The FHS Reports Record Levels for Swiss Watch Exports in 2021

The industry bounces back from the pandemic

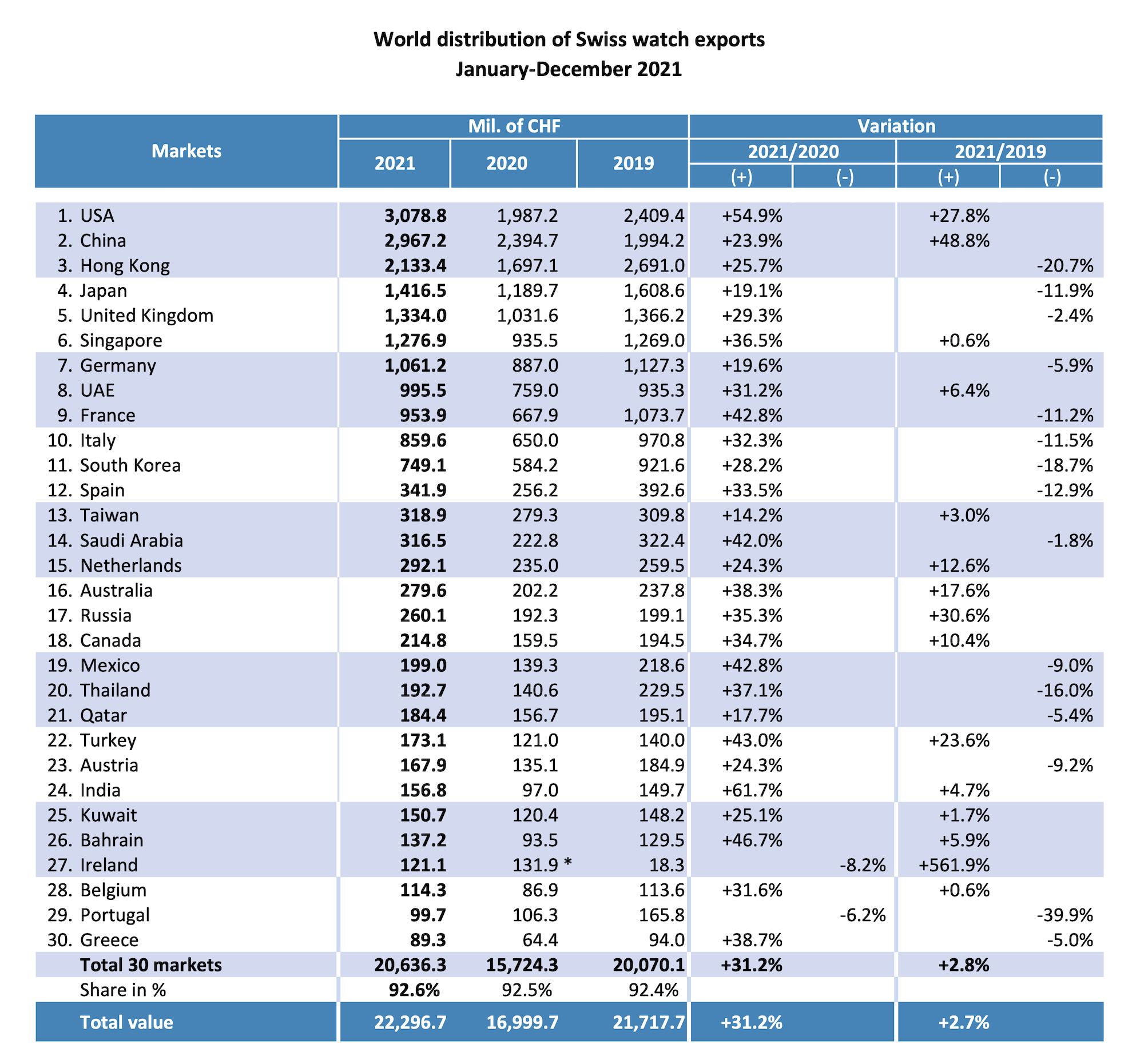

2020 was a very difficult year for the Swiss watch industry with a historic fall of 21.8%, the steepest decline since 2009. Following this sharp contraction of the global watch market, 2021 has seen a recovery from the pandemic and a return to growth, to the point of recording its best year ever! The FHS, the Federation Horlogère Suisse (or the Swiss Watch Federation), has just released export statistics for 2021. At CHF 22,297 million, exports were 31.2% higher than 2020, 2.7% higher than 2009 and 0.2% higher than the highest ever recorded by the industry, in 2014.

Following the big hit taken during the pandemic, the watch industry bounced back to growth. Of course, the past two years have been a period of profound changes and the situation differs from one brand to the other. But top players like Rolex, Patek Philippe or Audemars Piguet seem to be immune to crisis and are stronger than ever; the surge of independent watchmaking has been remarkable over the past few months; Conglomerates Richemont and Swatch Group have just unveiled results reflecting the recovery of the industry. Overall if the outlook was gloomy and if the industry still faces challenges, things have improved sharply over the past few months. The main concern is now often to speed up manufacturing while Omicron is disrupting supply chains.

