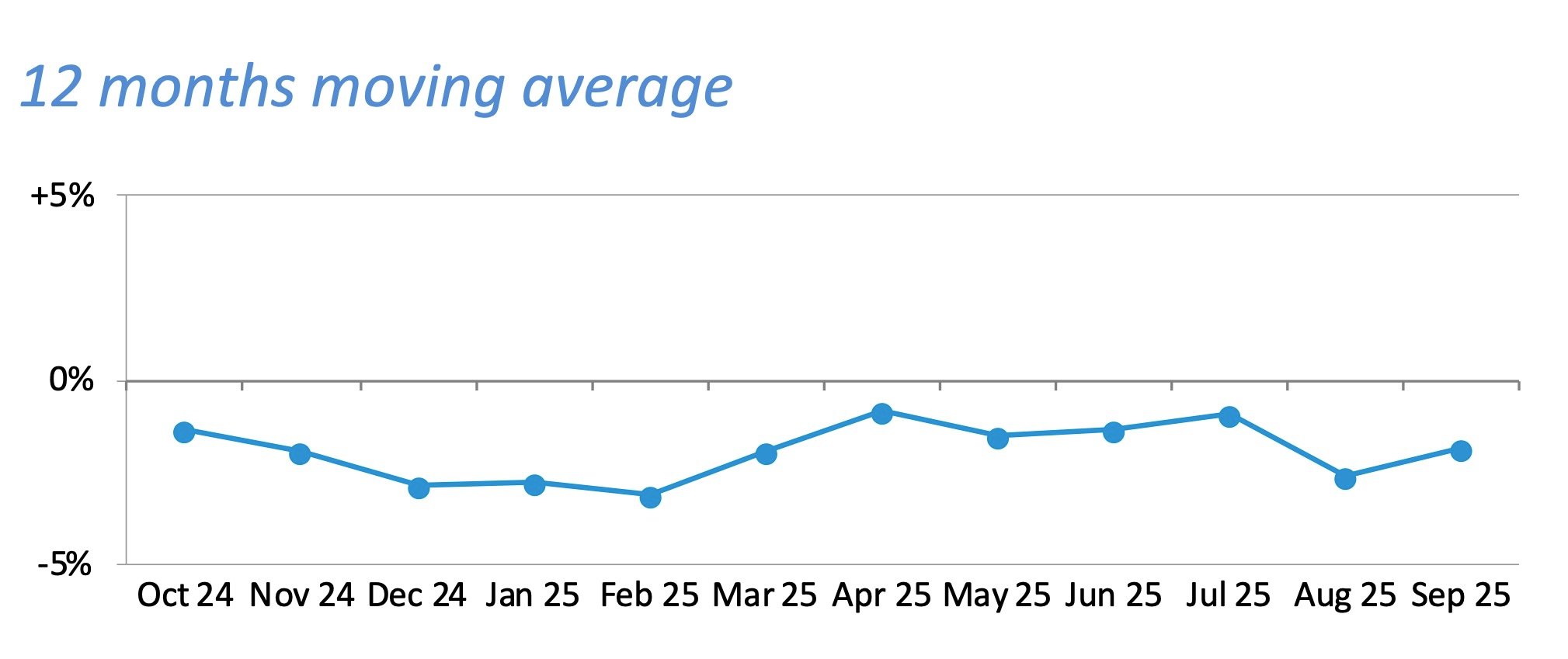

As the FHS outlined in its report, on a global scale, “Swiss watch exports in September contracted by 3.1% year-on-year, to 2 billion francs. This downward movement took cumulative exports for the first nine months of the year to 19 billion francs, an overall decline of 1.2%”. All the more interesting is this second statement of the FHS, indicating that “most markets saw marked increases in September, but these were cancelled out by the huge correction in the United States (-55.6%). Without this expected but nonetheless extraordinary development, Swiss watch exports would have grown by 7.8%”.