A recovery supported by higher priced models

Overall, the recovery is supported by higher priced models. If these retain their appeal and have enjoyed continuous growth, the low/mid-end segments have been under pressure for several years. In particular, the smartwatch expansion seems to come at the expense of the lower-priced Swiss timepieces (in particular those fitted with quartz movements). The average export value of Swiss watches is now over CHF 1,300 versus CHF 720 in 2015.

Trend by markets

Taking a look at the trend by region, the USA (CHF 3,078 million +54.9% versus 2020 and +27.8% versus 2019)) and China (CHF 2,967 million +23.9% versus 2020, +48.8% versus 2019), are the two main destinations for Swiss watch exports and have clearly been driving the growth. The USA are back as the number one destination for Swiss watch exports. China is more than ever a strategic market for the watch industry. Specifically, since the pandemic has stopped international travel, Chinese consumers have spent a growing proportion of their luxury budget on their domestic market. This has long been encouraged by government policies and the pandemic is accelerating this reshoring of luxury consumption on a local basis.

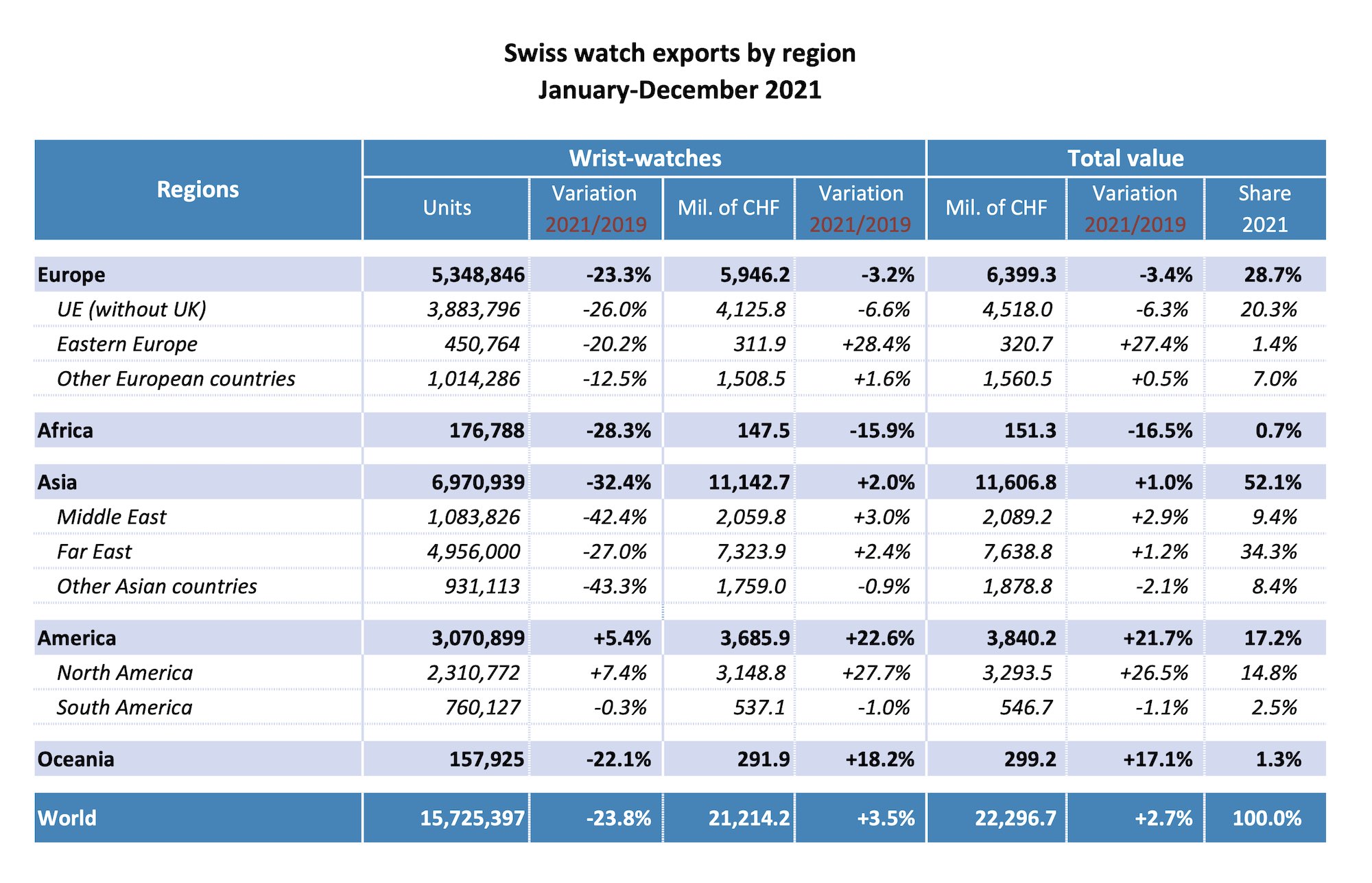

While most countries are on the path to recovery, the most affected during 2020/21 are those depending on tourism, in particular Europe and Hong Kong. Today, Asia accounts for 52.1% of the watch exports, Europe 28.7%, America 17.2%. Oceania 1.3% and Africa 0.7%.

For more information, please visit the website of the Federation of the Swiss Watch Industry.

1 response

Hong Kong and Taiwan are part of China, so it’d be more accurate to state that China is the number 1 destination by quite some margin. And therein lies the main source of the industry’s latest renaissance.