Several comments are, however, necessary in order to get past the shock of this “55.6% decrease” announcement. First of all, if we look at the bigger picture – specifically the behaviour of Swiss watch exports to the United States over the entire 9-month period of 2025 – the situation is more complex and actually not that dramatic. It is far from positive, but it’s less alarming than the title of this article might suggest. First of all, since Donald Trump’s Liberation Day speech, most brands have anticipated the imposition of the tariffs and have thus taken preventive measures. This is easily seen in the exports for April 2025 (+149.2% compared to 2024) and July 2025 (+45% compared to 2024), interspersed with two months of decline in May and June.

This September 2025 situation is only a portion of the reality. Brands have indeed massively exported watches to their U.S.-based subsidiaries, drastically increasing inventories to meet consumers’ demand for several months. The application of the tariffs on August 7th was well anticipated by many brands and groups, and the situation in September was certainly expected. Second, looking at the larger picture, we can see that, for the first 9 months of 2025 (January-September), the overall performance of the U.S. market shows a growth of 10.4% compared to 2024, and a growth of 15.9% compared to 2023, which was, I should remind, an all-time record for the watch industry.

Also important to take into account here is that we’re looking at a very specific piece of information: watch exports. While this data is an important factor in assessing the health of the market, it doesn’t necessarily reflect sales to end consumers. There is, very possibly, a difference in September 2025 between the exports that plunged dramatically and the reality of the market and sales at boutiques and retailers – something we can’t measure for now.

Some unexpected surprises

While the United States is one of the most important markets for the watch industry, it is thankfully not the only one. Growth has been reported in the United Kingdom, now the number 1 market for Swiss watch exports. With exports at CHF 173 million, exports were up 15.2% in September 2025, and a relatively stable performance on the first 9 months of the year, at -0.8% compared to the same period in 2024.

Moving to the other side of the world, there was an unexpected turn in Greater China, with Hong Kong and China both reporting significant growth in September, at +20.6% and +17.8%, respectively. Singapore, an important market for high-end watches, also posted a pleasant growth of +8.3% and the whole region “showed renewed dynamism”, according to the FHS. This could be the first sign of recovery in the region, which has been lagging over the past 9 months, as China is down 16% in 2025 and Hong Kong 8%.

Possibly as a consequence of the application of tariffs in the United States, two neighbouring countries, Canada and Mexico, both reported impressive growth in September 2025, respectively increasing imports of Swiss watches by 18% and 44%. India also reported a boom in imports of 28%. Finally, despite a weak performance, Japan continues to move up the list of the main importers of Swiss watches, now the second-largest market, up from fifth place.

In Europe, the situation in September, with exports to France (-3.5%), Italy (-3.9%), and specifically Germany (-14.6%), isn’t particularly promising. On a 9-month period, these countries (the 3 largest in Europe) respectively imported -4.7%, -6.5% and -0.3% Swiss watches.

Finally, looking at the whole picture, Swiss watch exports have dropped 3.1% in September 2025 compared to September 2024, and for the first 9 months of the year, exports are down 1.2% compared to 2024. It is certainly not positive, but it is also less dramatic than some expected… For now, at least.

4 responses

In the meantime, the brands will continue to raise their prices in addition to the increased tariffs, and will be laughing all the way to their bank. They won’t blink. They’re too busy charging as much as they can get away with under the cover of the tariffs.

why did swiss watchmakers increased prices in europe too? no reason. you are shooting yout own foot, instead of lowering prices in europe to compensate.

So in retaliation to America’s tariffs and market impact, Swiss watchmakers decide to shaft the rest of the world marketplace with higher prices. It’s just a very greedy perspective. Why not keep prices lower in other markets so the Americans can see how they are being screwed by tariffs. Also, Swiss watchmakers should show appreciation to watch buyers in other markets.

It is easy to fix. Swiss should reduce the tariffs over american made products. That is why the reciprocal tariff exist. sign an agreement.